A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings.

A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings.

Ovum Research senior analyst Kamalini Ganguly said AT&T’s fiber to the home (FTTH) network in Austin — set to upgrade customers to 1Gbps next year — is likely to confuse AT&T and its shareholders over the future direction of AT&T’s current fiber to the neighborhood (FTTN) upgrade effort, dubbed Project VIP.

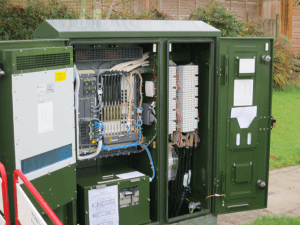

Having spent eight years deploying the U-verse FTTN service, a year ago AT&T chose to expand household coverage and upgrade speeds. That effort, called Project VIP, is still ongoing and until now has reflected AT&T’s projection that 45Mbps downstream (and 6Mbps upstream) should be good enough for the majority of its customers.

AT&T says it intends to boost part of its Project VIP footprint to 75Mbps or 100Mbps with VDSL2 vectoring, but the extent of this is unknown. It has also deployed a small amount of GPON FTTH in greenfield markets, typically designed to support 80–100Mbps to each household. Also as part of Project VIP, it plans to reach 1 million businesses with symmetric 1Gbps FTTH.

However, the GigaPower offering in Austin will be AT&T’s first 300Mbps or 1Gbps mass-market FTTH offering targeting consumers, not just businesses, in a major market. It is also a symmetric offering, meaning upstream will be 1Gbps as well. Those speeds are far higher than what Project VIP will deliver to the majority of consumers. The jump from 45/6Mbps to 1/1Gbps for consumers raises questions around its strategy. The cost issue looms large. Deploying 1Gbps point-to-point FTTH will continue to cost much more than GPON FTTH, which in turn still costs a lot more than FTTN – even with vectoring. AT&T needs to explain better what has changed from last year in the business case for FTTH over FTTN.

Wall Street is asking questions because AT&T has repeatedly denied its fiber project in Austin has anything to do with Google’s intention to offer a similar fiber network in Austin next year and everything to to do with its general broadband strategy. There is increasing skepticism about AT&T’s veracity on that point, particularly after AT&T announced pricing that was suspiciously similar to what Google charges its fiber customers in Kansas City and is likely to charge in Austin. Ovum’s researchers also took special note of AT&T’s intention to “examine its customers’ browsing habits in order to generate incremental revenues with targeted ads and commercial offers.”

There is evidence Google is proving a growing market disruptor, turning cable and telco industry pricing models upside down where the search engine giant threatens to compete. Industry plans to charge premium prices for incrementally faster broadband speed tiers is at risk with Google’s gigabit offer, priced at just $70 a month. Comcast charges up to $300 a month for considerably less speed. Community owned fiber broadband providers are increasingly adopting Google’s pricing model themselves. EPB in Chattanooga reduced the price of its 1Gbps tier from $300 to $70 earlier this year.

“By accepting a ceiling of $70, AT&T may be making it harder to break even,” writes Ganguly. “We may see lower prices cascading down for all broadband services. AT&T runs the risk of de-valuing its own broadband business and ultimately that of others too. On a more positive note, demand for 1Gbps was seen as questionable when prices were unaffordable for consumers and when multiple HD streams can be supported by 40–50Mbps. With these price levels however, demand may spike and boost the business case for 1Gbps.”

Subscribe

Subscribe Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network.

Residents in Los Angeles and San Diego join those in New York and Kansas City that can now receive local over the air programming on their home computer, tablet, game console, or Roku box. Time Warner Cable requires viewers to subscribe to both its television and broadband services to watch, and only from your home’s Wi-Fi network. AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide.

AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide. Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts.

Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts. SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born.

SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born. Rural Norway is getting a broadband upgrade. Out goes last century’s DSL service and in comes gigabit fiber to the home service for villages and towns that American providers would consider unprofitable to serve.

Rural Norway is getting a broadband upgrade. Out goes last century’s DSL service and in comes gigabit fiber to the home service for villages and towns that American providers would consider unprofitable to serve.