Phillip Dampier

While tech fans in Kansas City rejoice over 1Gbps broadband for $70 a month, the average broadband user will think long and hard about the prospect of paying $840 a year for broadband at any speed.

That is why Google Fiber-delivered broadband in and of itself is not a cable/phone company-killing proposition.

We too easily forget our friends and neighbors that seem clueless satisfied with their 3Mbps DSL account from AT&T that they were sold with a phone line package for around $60 a month. Web pages slow to load and constantly-buffering multimedia? In their world, that means “the Internet is slow today,” not their provider.

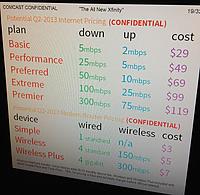

Phone and cable companies have the internal studies to back up their claims that price matters… a lot. Those who treat the Internet as a useful, but not indispensable part of their life are going to be a tough sell at $70 a month. In fact, it is my prediction many future income-challenged and older customers will splurge on Google’s free-after-paying-for-installation 5Mbps service, satisfied that speed is currently “good enough” for the web browsing, e-mail, and occasional web video they watch on their home computer.

That is why Google was smart to offer the ultimate in “budget Internet.” Free after the $300 installation fee (thank goodness for the interest-free budget $25 payment plan) is far better than $20-25 a month for 1-3Mbps service many cable and phone companies offer their “light users.” It also brings Google’s fiber into the customer’s home, a perfect way to up-sell them later or offer other services down the road.

But the smartest move of all was Google’s very-familiar quasi-triple play package price point — $120 for broadband and television service (they really should bundle Google Voice into the package and cover the phone component for those who still want it). With the phone and cable company charging upwards of that amount already for after-promotion triple-play service, the sticker shock disappears. It’s no longer $70 for broadband, it’s $120 for everything. That is a much easier sell for the non-broadband-obsessed.

It also provides Google a critically-important broadband platform to roll out other services, including those that will appeal to customers who don’t have the first clue what a megabit or gigabit is all about. They don’t really care — they just want it to work and deliver the services they want to use hassle-free.

For Google Fiber to prove a profitable proposition, the search engine giant has to:

- Find a way to manage the huge infrastructure and installation costs, especially bringing fiber lines to individual homes. Middle-mile networks with fiber cables that string down major roadways, but ultimately never connect to individual homes and businesses are far less expensive than providing retail service. Google’s $300 installation fee is steep, but manageable with payments and even better when customers commit to a multi-year contract to waive it;

- Offer the services customers want. An incomplete cable television package can be a deal-breaker for many customers who demand certain sports or movie channels. Although younger customers may not care a bit about cable television service, they also may not be able to afford the $70 broadband-only price. Google will need to attract families, and most of them still subscribe to cable, satellite, or telco TV. They are also the most grounded customers, an attractive proposition for a company dealing with high infrastructure expenses that will take years to pay off. It’s harder to cover your costs selling to a customer still in school and likely to move after they graduate in a few years;

- Sell customers on the hassle and inconvenience of throwing out the incumbent provider in favor of fiber, which will require considerable rewiring. It is one thing to express dissatisfaction with the local cable or phone company, it is another to take a day off from work to return old equipment and have unfamiliar installers in your home to provision fiber service. Some don’t want the hassle or lost time, others won’t switch until they get around to cleaning their messy house or apartment before they invite Google inside;

- Deliver an excellent customer service experience. Google’s current level of support for its web-based services would never be tolerated by a paying broadband/cable customer. Google will have to learn as they go in Kansas City, but first impressions can mean a lot;

- Expansion to get economy of scale. It is highly likely Google Fiber is a marketplace experiment for the company, and one it will study for a long time before it decides where to go next. Google’s “beta” projects are legendary and long, and if their fiber experiment does prove successful (or at least potentially so), the company will need to expand it rapidly to enjoy the kinds of vendor discounts a super-player can negotiate.

Verizon FiOS is the largest fiber to the home network in the United States. Their “take rate” of customers willing to sign up for the service has not exactly put incumbent cable companies into bankruptcy, even with $300-500 reward debit rebate cards and ultra-cheap introductory rates. Motivating subscribers to switch has never been as successful as theory might suggest. But Verizon has also shown other providers they can hard-negotiate significant discounts on hardware and equipment, and price cutting sessions have become ruthless.

At least Google has set its targets at reasonable levels. Only between 5-25% of eligible families have to commit to signing up for service in each “fiberhood” for Google to proceed with service rollout in that immediate area. That’s a realistic target with all of the factors necessary to deem the project a success.

Some Time Warner Cable customers have received e-mail notifications of a security breach involving legacy Road Runner Safe Storage accounts:

Some Time Warner Cable customers have received e-mail notifications of a security breach involving legacy Road Runner Safe Storage accounts:

Subscribe

Subscribe