Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013.

Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013.

Jeff Gardner, Windstream’s CEO, told investors on a conference call last week the company’s highest priority in 2013 is preserving its current dividend to create value for shareholders. Not on the priority list: improving broadband infrastructure to support video streaming services, further expanding broadband in areas it now bypasses, and boosting the quality of service it delivers to current customers.

Gardner called the company’s increased investment in 2011 and 2012 a result of “finite opportunities that provide[d] attractive investment returns.”

But most of that spending will come to an end next year.

“We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”

“We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”

That could be bad news for communities in places like Wayne County, Mo., which suffers with inadequate broadband from the company. In some areas when local broadband traffic reduces DSL speeds to a crawl, area businesses are occasionally forced to shut down for the day.

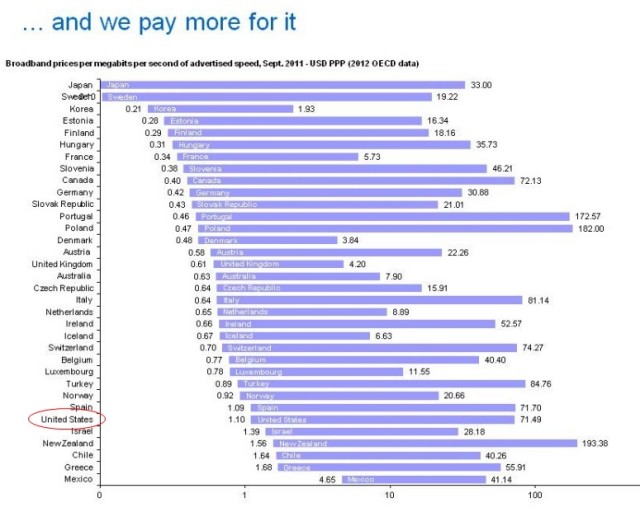

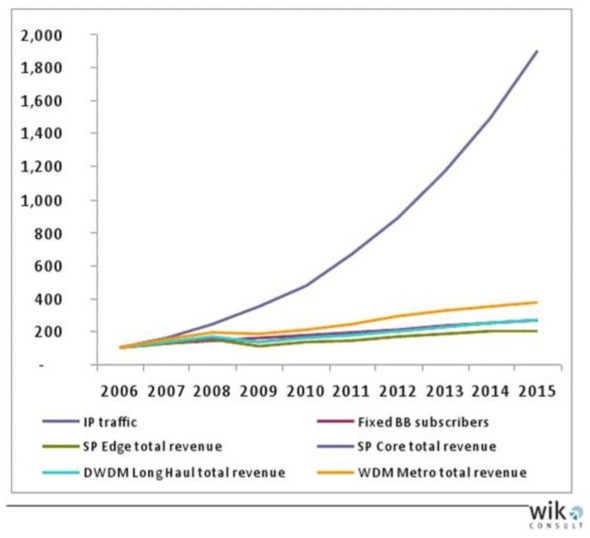

Broadband and business services now account for 70% of Windstream’s revenue, but it has come with a price: increased investment, that Wall Street considers negative to the company’s value. To satisfy analysts and shareholders, Gardner made it clear improving the balance sheet is a major priority. He said he will continue to direct excess free cash flow first to preserve the company’s shareholder dividend, and then direct much of the rest to debt repayment.

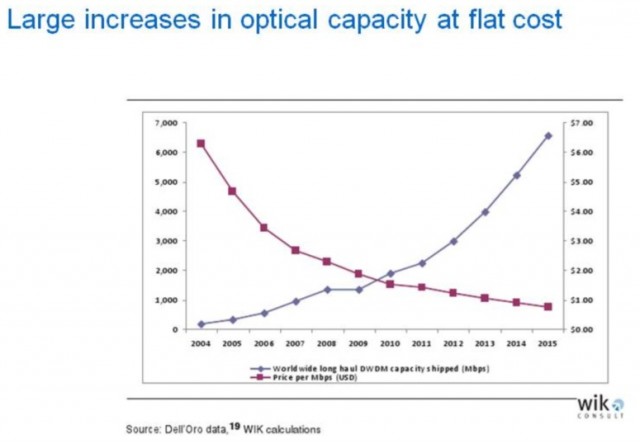

That does not mean Windstream will end all investments in its business. The company now spends 12.4% on ongoing capital investments and will continue to do so, but much of the spending will cover network upkeep and supporting more profitable business services.

“Over the last four years, our acquisitions have been very targeted on businesses that are growing in the strategic growth areas that we’re focused on, and we’ve really changed the mix very significantly here, away from the consumer business toward the enterprise space, and I think that puts us in a very different position with respect to the stability of our revenue and OIBDA over time,” Gardner added.

Windstream plans to bring back its “price for life” promotion this year.

Gardner noted Windstream is well-positioned to take advantage of the fact it has few competitors, which reduces pressure to invest and improve its networks to stay competitive.

“Our residential customers remain concentrated in very rural areas where there is less competition, which has contributed to a more stable consumer business,” Gardner admitted.

He added that those rural customers will have to rely on the company’s satellite partner Dish Networks for video services. Windstream will not build a “capital-intensive facilities based technology” to support online video. In contrast, CenturyLink has invested in Prism, a fiber-to-the-neighborhood service in several of its larger markets, to offer triple play packages of broadband, phone, and cable TV. Windstream has no plans to follow.

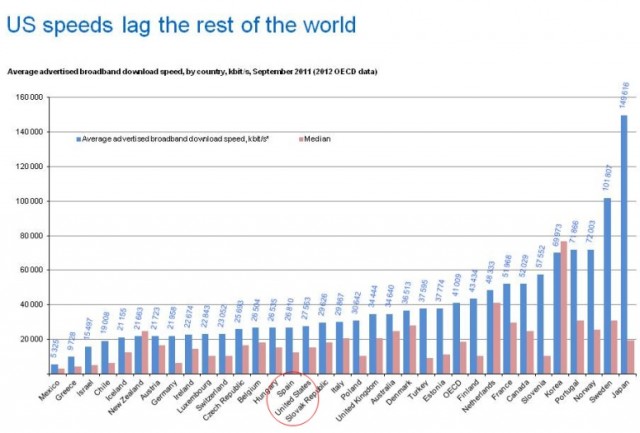

Despite investments in 2011 and 2012 to improve broadband service and speeds, Windstream’s DSL services have not kept up with its cable competitors.

During the last quarter, Windstream lost 2,000 broadband customers and 23,000 consumer voice lines (a 4.5% decline year over year).

To stem the tide of customers moving away from the phone company, Windstream is trying to sell value-added Internet support services, online backup, and faster speeds to maximize profitability. It will also add new customers made possible from federally funded broadband stimulus projects.

Windstream customers can expect to see increased promotional activity this year to win or keep their business:

- Covering the costs of switching from another provider to Windstream;

- A return to the “price for life” promotion, which promises stable rates as long as a customer stays with the company;

- A substantial introductory discount on satellite TV when bundled with Windstream’s own services.

Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.

Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.

Subscribe

Subscribe

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.

Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013.

Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013. “We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”

“We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”

AT&T and Verizon have forced some of their customers to abandon DSL service in favor of fiber upgrades that are sometimes not actually up and running or leave customers with no phone service during power outages.

AT&T and Verizon have forced some of their customers to abandon DSL service in favor of fiber upgrades that are sometimes not actually up and running or leave customers with no phone service during power outages. But Verizon’s CEO says the company is embarked on a plan to rid itself of its copper wire network, especially where FiOS fiber exists.

But Verizon’s CEO says the company is embarked on a plan to rid itself of its copper wire network, especially where FiOS fiber exists.