Residents of southern Vermont are upset about Comcast’s proposed acquisition of an independent cable company that has served the region for more than 30 years, fearing the cable giant will bring its reputation of high rates, poor service, and abusive customer relations to an area known for resisting large corporations.

Residents of southern Vermont are upset about Comcast’s proposed acquisition of an independent cable company that has served the region for more than 30 years, fearing the cable giant will bring its reputation of high rates, poor service, and abusive customer relations to an area known for resisting large corporations.

The Southern Vermont Cable Company (SVCC) owns several small cable systems serving about 2,450 subscribers around Brattleboro, just a short distance from the Massachusetts and New York borders. SVCC launched service because larger cable companies including Comcast and what was formerly Time Warner Cable did not see a viable business opportunity serving southern Vermont. The independent operator successfully launched service on its own, but has faced business pressure from cord-cutting and a constant need to upgrade its cable plant to meet growing demands for fast and robust broadband service.

“For more than 30 years, SVCC has offered great local service to its customers and has made significant capital investments in its system throughout the years,” Daniel M. Glanville, vice president of government/regulatory affairs and community impact for Comcast’s western New England region, said in testimony before state regulators reviewing the sale. “However, there is a need for continued capital investment as technology continues to evolve and video competition continues to increase due to an ever-growing number of video service options.”

“For more than 30 years, SVCC has offered great local service to its customers and has made significant capital investments in its system throughout the years,” Daniel M. Glanville, vice president of government/regulatory affairs and community impact for Comcast’s western New England region, said in testimony before state regulators reviewing the sale. “However, there is a need for continued capital investment as technology continues to evolve and video competition continues to increase due to an ever-growing number of video service options.”

Instead of offering to sell the system to the communities it serves, SVCC executives elected to sell the system to Comcast.

“I am confident that an organization like Comcast will provide SVCC’s subscribers with quality customer service and will continue to invest in SVCC’s systems,” said Ernest Scialabba, president and owner of SVCC.

Customers have a much different view, according to the Brattleboro Refomer:

Steve West of Dummerston told regulators he has “only praise for the good folks at SVCable, and nothing but contempt for Comcast.”

“As a computer repair professional for 20 years, I’ve had many dealings with Comcast/Xfinity, nearly all of it bad,” he wrote. “Many of us in rural Vermont have few options. I view them as one of the most toxic companies in the U.S., and I’ve successfully avoided being a customer.”

Martha Ramsey of Brattleboro told the commission she is a Comcast customer and “can attest, along with all my neighbors, that Comcast has a long way to go to providing reliable cable service” to southern Vermont.

“Therefore, I can only assume that this sale would simply be a hostile buyout for the benefit not of customers but of shareholders, and so should not be permitted, in order to prevent any further erosion of decent utility services in Vermont,” she wrote. “My Comcast bill has already increased by an outrageous percentage in the last five years without any credible explanation, and I expect such increases to continue. Helping Comcast to become the only player in the market would be to accelerate this race to the bottom — that is, increasingly unaffordable and increasingly shoddy infrastructure and service — that at a scary pace is impoverishing all but the very wealthy.”

“Comcast will provide increased reliability and network capacity which will enable former SVCC customers to enjoy the full suite of Comcast’s Xfinity TV services, including the X1 platform, Xfinity on Demand (Comcast’s video on demand service), multiple high-definition offerings, sports programming and international programming,” said a Comcast representative. “Comcast will also introduce Comcast Business Services, which provides business-grade products and services for businesses of all sizes. Video customers will also be able to use the Xfinity Stream app on their tablet or smartphone to view live and Xfinity On Demand programming.”

“Comcast will provide increased reliability and network capacity which will enable former SVCC customers to enjoy the full suite of Comcast’s Xfinity TV services, including the X1 platform, Xfinity on Demand (Comcast’s video on demand service), multiple high-definition offerings, sports programming and international programming,” said a Comcast representative. “Comcast will also introduce Comcast Business Services, which provides business-grade products and services for businesses of all sizes. Video customers will also be able to use the Xfinity Stream app on their tablet or smartphone to view live and Xfinity On Demand programming.”

But the idea a giant multinational company like Comcast, with more than 830,000 customers, will preserve a local touch to SVCC’s operations is absurd, according to local residents.

“Please don’t allow this to happen,” Kathleen Fleischmann wrote. “One of the reasons we chose to move to Vermont was that it wasn’t owned by the multinationals. Southern Vermont Cable is a great company, and our service would certainly be degraded by having to deal with Comcast. You must be aware that they are one of the most hated corporations in the country. Their lack of customer service is legendary.”

Eli K. Coughlin-Galbraith urged the commission not to “let this one go. We’re all being strangled by massive multinational corporations piece by piece. Fight it. Fight it any way you can.”

The Vermont Department of Public Service will hold a public hearing about the proposed sale from 4-8 p.m. on Feb. 3 at the O’Brien Auditorium in the East Academic Building at Landmark College in Putney.

Subscribe

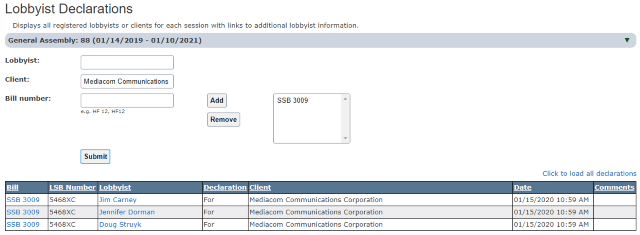

Subscribe Lobbyists for Mediacom, one of America’s medium-sized cable operators, are reportedly behind the latest effort to curtail public broadband in the state of Iowa with a new bill designed to make life difficult for municipalities trying to get internet access to their residents.

Lobbyists for Mediacom, one of America’s medium-sized cable operators, are reportedly behind the latest effort to curtail public broadband in the state of Iowa with a new bill designed to make life difficult for municipalities trying to get internet access to their residents.

Comcast and Charter Communications have begun to compete outside of their respective cable footprints, potentially competing directly head to head for your business, but only if you are a super-sized corporate client.

Comcast and Charter Communications have begun to compete outside of their respective cable footprints, potentially competing directly head to head for your business, but only if you are a super-sized corporate client.

But neither company wants to end their comfortable fiefdoms in the residential marketplace by competing head to head for customers. Companies claim it would not be profitable to install redundant, competing networks, even though independent fiber to the home overbuilders have been doing so in several cities for years. It seems more likely cable operators are deeply concerned about threatening their traditional business model supplying services that face little competition. In the early years, that was cable television. Today it is broadband. Large swaths of the country remain underserved by telephone companies that have decided upgrading their deteriorating copper wire networks to supply residential fiber broadband service is not worth the investment, leaving most internet connectivity in the hands of a single local cable operator. Most cable companies have taken full advantage of this de facto monopoly by regularly raising prices despite the fact that the costs associated with providing internet service have been declining for years.

But neither company wants to end their comfortable fiefdoms in the residential marketplace by competing head to head for customers. Companies claim it would not be profitable to install redundant, competing networks, even though independent fiber to the home overbuilders have been doing so in several cities for years. It seems more likely cable operators are deeply concerned about threatening their traditional business model supplying services that face little competition. In the early years, that was cable television. Today it is broadband. Large swaths of the country remain underserved by telephone companies that have decided upgrading their deteriorating copper wire networks to supply residential fiber broadband service is not worth the investment, leaving most internet connectivity in the hands of a single local cable operator. Most cable companies have taken full advantage of this de facto monopoly by regularly raising prices despite the fact that the costs associated with providing internet service have been declining for years.

“It’s very much a mobility strategy, with a secondary product of Home [5G], rather than us changing our overarching mobility deployment to try to accelerate Home at the expense of the overall 130 million customer base,” Dunne explained.

“It’s very much a mobility strategy, with a secondary product of Home [5G], rather than us changing our overarching mobility deployment to try to accelerate Home at the expense of the overall 130 million customer base,” Dunne explained. More than 121,000 homes and businesses in 17 states will receive subsidized satellite internet service from Viasat, after the Federal Communications Commission

More than 121,000 homes and businesses in 17 states will receive subsidized satellite internet service from Viasat, after the Federal Communications Commission