Phillip “Ouch!” Dampier

Spending the day watching cable business news channels gush approval of last night’s surprise announcement that Comcast would acquire Time Warner Cable is just one excellent reason this deal should never be approved.

CNBC, owned by Comcast, particularly fell all over itself praising the transaction. Some of the reporters — many Time Warner Cable customers — actually believed Comcast would be a significant improvement over TWC. It is, if you want higher modem rental fees, higher cable TV bills, and faster broadband speeds you can’t use because of the company’s looming reintroduction of usage caps. CNBC didn’t bother to mention any of that, and why should they? CNBC reporter David Faber was the first to break the story of the merger last evening and among the first this morning to score an extended, friendly interview with the CEOs of both Comcast and Time Warner Cable, pitching softball questions to the two of them for nearly 15 minutes.

That’s a problem. How often do you hear news reports that include the fact the parent company of the channel has an ownership interest in one of the players. Do you think you are getting the full story when a Comcast employee asks Comcast’s CEO about a multi-billion dollar deal on a network owned and operated by Comcast. Incorporating Time Warner Cable and its news operations into Comcast only makes the problem worse.

As far as cable business news networks and the parade of Wall Street analysts are concerned, this is a fine deal for shareholders, consumers, and the cable business. Ironically, several on-air reporters and commentators defended the merger claiming it isn’t an antitrust issue because Comcast and Time Warner Cable never compete with each other. They never asked why that is so.

They’re here!

Comcast is hoping the government will give its merger a pass with few conditions for the same reason, without bothering to note the cable industry has existed as a cartel in the United States for decades, each company with a territory they informally agree not to cross. With this deal, Comcast’s fiefdom will now cover about half of all cable subscribers in the U.S., covering 43 of the 50 largest metropolitan markets, and have about a 30% total market share among all competing providers — by far the largest. An 800 pound gorilla is born.

Three million current Time Warner Cable subscribers will not be coming along for the ride and will likely be auctioned off to Charter or another cable operator in a token gesture to keep Comcast’s total market share at the 30% mark the FCC formerly insisted on as an absolute ownership limit — before Comcast successfully sued to have that limit overturned.

The rest of us can say goodbye to our unlimited broadband plans and get ready to pay substantially more for cable and broadband service. Despite claims from remarkably shallow media reports, an analysis of Comcast and Time Warner Cable’s rates clearly show TWC charges lower prices with fewer “gotcha” fees.

Reviewing some recent promotional offers for new customers, Comcast customers pay nearly $35 more for a triple play package than Time Warner customers pay:

Time Warner Cable’s Rob Marcus gets a $56.5 million golden parachute after 43 days on the job as CEO.

The Comcast Starter plan costs $99 per month for the first 12 months with a 2-year agreement that includes a nasty divorce penalty. After 12 months, your price increases to $119.99 for the remaining year. The $99 plan accidentally doesn’t bother to mention that customers renting a Comcast cable modem/gateway will pay an extra $8 a month, which raises the price. Since many cable subscribers also want HD DVR service, that only comes free for the first six months, after which Comcast slaps on a charge ranging from $16-27 a month for the next 18 months. Assuming you are happy with the limited channel lineup of the Starter package (and many are not), you will pay up to $154 a month. Oh, we forgot to mention the Broadcast TV surcharge just introduced that increases the bill another $1.50 a month.

Time Warner Cable’s new customer promotions typically cost around $96 a month, including their annoying modem rental fee. DVR service can range from free to $23 a month depending on the promotion, making your monthly rate around $119 a month for 12 months, with no contract and no penalty if you decide to cancel.

“It is pro-consumer, pro-competitive, and strongly in the public interest,” said Comcast CEO Brian Roberts, defending the deal.

Actually, it is in Comcast’s interest. If approved, the biggest investment Comcast will make is spending $10 billion — not to upgrade Time Warner Cable systems — but to launch a major stock buyback program that will directly benefit shareholders.

“On a personal level, it’s never easy to cede control of a company,” said Rob Marcus, Time Warner Cable’s chief executive. “However in this case, it just makes too much sense.”

Before reaching for a Kleenex to wipe any tears away, consider the fact Marcus will do just fine giving up his leadership of TWC just over a month after taking over. His generous goodbye package is worth $56.5 million, not bad for 43 days of work. Time Warner Cable employees won’t share that bounty. In fact, with $1.5 billion in promised savings from the deal’s “synergies” — code language for layoffs, among other things — a substantial number of Time Warner Cable employees can expect to be fired during the first year of the combined company.

The biggest impact of this deal is a further cementing of the duopoly of cable and phone companies into their cozy positions. Instead of encouraging competition, Comcast’s new size-up will guarantee fewer competitors thanks to the concept of volume discounts. The largest providers get the best prices from cable programmers, while smaller ones pay considerably more for access to CNN, ESPN, and other popular channels. Comcast will benefit from reduced pricing for cable programming, which we suspect will never reach customers through price reductions. But any potential startup will have to think twice before selling television programming at all because the prices they will pay make it impossible to compete with Comcast.

Another satisfied customer

Frontier discovered this problem after acquiring FiOS systems from Verizon in Indiana and the Pacific Northwest. When Verizon’s volume discount prices expired, Frontier’s much smaller customer base meant much higher programming costs on renewal. They were so high, in fact, Frontier literally marketed FiOS customers asking them to give up fiber optic television in favor of satellite.

Unless you have pockets as deep as Google, offering cable TV programming may be too expensive for Comcast’s competitors to offer.

Broadband is already immensely profitable for both Time Warner Cable and Comcast, but now it can be even more profitable as Comcast persuades customers to adopt their wireless gateway/modems (for a price) and imposes a usage cap of around 300GB per month. Yes, Comcast will deliver speed increases Time Warner Cable couldn’t be bothered to offer, but with a pervasive usage cap, the value of more Internet speed may prove limited. It’s a case of moving away from Time Warner’s argument that you don’t need faster Internet speed to Comcast’s offer of faster speed that you can’t use.

Customers hoping for a better customer service experience may have been cheered by this misleading passage in today’s New York Times:

Nonetheless, about 8 million current Time Warner Cable customers will become Comcast customers. That may be a good thing for those customers, as Comcast is seen as an industry leader in terms of providing high-quality television and Internet services, while Time Warner Cable has a reputation for poor customer service.

It may be seen as an industry leader by Comcast itself, but consumers despise Comcast just as much as they hate Time Warner Cable. In fact, the American Consumer Satisfaction Index found Comcast was hardly a prize:

- ACSI’s lowest rated ISP

- Second-lowest ranked TV service

- Third-lowest ranked phone service

Comcast consistently scores as one of the lowest rated companies across all the segments it participates in. It has the dubious description of being the lowest rated company in the lowest rated industry.

So why the near universal disdain for ISPs? Even cable companies have to compete with satellite providers. That’s not the case here. Add to that the relatively few companies, regional near-monopolies, high costs, and unreliable service and speed and you have a recipe for bad customer service and little incentive to improve it.

Customers particularly dislike their experiences with call centers, and the range and pricing of available plans.

Higher prices, usage caps, surcharges, and fewer channels for more money. What’s not to love about that?

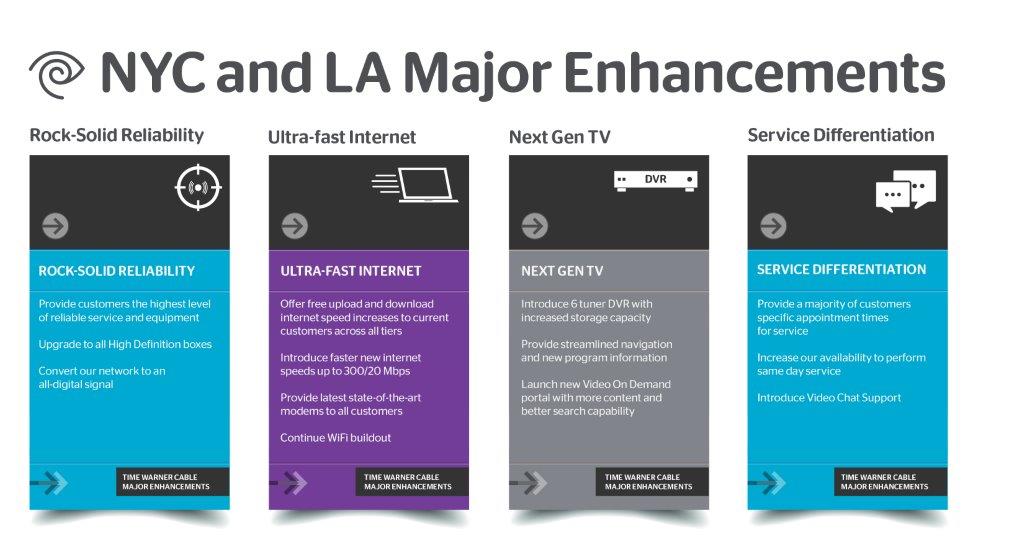

Just about a week ago, Rob Marcus unveiled his vision of an upgraded Time Warner Cable that looked good to us, and retained unlimited use broadband service. Apparently this is all a case of “never mind.”

The fact is, a merger of Comcast and Time Warner Cable will only benefit the companies, executives, and shareholders involved, while doing nothing to improve customer service, expand broadband, increase speeds, cut prices, and give customers the service they want. It is anti-consumer, further entrenches Comcast’s enormous market power (it also owns NBC and Universal Studios), and gives one company far too much control over content and distribution, particularly for customers who don’t have AT&T U-verse or Verizon FiOS or a community-owned provider as an alternative.

This deal needs to be rejected. When T-Mobile found itself out of a deal with AT&T, it survived on its own even better than expected. So can Time Warner Cable, with the right management team.

Subscribe

Subscribe

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive.

Verizon FiOS expansion is still dead while cash cow Verizon Wireless will continue to get the bulk of Verizon’s attention this year, according to a top executive. Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Again this year, Verizon Wireless will get the bulk of Verizon’s attention and financial resources. Verizon Wireless finished 2013 with $81 billion in wireless revenue — up $5.2 billion from 2012 — which represents two-thirds of Verizon’s total earnings. The wireless business has delivered a profit margin of 49% or higher for five of the last seven quarters.

Where there is no disruptive new player in town to shake things up, there is little incentive to speed broadband service up. But there is plenty of room to keep increasing prices for a service that is becoming as important as a working telephone. Companies are using broadband profits to cover increasing losses from pay television service, investing in stock buybacks, paying dividends to shareholders, or just putting the money in a bank, often offshore.

Where there is no disruptive new player in town to shake things up, there is little incentive to speed broadband service up. But there is plenty of room to keep increasing prices for a service that is becoming as important as a working telephone. Companies are using broadband profits to cover increasing losses from pay television service, investing in stock buybacks, paying dividends to shareholders, or just putting the money in a bank, often offshore.

That is why we still celebrate and honor Svetlana Radkevich from Belarus who competed in the speed skating competition at the Vancouver 2010 Winter Olympics. She made it to the finish line and ranked 33rd. Ironically, South Korea ranked fastest overall that year, taking home three gold and two silver medals. In Powell’s world, that’s a distinction without much difference. You don’t need South Korean speed and gold medals when Belarus is enough. That argument always plays well in the United States, where Americans can choose between Amtrak or an airline for a long distance trip. Who needs a non-stop flight when a leisurely train ride will get you there… eventually.

That is why we still celebrate and honor Svetlana Radkevich from Belarus who competed in the speed skating competition at the Vancouver 2010 Winter Olympics. She made it to the finish line and ranked 33rd. Ironically, South Korea ranked fastest overall that year, taking home three gold and two silver medals. In Powell’s world, that’s a distinction without much difference. You don’t need South Korean speed and gold medals when Belarus is enough. That argument always plays well in the United States, where Americans can choose between Amtrak or an airline for a long distance trip. Who needs a non-stop flight when a leisurely train ride will get you there… eventually.