The Democrats are countering the Trump Administration’s economic proposals with plans of their own they broadly call “A Better Deal.”

Democrats in Washington are countering President Donald Trump’s lack of commitment to earmark funding for rural broadband with a $40 billion plan of their own that is part of a broader trillion-dollar infrastructure investment package released Wednesday.

The plan, “Returning the Republican Tax Giveaways for the Wealthy to the American People,” specifically targets funding for a new, last-mile focused, broadband expansion program that would target funding specifically to providing broadband service to the homes and businesses in the country that cannot get the service now.

“The electricity of 2017 is high-speed Internet,” according to the Democrats. “While the private sector has delivered high-speed internet to many, millions of Americans in less profitable rural and urban areas have been left out.”

Rural broadband is expected to become a campaign issue in the midterm elections, as Democrats push their new working and middle class recovery program they call “A Better Deal,” reminiscent of President Franklin D. Roosevelt’s “New Deal” program during the Depression of the 1930s.

The Democrats claim they will do a better job overcoming the digital divide by forcing providers to compete for public funding. In contrast, the Trump Administration’s general infrastructure program offered $200 billion for all types of infrastructure projects, with no funding earmarked for broadband. But most of that money can only be unlocked if a private company enters into a public-private partnership with the government and agrees to invest even more in private dollars than the federal government will offer in supplementary funding.

The Democrats also claim their broadband investment program will be open to public providers like municipalities, co-ops, and publicly owned utilities, not just private companies. The Republicans have generally opposed municipal broadband projects, although there are some exceptions in rural areas where local and state officials share the frustration of bypassed local residents.

Manchin

“If you actually get out to Trump country and talk to folks, you will discover that they are angry and frustrated and pissed off that the companies won’t serve them (because it is too expensive to provide service) and won’t let them deploy their own networks,” wrote Harold Feld, senior vice president at the consumer advocacy group Public Knowledge, in a Facebook post this week. “Traditionally, rural Republicans have been eager to use the tools of government to bring essential services to rural America. If this helps pressure rural Republicans to break with the anti-government mantra and return to traditional bipartisan approaches to bringing service to rural America, so much the better.”

Moderate Democrats in states with large rural populations are especially excited by the Democratic plan.

“The way we speak in plain-speaking West Virginia, this is a really good deal,” said Sen. Joe Manchin III (D-W.V.) at a news conference Thursday. “All of you who’ve come from urban areas, you take this for granted.”

The rural broadband funding is part of a much larger $1 trillion investment package paid for by reversing certain tax breaks. The corporate tax rate, which was slashed from 35 percent to 21 percent under the Republican plan, would be raised to 25 percent under the Democratic plan. Democrats are also seeking to restore estate taxes on couples earning over $11 million annually.

Subscribe

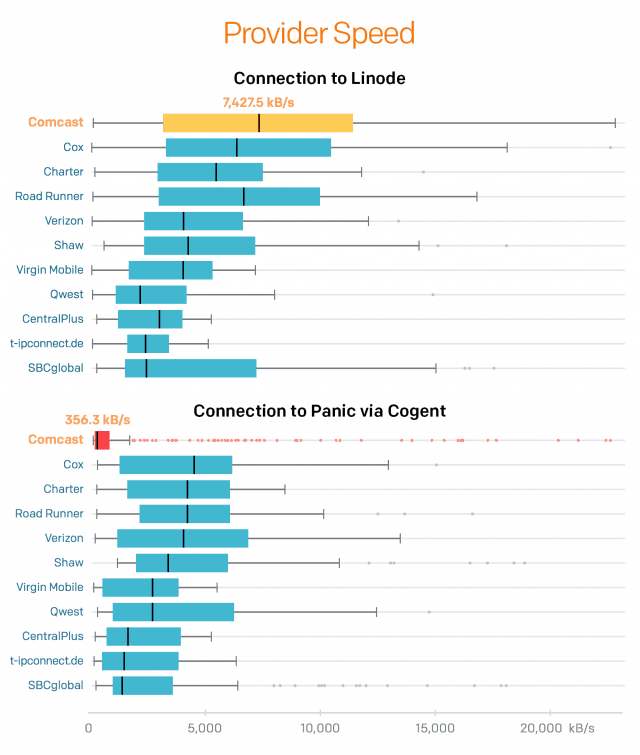

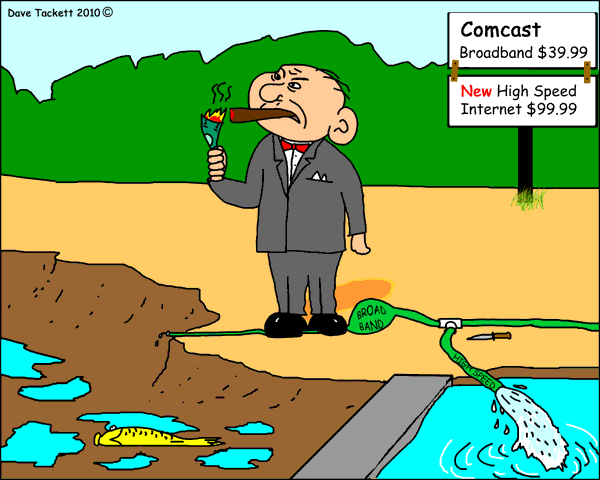

Subscribe Comcast is raising internet speeds of several of its XFINITY internet service plans in the northeastern United States as it continues to battle Verizon’s fiber to the home network FiOS.

Comcast is raising internet speeds of several of its XFINITY internet service plans in the northeastern United States as it continues to battle Verizon’s fiber to the home network FiOS. The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

The country’s largest cable internet service provider needed help from an app developer in Portland, Ore. to let it know its broadband pipes were full and to do something about it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

In addition to giving the internet public policy community new evidence that peering fights leaving customers stuck in the middle might be heating up once again. It also suggests if Comcast was unaware of the problem, it does not reflect well on the cable company to wait weeks until a customer reports such a serious slowdown before fixing it.

“I shouldn’t have been surprised to learn industry completely re-wrote proposed broadband legislation to their favor as a ‘substitute bill’ in legislative committee today,” Orr wrote on her Facebook page on Feb. 19. “The substitute bill is substantially different than the original bill. And it wasn’t posted online or anywhere for anyone except insiders to have access to. CenturyLink and Spectrum are bullies. It’s wrong, and they are hurting Cheyenne and other Wyoming communities from gaining affordable access.”

“I shouldn’t have been surprised to learn industry completely re-wrote proposed broadband legislation to their favor as a ‘substitute bill’ in legislative committee today,” Orr wrote on her Facebook page on Feb. 19. “The substitute bill is substantially different than the original bill. And it wasn’t posted online or anywhere for anyone except insiders to have access to. CenturyLink and Spectrum are bullies. It’s wrong, and they are hurting Cheyenne and other Wyoming communities from gaining affordable access.”