Super monopoly?

Some Wall Street analysts are pondering ideas on how to limit forthcoming 5G wireless home broadband, suggesting providers might want to set up local monopolies, keeping competition to a minimum and profits to a maximum.

Verizon’s presentation at its annual Analyst Day meeting drew little praise from analysts and investors in attendance, “landing like a thud” to quote one person at the event.

The issue concerning Wall Street is what impact 5G wireless broadband will have on the internet access marketplace, which is currently a comfortable monopoly or duopoly in most American cities. That may radically change if the country’s four wireless companies each launch their own 5G services, designed to replace wired home broadband services from the cable and phone companies.

This week Verizon formally announced Sacramento would be the first city in the country to get its forthcoming 5G service, with an additional four of five unnamed cities to follow sometime next year.

Verizon will advertise 1,000Mbps service that will be “priced competitively” with current internet providers in the market. But Verizon intends to market itself as “a premium provider,” which means pricing is likely to be higher than one might expect. Verizon claims they intend to roll out 5G service to 30 million households — 25-30% of the country, making Verizon a prominent provider of fixed wireless home broadband service.

But analysts panned Verizon’s presentation for raising more questions than the company was prepared to answer. Barron’s shared the views of several analysts who were underwhelmed.

Notably, Craig Moffett from Moffett-Nathanson was particularly concerned about how to rate 5G service for his investor clients, and more importantly to them, how to forecast revenue and profit.

Moffett

The biggest problem for Moffett is the prospect of additional competition, and what that will do to each current (and future) provider’s share of customers and its revenue. If every major wireless carrier enters the 5G home broadband business, that will raise the prospective number of ISPs available to consumers to six or more — four wireless carriers competing with the phone and cable company. That is potentially very dangerous to big profits, especially if a competitive price war emerges.

“Let’s assume that AT&T is just as aggressive about this opportunity as Verizon,” Moffett told his investor clients. “Will they enter the same markets as Verizon, or different ones? […] If multiple players enter each market, all targeting the same 25-30% [where 5G service will be sold]. Well, what then? Let’s suppose the 30% market share estimate is right. Wouldn’t it be now shared among two, three, or even four [5G fixed wireless broadband] providers?”

Moffett gently proposes a concept where this profit-bruising competition can be abated by following the cable television model — companies agree to stay out of each others’ markets, giving consumers a choice of just one 5G provider in each city instead of four.

“There’s a completely different future where each operator targets different markets […] Let’s say that AT&T decides to skip Sacramento. After all, Verizon will have gotten there first,” Moffett suggests. “If the required share of the [fixed wireless] market is close to Verizon’s estimated 30%, then there is only room for one provider. So AT&T decides to do Stockton, about 40 miles to the south. Verizon would then skip Stockton, but might do Modesto, twenty miles further south… and then AT&T would then skip Modesto and instead target Fresno… unless Sprint or T-Mobile got there first.”

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.

“That would create a truly bizarre market dynamic that is almost unimaginable today, where each operator ‘owned’ different cities, not just for [5G] but also for 4G LTE. If this kind of patchwork were to come to pass, the only viable solution might then be for companies to reciprocally wholesale their networks. You can use mine in Modesto if I can use yours in Fresno. To state the obvious, there is almost no imaginable path to that kind of an outcome today.”

The reason providers have not attempted this kind of “one provider” model in the past is because former FCC commissioners would have never supported the idea of retiring wireless competition and creating a cable monopoly-like model for wireless service. But things have changed dramatically with the advent of Chairman Ajit Pai, who potentially could be sold on the idea of granting local monopolies on the theory it will “speed 5G deployment” to a large number of different cities. Just as independent wireless providers lease access on the four largest carriers today (MVNO agreements), AT&T, Verizon, T-Mobile and Sprint could sell wholesale access to their networks to each other, allowing massive cost savings, which may or may not be passed on to customers.

But it would also bring an end to network redundancy, create capacity problems, and require every carrier to be certain their networks were interoperable with other wireless companies. The federal government’s emergency first responder program also increasingly depends on a wireless network AT&T is building that would give them first priority access to wireless services. How that would work in a city “designated” to get service from Verizon is unclear.

Restricting competition would protect profits and sharing networks would slash expenses. But such prospects were not enough to assuage Wall Street’s insatiable hunger for maximum profits. That is why analysts were unimpressed with Verizon’s presentation, which “lacked the financials” — precise numbers that explain how much the network will cost, how quickly it will be paid off, and how much revenue it can earn for investors.

A small cell attached to a light pole.

Verizon did sell investors on the idea 5G will put an end to having to wire fiber optics to every home. The service will also keep costs to a minimum by selling retail activation kits customers will install themselves — avoiding expensive truck rolls. Billing and account activation will also be self-service.

Verizon also announced a new compact 4G/5G combined antenna, which means 5G service can be supplied through existing macro/small cell 4G equipment. Verizon will be able to supplement that network by adding new 5G nodes where it becomes necessary.

Investor expectations are that 5G will cost substantially less than fiber to the home service, will not cost massive amounts of new investment dollars to deploy in addition to maintaining existing 4G services, will not substantially undercut existing providers, and will allow Verizon to market 21st century broadband speeds to its customers bypassed for FiOS fiber service. It will also threaten rural phone companies, where customers could easily replace slow speed DSL in favor of what Verizon claims will be “gigabit wireless.”

Despite that, Instinet’s Jeffrey Kvaal was not wowed by Verizon’s look to the future.

“Verizon’s initial fixed wireless implementation seems clunky and it withheld its pricing strategy,” Kvaal told his clients. He believes fixed wireless broadband will cost Verizon an enormous amount of money he feels would be better spent on Verizon’s mobile network. “Verizon glossed over 5-10x LTE upgrades that are already offering ~100Mbps of fully mobile service at current prices to current phones without line of sight. A better 5G story might be to free up sufficient LTE capacity to boost the unlimited cap from 25GB to 100GB for, say, a $25 premium. The ‘cut the cord’ concept was successful in voice, in video, and should be in broadband.”

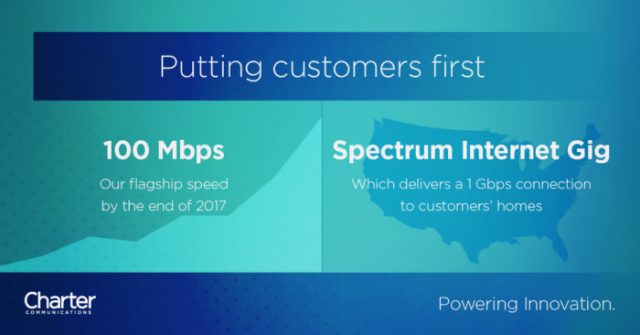

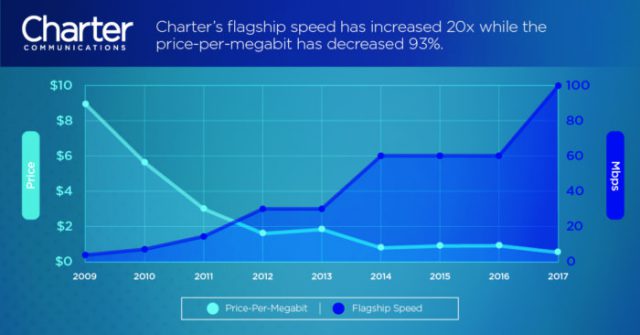

[Clarification 1/15/2018: This list only covers customer-owned modems approved by Charter Communications. It is not a comprehensive list of modems that may have been supplied directly by Charter/Spectrum, or its predecessors Time Warner Cable or Bright House Networks, which are obviously also acceptable. However, if you have a modem supplied by Time Warner or Bright House, it might not support the upgraded faster speeds Spectrum now offers. You might want to contact customer service to verify whether your current modem is capable of performing at the speeds now provided.]

[Clarification 1/15/2018: This list only covers customer-owned modems approved by Charter Communications. It is not a comprehensive list of modems that may have been supplied directly by Charter/Spectrum, or its predecessors Time Warner Cable or Bright House Networks, which are obviously also acceptable. However, if you have a modem supplied by Time Warner or Bright House, it might not support the upgraded faster speeds Spectrum now offers. You might want to contact customer service to verify whether your current modem is capable of performing at the speeds now provided.]

Subscribe

Subscribe

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.

But Moffett is thinking even further ahead, by suggesting wireless carriers might be able to stop spending billions on building and expanding their competing 4G LTE networks when they could all share a single provider’s network in each city. That idea could work if providers agreed to creating local monopolies.

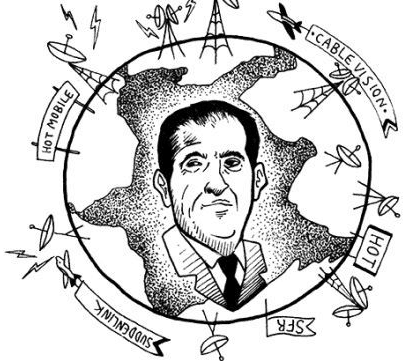

The biggest enemy of Altice in Europe is robust competition, which has allowed dissatisfied customers to switch providers in droves. SFR-Numericable, despite promises of fiber-fast speeds, has endured complaints about slow and uneven speeds and persistent service outages. Drahi’s original business plan was to upgrade broadband speeds and performance to win over France’s remaining DSL customers. That worked for a time, according to the French newspaper Libération,

The biggest enemy of Altice in Europe is robust competition, which has allowed dissatisfied customers to switch providers in droves. SFR-Numericable, despite promises of fiber-fast speeds, has endured complaints about slow and uneven speeds and persistent service outages. Drahi’s original business plan was to upgrade broadband speeds and performance to win over France’s remaining DSL customers. That worked for a time, according to the French newspaper Libération,

Drahi was banking on his ability to manage Altice’s debt and boost revenue by milking U.S. cable customers. Unlike in France, where competition and regulation have kept cable television and broadband prices much lower than in North America, Drahi saw enormous potential from the U.S. telecom market, where Americans routinely pay double or even triple the price many Europeans pay for television and internet access. Drahi sold investors on the prospects of slashing costs, initiating employee cutbacks, and raising prices for acquired U.S. cable companies. Suddenlink customers are particularly captive to cable broadband because the only alternative in many Suddenlink markets is slow speed DSL. Cablevision faces fierce competition from Verizon FiOS, but Verizon has sought to ease revenue-eating promotions that the company has offered in prior years. Both U.S. cable operators have raised prices since Altice acquired them.

Drahi was banking on his ability to manage Altice’s debt and boost revenue by milking U.S. cable customers. Unlike in France, where competition and regulation have kept cable television and broadband prices much lower than in North America, Drahi saw enormous potential from the U.S. telecom market, where Americans routinely pay double or even triple the price many Europeans pay for television and internet access. Drahi sold investors on the prospects of slashing costs, initiating employee cutbacks, and raising prices for acquired U.S. cable companies. Suddenlink customers are particularly captive to cable broadband because the only alternative in many Suddenlink markets is slow speed DSL. Cablevision faces fierce competition from Verizon FiOS, but Verizon has sought to ease revenue-eating promotions that the company has offered in prior years. Both U.S. cable operators have raised prices since Altice acquired them.