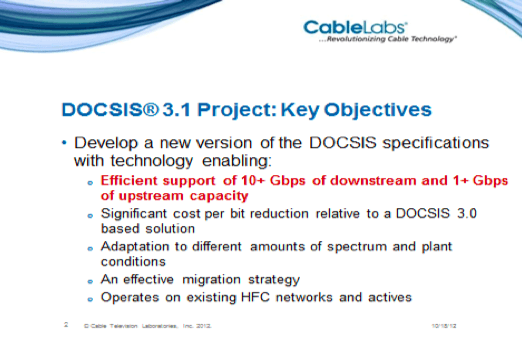

The original DOCSIS 3.1 standard offers up to 10/1Gbps speeds. Adding “full duplex” technology could boost that upstream speed as high as 10Gbps.

The cable industry is seeking to confront one of the strongest selling points of fiber broadband – identical upload and download speeds – by enhancing the DOCSIS 3.1 standard to support “full duplex” technology.

Since inception, cable broadband has been designed to deliver asymmetrical speeds, with priority given to download speeds. To this day, cable systems typically offer customers only a fraction of those fast download speeds for uploads. Cable broadband engineers originally assumed that since the majority of customer broadband usage would be on the download side, less bandwidth was needed for upstream activity. During the late 1990s, it was not uncommon to receive 6-10Mbps of download speed, while being offered just 384kbps for uploads. Today, 1-5Mbps is more typical for entry-level broadband upload speed, but that may no longer be sufficient.

The ongoing buzz for fiber broadband has called out this speed disparity. Most fiber to the home networks offer identical upload and download speeds, which can be as fast as 1,000Mbps or in some cases even faster. That marketing advantage may be costing some cable companies broadband customers. CableLabs, the engineering association of the cable industry, has been tasked with closing that gap and this week announced symmetrical speeds using the newest DOCSIS 3.1 specification are on the fast track and a release schedule could be announced as early as mid-2016.

Dan Rice, CableLabs’s senior vice president of R&D, told Multichannel News “full duplex” will be an extension of DOCSIS 3.1, not a replacement, which guarantees a faster rollout of the enhancement.

The delivery of symmetrical Internet speeds will likely require some cable operators to make hardware changes to their infrastructure. Key to that may be ridding cable plant of multiple amplifiers and filters installed between the cable company’s nearest fiber node and the customer’s home. As cable operators push more reliable fiber further out into their networks, reducing the amount of coaxial copper cable in use, network advancements become easier and less costly.

Whether cable companies will use the enhanced upstream broadband capacity to match their download speeds or just moderately improve them isn’t known. The completion of the enhanced specification will likely give engineers and accountants at each cable company a better idea of how much upload bang for the buck makes the most sense.

Subscribe

Subscribe Frontier Communications plans to leverage their existing fiber-copper infrastructure to

Frontier Communications plans to leverage their existing fiber-copper infrastructure to

Time Warner Cable will upgrade its Cincinnati area customers to Time Warner Cable Maxx service offering broadband speeds up to 200Mbps by this summer.

Time Warner Cable will upgrade its Cincinnati area customers to Time Warner Cable Maxx service offering broadband speeds up to 200Mbps by this summer. CenturyLink is planning to trial usage caps on its broadband service later this year, not to reduce congestion or to bank the extra money for service upgrades, but to boost revenue and profits.

CenturyLink is planning to trial usage caps on its broadband service later this year, not to reduce congestion or to bank the extra money for service upgrades, but to boost revenue and profits.

CenturyLink now has 940,000 households connected to its Gigabit Passive Optical Network (GPON), many for its Prism TV service. Another 490,000 businesses also have access to CenturyLink’s GPON network, primarily for broadband. Post claims more than 30% of the company’s service area is now served with broadband speeds of 40Mbps or greater.

CenturyLink now has 940,000 households connected to its Gigabit Passive Optical Network (GPON), many for its Prism TV service. Another 490,000 businesses also have access to CenturyLink’s GPON network, primarily for broadband. Post claims more than 30% of the company’s service area is now served with broadband speeds of 40Mbps or greater. Despite claims satellite broadband has improved, our readers respectfully disagree:

Despite claims satellite broadband has improved, our readers respectfully disagree: