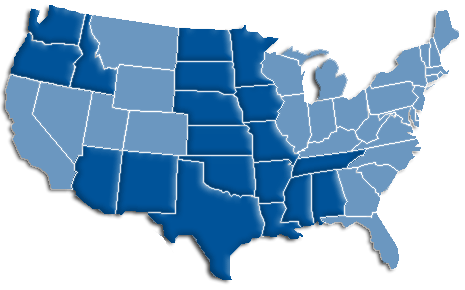

Newly independent Cable One will reduce its emphasis on cable television and turn its time, attention, and capital towards improving broadband service for its 690,000 largely rural customers in 19 states.

Newly independent Cable One will reduce its emphasis on cable television and turn its time, attention, and capital towards improving broadband service for its 690,000 largely rural customers in 19 states.

Cable One was spun off from Graham Holdings on July 1 and is not likely to stay independent for long before it is acquired by another cable operator, most likely Patrick Drahi’s Altice, S.A. — which recently acquired Suddenlink. But in the meantime, Cable One is attempting to persuade investors it is remaking itself into a broadband company, de-emphasizing the traditional cable television package in favor of dedicating more bandwidth for faster broadband speeds.

“Our standard broadband offering for our residential customers since 2011 has been a download speed of 50Mbps, which is at the high-end of the range of standard residential offerings even today in our markets,” the company reported in a statement. “Our enhanced broadband offering for our residential customers is currently a download speed of 75Mbps, which we expect to raise to 100Mbps by the end of 2015.”

Cable One primarily serves small cities and towns in the central and northwestern United States.

In several markets, 100Mbps speed is already available and regular pricing has been simplified to $1 per megabit of service: 50Mbps for $50, 75Mbps for $75, or 100Mbps for $100 a month.

To protect its broadband business model, which carries prices traditionally higher than larger operators, Cable One will stay focused on largely uncompetitive markets where it faces token DSL broadband competition from companies like Frontier Communications, CenturyLink, and Windstream. More than 75 percent of its customers are located in Mississippi, Idaho, Oklahoma, Texas and Arizona, many served by these three telephone companies.

Cable One signaled it will hold the line on cable programming costs as well. In April 2014, the company dropped 15 Viacom networks, including MTV, VH1, Comedy Central, Nickelodeon and others over contract renewal prices it claimed were too high. The cable TV package has continued without the Viacom networks for more than a year, resulting in the loss of more than 20% of its cable TV customers. More than 100,000 homes have dropped Cable One video service for another provider, but ironically that actually helped Cable One increase its cash flow by more than 11%, because it no longer has to pay programming fees on behalf of the lost customers.

On the bright side, Cable One executives discovered many of its former TV customers have stayed with Cable One for Internet service because the competition either does not offer broadband or generally provides DSL at speeds under 10Mbps. Company officials have emphasized this point to investors, suggesting broadband is a true money-maker and television can safely take second chair without sabotaging profits.

“We certainly have some sympathy for the notion that a broadband-only cable operator might be more profitable,” wrote analyst Craig Moffett in an investor note this month. “But there are some critical holes in the Cable One story. Does the company truly believe that all costs are variable such that cutting video will bring endless margin expansion? Are Cable One’s new shareholders really better off for having played hardball with Viacom?”

Moffett does not believe so because he is convinced Cable One’s independence will be short-lived.

“We all know the consensus opinion is that someone will buy Cable One,” Moffett wrote. “But the above questions still matter. Any potential acquirer would still place value on a video business, or pay less for the fact that Cable One has less of one.”

But as long as rural telephone companies barely compete for broadband customers, Cable One’s broadband performance will deliver them a de facto broadband monopoly in their largely rural service areas. That gives the cable company, or its next owner, plenty of room for rate hikes.

Subscribe

Subscribe Montréal cable subscribers will soon be able to buy gigabit broadband speeds from Vidéotron after a successful pilot project demonstrated the cable company’s existing DOCSIS 3.0 network was up to the task.

Montréal cable subscribers will soon be able to buy gigabit broadband speeds from Vidéotron after a successful pilot project demonstrated the cable company’s existing DOCSIS 3.0 network was up to the task.

Residents of one of the world’s most isolated countries will soon have the option of getting fiber-to-the-home service that will offer faster Internet access than most Americans get with traditional DSL from their phone company.

Residents of one of the world’s most isolated countries will soon have the option of getting fiber-to-the-home service that will offer faster Internet access than most Americans get with traditional DSL from their phone company.

But Zibelman assumes at least some of those disputes have since been settled and now wants details about where Verizon is still unable to offer FiOS in New York City and why. She also wanted to make sure Verizon was not favoring certain areas over others for fiber service:

But Zibelman assumes at least some of those disputes have since been settled and now wants details about where Verizon is still unable to offer FiOS in New York City and why. She also wanted to make sure Verizon was not favoring certain areas over others for fiber service: “Indicate whether Verizon has achieved its six-year build-out in the cable franchise agreement,” Zibelman asked. “If Verizon has not achieved that build-out, please provide all documentation that Verizon provided to the City to justify the basis for any delay. In addition, please provide a current status of the FTTP build-out, by Borough, indicating the percentage and number of buildings served, and the remainder of buildings yet to be served. Provide a status update of the buildings identified in previous Verizon petitions for Orders of Entry.”

“Indicate whether Verizon has achieved its six-year build-out in the cable franchise agreement,” Zibelman asked. “If Verizon has not achieved that build-out, please provide all documentation that Verizon provided to the City to justify the basis for any delay. In addition, please provide a current status of the FTTP build-out, by Borough, indicating the percentage and number of buildings served, and the remainder of buildings yet to be served. Provide a status update of the buildings identified in previous Verizon petitions for Orders of Entry.”