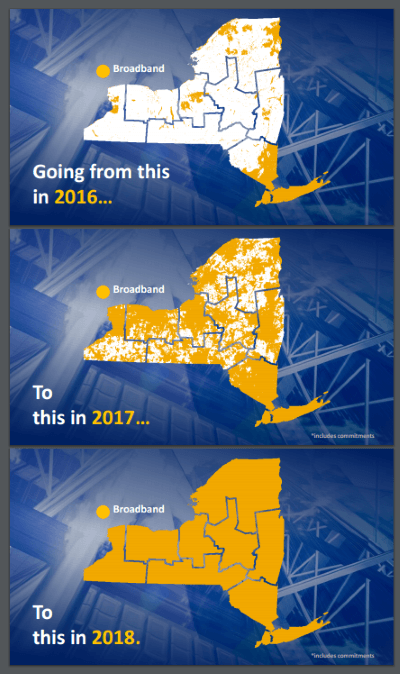

Governor Andrew M. Cuomo yesterday announced that the “New NY Broadband Program” is well on its way to achieving “sweeping progress toward achieving its nation-leading goal of broadband for all” New Yorkers.

Governor Andrew M. Cuomo yesterday announced that the “New NY Broadband Program” is well on its way to achieving “sweeping progress toward achieving its nation-leading goal of broadband for all” New Yorkers.

The governor claimed that 97% of New York residents will have access to high-speed internet access by 2017, with a vague goal of serving 100% of New Yorkers by the end of 2018.

To do this, Gov. Cuomo relies heavily on the state’s new and overwhelmingly dominant cable operator – Charter Communications, which closed on its acquisition of Time Warner Cable earlier this summer. A press release promoting the governor’s efforts quotes Charter’s executive vice president of government affairs Catherine Bohigia as being excited to work with the governor and his administration to expand service to about 145,000 households currently not served by Time Warner Cable or Charter in New York.

Charter officials are working with the Public Service Commission to identify the households to be served, and highly redacted documents suggest Charter is identifying new housing developments and areas immediately next to existing Charter/Time Warner Cable service areas for this expansion.

A second separate plan to subsidize private cable and phone companies to help cover the costs of reaching another 34,000 homes that won’t be served by Charter is only expected to reach 50% of the remaining unserved homes and businesses in the state. A further round of funding will target the the remainder of unserved areas, including certain rural landline areas where Verizon has shown no interest in offering customers internet access of any kind.

Charter Communications

Charter Communications has effectively canceled the Time Warner Cable Maxx upgrades that were either underway, in progress, or in the planning stage in upstate New York. Instead, Charter plans to speed up the roll-out its own originally proposed upgrade, which includes two tiers: 60 and 100Mbps, for more than two million upstate homes and businesses by early 2017 in Buffalo, Rochester, Syracuse, Binghamton and Albany.

Customers in Central New York are likely to be left in limbo, some already getting Maxx upgraded 300Mbps internet access while others were scheduled to get the speed upgrade the same week Charter froze further Maxx upgrades. Those customers are now likely to receive a maximum of 100Mbps service sometime next year under Charter’s new plan.

Charter is also negotiating with state officials about where it will deploy broadband to 145,000 currently unserved homes in upstate New York over the next four years.

State-funded Rural Broadband Awards – Round I

New York State will help subsidize broadband rollouts to approximately 34,000 homes and businesses currently not served (or not served adequately) in rural areas. All but two of these projects will rely on fiber to the home service and each will offer service to a few thousand people:

| Applicant Name |

Technology | REDC Region | Census Blocks | Housing Units | Total Units | State Grant Total | Private Match | Total Project Cost |

|---|---|---|---|---|---|---|---|---|

| Armstrong Telecommunications, Inc. | FTTH | Finger Lakes, Southern Tier, Western NY | 176 | 1,135 | 1,162 | $3,930,189 | $982,549 | $4,912,738 |

| Armstrong Telephone Company | FTTH | Southern Tier, Western NY | 74 | 466 | 504 | $1,778,256 | $444,564 | $2,222,820 |

| Citizens Telephone Company of Hammond, N.Y., Inc. | FTTH | North Country | 146 | 1,789 | 1,860 | $3,316,810 | $829,202 | $4,146,012 |

| Empire Access | FTTH | Southern Tier | 124 | 719 | 724 | $1,797,894 | $449,474 | $2,247,368 |

| Empire Access | FTTH | Southern Tier | 117 | 1,202 | 1,268 | $1,598,480 | $399,620 | $1,998,100 |

| Frontier Communications | FTTH | Southern Tier | 1 | 62 | 65 | $67,592 | $16,899 | $84,491 |

| Frontier Communications | FTTH | North Country | 3 | 188 | 216 | $129,634 | $32,409 | $162,043 |

| Frontier Communications | FTTH | Southern Tier | 12 | 129 | 142 | $197,104 | $49,276 | $246,380 |

| Frontier Communications | FTTH | Capital Region | 23 | 391 | 394 | $318,304 | $79,576 | $397,880 |

| Frontier Communications | FTTH | Mohawk Valley | 30 | 402 | 405 | $924,663 | $231,166 | $1,155,829 |

| Frontier Communications | FTTH | North Country | 105 | 1,928 | 2,096 | $1,702,246 | $425,562 | $2,127,808 |

| Germantown Telephone Company | FTTH | Capital Region | 208 | 2,195 | 2,334 | $2,512,562 | $628,140 | $3,140,702 |

| Haefele TV Inc. | FTTH | Southern Tier | 413 | 3,029 | 3,238 | $271,568 | $67,892 | $339,460 |

| Hancock Telephone Company | FTTH | Southern Tier | 136 | 1,505 | 1,675 | $4,915,920 | $1,228,981 | $6,144,901 |

| Heart of the Catskills Communications | Hybrid-Fiber Coax | Southern Tier | 216 | 2,836 | 3,177 | $1,224,946 | $524,977 | $1,749,923 |

| Margaretville Telephone Company | FTTH | Mid-Hudson, Southern Tier | 209 | 1,882 | 2,002 | $4,791,505 | $2,053,503 | $6,845,008 |

| Mid-Hudson Data Corp | Fixed Wireless | Capital Region | 60 | 647 | 663 | $950,184 | $237,546 | $1,187,730 |

| Mid-Hudson Data Corp | FTTH | Capital Region | 6 | 354 | 362 | $59,155 | $14,789 | $73,944 |

| State Telephone Company, Inc. | FTTH | Capital Region | 231 | 3,801 | 4,134 | $5,805,600 | $1,451,400 | $7,257,000 |

| State Telephone Company, Inc. | FTTH | Capital Region | 101 | 516 | 595 | $2,914,960 | $728,740 | $3,643,700 |

| TDS Telecom | FTTH | Southern Tier | 156 | 2,369 | 2,423 | $1,895,390 | $1,895,390 | $3,790,780 |

| TDS Telecom | FTTH | North Country | 74 | 506 | 543 | $1,084,000 | $1,084,000 | $2,168,000 |

| TDS Telecom | FTTH | Central NY, Finger Lakes | 106 | 996 | 1,038 | $1,424,793 | $1,424,793 | $2,849,586 |

| TDS Telecom | FTTH | Southern Tier | 395 | 3,528 | 3,551 | $4,989,570 | $4,989,570 | $9,979,140 |

| The Middleburgh Telephone Company | FTTH | Capital Region, Mohawk Valley | 250 | 1,596 | 1,651 | $5,562,548 | $1,390,637 | $6,953,185 |

After Verizon abdicated any interest in participating in rural broadband expansion funding through the FCC’s Connect America Fund, New York’s Broadband Program Office (BPO) and the Public Service Commission urged the FCC to keep the original funding intended for rural New York intact and open to other applicants seeking to build rural broadband projects. The FCC has not fully committed to do this, but it is an agenda item. Assuming this funding becomes available, it will be used to help pay for independent broadband providers or rural cable operators to begin delivering broadband service into still unserved parts of New York not included in the Charter expansion or Round I projects noted above. Many Verizon territories are expected to be included.

Applicants will have to provide at least 100Mbps service in most places or a minimum of 25Mbps in the most remote corners of New York. The application form discourages applicants from delivering broadband over DSL or wireless and clearly favors fiber to the home or cable broadband technology. Price controls will be in place for the first few years to assure affordability and those winning funding are strictly prohibited from introducing usage caps or usage-billing.

A vaguely defined “third phase” is scheduled to launch early next year to offer internet access to all remaining unaddressed service areas. Nobody mentions where the money is coming from to cover the last 1-3% of unserved areas, which are likely to be notoriously expensive to reach.

Gov. Cuomo explains progress on his New York Broadband for All program. (26:31)

Subscribe

Subscribe It wasn’t difficult to understand Verizon’s sudden reticence about continuing its fiber to the home expansion program begun under the leadership of its former chairman and CEO Ivan Seidenberg. Starting his career with Verizon predecessor New York Telephone as a cable splicer, he worked his way to the top. Seidenberg understood Verizon’s wireline future as a landline phone provider was limited at best. With his approval, Verizon began retiring decades-old copper wiring and replaced it with fiber optics, primarily in the company’s biggest service areas and most affluent suburbs along the east coast. The service was dubbed FiOS, and it has consistently won high marks from customers and consumer groups.

It wasn’t difficult to understand Verizon’s sudden reticence about continuing its fiber to the home expansion program begun under the leadership of its former chairman and CEO Ivan Seidenberg. Starting his career with Verizon predecessor New York Telephone as a cable splicer, he worked his way to the top. Seidenberg understood Verizon’s wireline future as a landline phone provider was limited at best. With his approval, Verizon began retiring decades-old copper wiring and replaced it with fiber optics, primarily in the company’s biggest service areas and most affluent suburbs along the east coast. The service was dubbed FiOS, and it has consistently won high marks from customers and consumer groups.

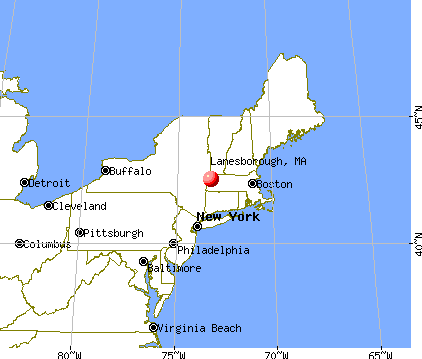

It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week.

It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week.