AEI: If you bought broadband service, that means you like your service and don’t need or want anything better.

The American Enterprise Institute wants the FCC to judge to quality of America’s broadband based on what customers are able to buy today and how much they are willing to pay to get it.

Section 706 of the Telecommunications Act of 1996 requires the FCC to report to Congress whether broadband “is being deployed to all Americans in a reasonable and timely fashion.” As part of that process, the FCC must determine if Americans are getting internet connections capable of providing “advanced telecommunications capability.”

If the FCC reports to Congress that the country’s biggest telecom companies are letting their customers down with inadequate service or no service at all, that can create conditions for the FCC to step in and start insisting on more competition and oversight as well as setting benchmarks for providers to meet. If the report shows that broadband service is adequately provided, the FCC need not regulate, and in some cases such a finding will fuel calls to further deregulate the industry by getting rid of “unnecessary regulation.”

Not surprisingly, findings since 2001 have varied depending on which political party holds the majority on the Commission. Under President George W. Bush, the FCC consistently found broadband service was being adequately deployed to Americans. The FCC also set the bar pretty low on broadband speed, claiming anything at or above 4/1Mbps service constituted “broadband.” That definition comfortably accommodated DSL service from the phone companies.

During the Obama Administration, the FCC set the bar higher. With dissent from the Republican minority, the FCC raised the minimum speed that could be defined as broadband to 25/3Mbps, immediately excluding most DSL and wireless connections. In 2015, former FCC Chairman Thomas Wheeler specifically excluded satellite and wireless connections from that formula, despite objections from FCC Commissioner Ajit Pai. Particularly under Wheeler’s watch, the Democratic majority frequently complained about inadequate broadband and competition, and used Section 706 as its authority to override state laws in North Carolina and Tennessee that placed onerous restrictions on municipal broadband networks. Wheeler felt such laws were anti-competitive, but the courts ruled the FCC exceeded its authority and overturned his pre-emption orders.

Under the Trump Administration, FCC Chairman Ajit Pai seems to be headed down a similar path taken during the Bush Administration, which was optimistic about the state of broadband service and, as a result, applied a lot less pressure on the telecommunications industry.

Chairman Pai is seeking to overturn current Net Neutrality regulations and seems ready to support efforts to undermine the broadband speed standard established by his predecessor. That would allow mobile/wireless companies to offer 10/1Mbps speed and have it qualify as broadband service. Even better, ISPs — wired or wireless — would be considered “competitive” in many cases, even if only one provider offered service in the area.

Pai’s proposal was met with serious objections from Democratic Commissioner Mignon Clyburn who claimed even the current 25/3Mbps standard no longer met the definition of “advanced telecommunications capability.”

“The statute defines advanced telecommunications capability as broadband that is capable of ‘originat[ing] and receiv[ing] high-quality voice, data, graphics, and video telecommunications. High-definition video conferencing is squarely within the rubric of ‘originating and receiving high-quality… video telecommunications,’ yet the 25/3Mbps standard we propose would not even allow for a single stream of 1080p video conferencing, much less 4K video conferencing. This does not even consider that multiple devices are likely utilizing a single fixed connection, or the multiple uses of a mobile device.”

<

div id=”attachment_954762″ class=”wp-caption aligncenter”>

Pai: Wants broadband providers and the competitive marketplace to determine whether broadband is good enough.

AEI dismissed the entire debate, claiming the only people who will respond to the FCC’s request for comments on the subject will be “pundits, special interests, and companies with skin in the game.”

Instead, AEI proposes the FCC rely on watching customers navigate their broadband options — a monopoly for some, duopoly for many others — and only address problems if something unusual emerges. AEI’s test is to see if “a location or demographic is inexplicably different and purchases less than would be expected.”

If something odd does happen in a particular area, AEI argues there could only be two reasons for that:

- Barriers to competition;

- Outdated government regulations and policies standing in the way of progress.

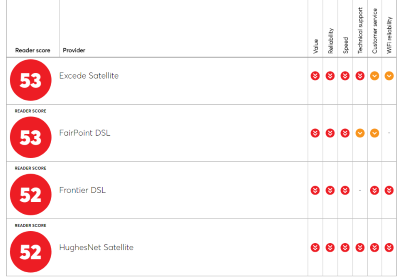

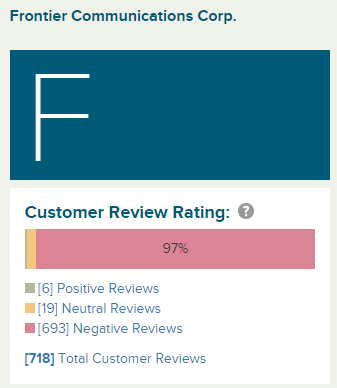

Missing from AEI’s list of possibilities is the presence of an abusive monopoly provider, a comfortable duopoly among two providers with no interest from a third competitor to enter the market, or an area served by two lackluster providers that won’t invest in their networks.

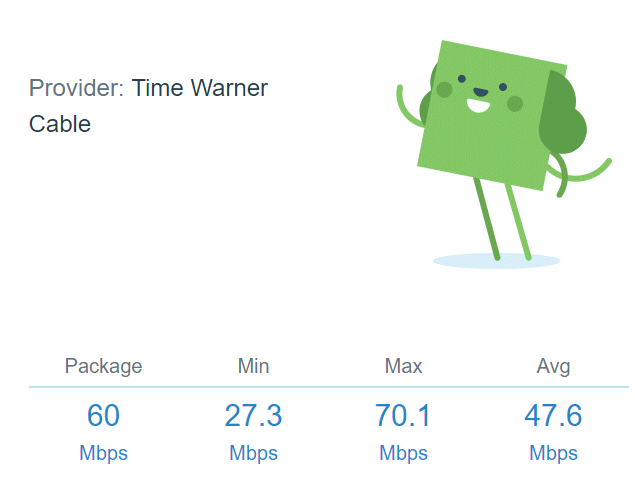

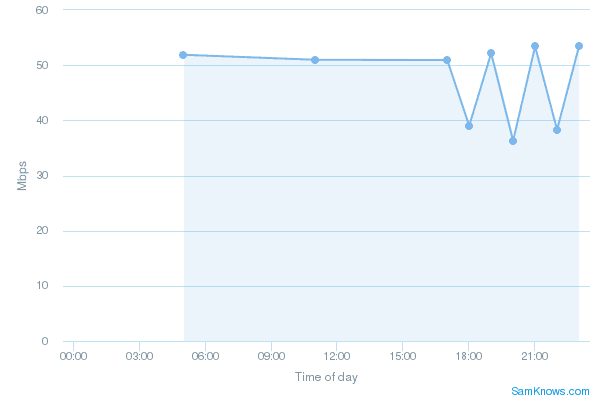

AEI’s test depends entirely on gathering data about what internet services are available for sale in any particular area now and then study who is buying what. But this does not measure customer satisfaction or consider whether those speed tiers and prices are adequate.

Under AEI’s test, “if a geographic area does not have broadband, the FCC could use the results of its customer study to determine what customers in the area would likely find valuable. Then, the FCC could do a cost-benefit study and an economic feasibility study — and conduct a reverse auction if a subsidy is potentially needed — to determine what, if any, financial incentive might be appropriate for the area.”

In other words, the same think tank that has been on record for decades opposing government subsidies to private companies now wants to offer telecom companies government funding to build what would become largely unregulated privately-owned broadband networks that would run with little or no oversight.

AEI’s willingness to let “customers express their opinions through their purchases” is hardly an adequate replacement for current broadband policies designed to keep the U.S. competitive with the rest of the world and ensure adequate service and competition. As any cable subscriber knows, you can subscribe to Comcast or Charter/Spectrum and still loathe your options and want something better. AEI doesn’t appear interested in seeing you get those options, much less preserve what little oversight, consumer protection, and broadband benchmarks we have now. Neither does current FCC Chairman Ajit Pai.

Subscribe

Subscribe