It took the four commissioners of the New York Public Service Commission just 20 minutes to vote unanimously to undo the multi-billion dollar 2016 merger of Charter Communications and Time Warner Cable, by revoking its approval for failing to meet the public interest.

It took the four commissioners of the New York Public Service Commission just 20 minutes to vote unanimously to undo the multi-billion dollar 2016 merger of Charter Communications and Time Warner Cable, by revoking its approval for failing to meet the public interest.

“Charter’s repeated failures to serve New Yorkers and honor its commitments are well documented and are only getting worse. After more than a year of administrative enforcement efforts to bring Charter into compliance with the Commission’s merger order, the time has come for stronger actions to protect New Yorkers and the public interest,” said Commission Chair John B. Rhodes. “Charter’s non-compliance and brazenly disrespectful behavior toward New York State and its customers necessitates the actions taken today seeking court-ordered penalties for its failures, and revoking the Charter merger approval.”

If the order withstands inevitable court challenges, it would be the first time a regulator drove a large cable operator out of business in a state for bad conduct. It would also make history, achieving similar notoriety to the 1981 case of Tele-Communications, Inc., vs. Jefferson City, Mo., when TCI’s national director of franchising personally threatened the mayor and the city’s cable consultant if their franchise was not renewed. When the city voted to award the franchise to another cable operator, TCI refused to sell its system, withheld franchise fee payments, and alternately told the city it would either strip its cables off utility poles in spite or let them “rot on the pole” rather than sell at any price.

Without modification, the Charter/Time Warner Cable merger was a bad deal for New York

After Stop the Cap! and other consumer groups participated in a detailed review of Charter Communications’ proposal to acquire Time Warner Cable, the Public Service Commission adopted many of our pro-consumer suggestions to ensure the merger benefited the people of New York at least partly as much as the executives and shareholders of the two companies. New York State law demands that telecommunications mergers must meet a public interest test to win approval. On its face, the Commission found the Charter/Time Warner Cable proposal failed to meet this test. The state received detailed evidence showing Time Warner Cable’s existing upgrade plan offered a better deal to New York residents than Charter’s own proposal. Time Warner Cable also maintained a large workforce in New York in call centers, direct hire technicians, and its corporate headquarters.

After Stop the Cap! and other consumer groups participated in a detailed review of Charter Communications’ proposal to acquire Time Warner Cable, the Public Service Commission adopted many of our pro-consumer suggestions to ensure the merger benefited the people of New York at least partly as much as the executives and shareholders of the two companies. New York State law demands that telecommunications mergers must meet a public interest test to win approval. On its face, the Commission found the Charter/Time Warner Cable proposal failed to meet this test. The state received detailed evidence showing Time Warner Cable’s existing upgrade plan offered a better deal to New York residents than Charter’s own proposal. Time Warner Cable also maintained a large workforce in New York in call centers, direct hire technicians, and its corporate headquarters.

After a detailed analysis, the PSC rejected the merger for failure to meet the public interest. At the same time, it also offered Charter a way to turn that rejection into a conditional approval. If the company agreed to “enforceable and concrete conditions” that would deliver positive net benefits for New Yorkers to share in the rewards of the merger deal, the Commission would approve the transaction.

Charter has complied with most of the deal conditions demanded by the Commission. The company has boosted its broadband speeds across the state ahead of schedule, committed to at least seven years of broadband service without data caps, introduced an affordable internet access program and temporarily maintained an existing offer for $14.99 slow-speed internet access available to any New York customer, and agreed to maintain jobs in New York (with the exception of a 1.5 year strike action ongoing in New York City affecting technicians).

But the most costly condition for Charter to meet is also the one it has repeatedly failed to meet — its commitment to wire unserved rural areas, largely in upstate New York. Charter committed to a timetable to roll out high-speed internet access for 145,000 homes and businesses that currently lack access to any internet provider.

Charter’s merger deal meets Gov. Cuomo’s Broadband for All Program

Gov. Andrew Cuomo announcing rural broadband initiatives in New York in 2015.

This rural broadband expansion condition was integral to Gov. Andrew Cuomo’s Broadband for All program, promising to make broadband access available to every resident and business in New York State.

Cuomo’s broadband program depended on several sources to accomplish its goal:

- State/Private Funding: The state invested $500 million of $5.7 billion dollars it earned from settling lawsuits against big banks and insurance companies over the improprieties that helped trigger the 2008 Great Recession. This money was designed to incentivize the private sector to expand high-speed internet access in underserved/unserved areas. Recipients had to provide a 1:1 financial match of whatever grant funds were given, putting the dollar value of this part of the program at over $1 billion.

- The FCC: The Federal Communications Commission’s Connect America Fund (CAF) offered funding to incumbent providers to expand service in certain areas in New York. Some $170 million of that funding allocated to the state was declined, principally by Verizon, which showed little interest in expanding its rural broadband network. A bipartisan effort to retain and divert those funds into the New NY Broadband Program was successful, allowing the state to fund several rural broadband projects Verizon was not interested in.

- Charter/Time Warner Cable Merger: To win approval of its merger in New York, Charter agreed to pass an additional 145,000 homes and businesses in less densely populated areas across the state. The company was required to file regular updates on its progress and coordinate with the state the exact locations it planned to serve. This was to ensure Charter would not spend money wiring areas already receiving broadband expansion funding.

For the program to be successful, it was essential that duplication of expansion efforts be avoided. As the program’s public funding wound down, the state discovered it lacked enough money to attract private bidders to serve the last 75,628 locations around the state that remained without a service provider, deemed too remote and expensive to serve. The state awarded over $15 million in state funds and an additional $13.6 million in federal and private funding to Hughes Network Services, LLC, which will furnish satellite-based internet service to those locations. That solution prompted loud complaints from residents discovering they were baited with high-speed internet access that realistically could provide gigabit speed, and suddenly switched to satellite service that cannot guarantee to consistently meet the FCC’s 25/3 Mbps broadband standard and comes with a data cap of 50 GB (or less in some instances) a month, rendering its usefulness highly questionable.

Bait rural upstate customers with the promise of Spectrum internet access, switch to expanding service in New York City instead

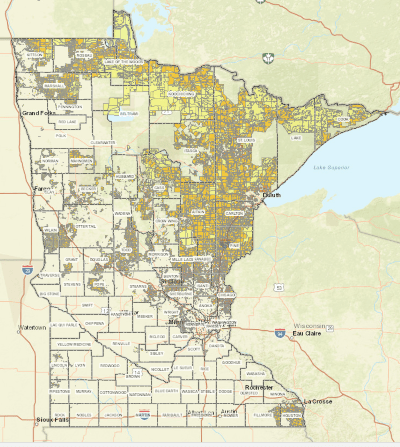

Rural broadband for urban customers.

The Cuomo Administration may also have to temper its excitement for successfully completing the Broadband for All program if Charter fails to deliver service to the homes and businesses the state expected it would. In fact, the Commission today accused Charter of substituting broadband expansion in dense urban areas where the company would undoubtedly offer service with or without an expansion commitment for the rural upstate areas it originally promised to service. By adding one customer in a converted loft in Brooklyn while deleting a customer it planned to serve in upstate Livingston County, Charter would save a substantial sum. In all, the Commission alleges Charter’s attempts to count urban areas as “newly passed” while leaving rural upstate areas unserved could save the company tens of millions of dollars.

The company’s failure to meet its rural buildout commitment began almost immediately. Despite a requirement to complete an initial buildout to 36,250 homes and businesses by May 18, 2017, Charter only managed to reach 15,164 premises — just 41.8% of its goal. As a result, the Commission began talks with Charter to get the company back on track and monitor Charter’s claim that utility companies were stalling approval of Charter’s pole attachment requests. The Commission even offered its staff to assist Charter with a comprehensive database tracking pole attachment issues, in hopes of facilitating prompt resolution of any problems that delayed service expansion.

To further assist Charter, the Commission set a new schedule of Charter’s buildout obligations for the period between December 2017 and May 2020, comprised of roughly 20,000-23,000 new passings during each six month period, a significant reduction from the original requirement of 36,250 new passings in the first buildout phase.

To incentivize Charter to stay on track, the Commission also required the company to establish a $12 million Letter of Credit to secure Charter’s obligations. If Charter missed further deadlines, the state could draw funds each time Charter missed a target, typically in $1 million increments.

On Jan. 8, 2018, Charter filed its first report under the new settlement on its buildout progress. The company claimed it exceeded its target by reaching 42,889 homes and businesses in the previous six months. The company also began airing commercials inserted into cable channels seen by Spectrum customers around the state, proclaiming it was expanding service ahead of schedule.

On closer inspection, however, the PSC discovered the most innovative part of Charter’s new-found success was inflating the numbers of new passings by including over 12,000 addresses in New York City and several upstate cities, 1,762 locations where Spectrum service was already available, and more than 250 addresses that were in areas that already received state funding to expand service. In addition to not being rural areas, Charter’s existing franchise agreements would have compelled the company to offer service to most of these addresses with or without the PSC deal conditions.

The state informed Charter it planned to disqualify 18,363 passings from the December report filed on Jan. 8, which meant Charter again failed to satisfy the required 36,771 passings it was supposed to have finished by mid-December. The Commission also removed addresses Charter unilaterally added to its 145,000 buildout plan where other providers already offered service or were planning to with the assistance of already-awarded grant funding.

The many fines for Charter Communications

The Commission has fined Charter $1 million for missing its December targets and another $1 million for not making good on correcting its earlier failures. On Friday, it fined Charter once again for another $1 million, reaching a total of $3 million in fines. The PSC also directed its Counsel to bring an enforcement action in State Supreme Court to seek additional penalties for past failures and ongoing non-compliance with its obligations. Earlier this month, the PSC referred a false advertising claim to the Attorney General’s office regarding Charter’s misleading ads about its progress expanding rural broadband in New York.

The Commission has fined Charter $1 million for missing its December targets and another $1 million for not making good on correcting its earlier failures. On Friday, it fined Charter once again for another $1 million, reaching a total of $3 million in fines. The PSC also directed its Counsel to bring an enforcement action in State Supreme Court to seek additional penalties for past failures and ongoing non-compliance with its obligations. Earlier this month, the PSC referred a false advertising claim to the Attorney General’s office regarding Charter’s misleading ads about its progress expanding rural broadband in New York.

The number of alleged misdeeds by Charter has been amply covered by Stop the Cap! in our own investigative report.

In fact, to date, the Commission says Charter has never met any of its rural buildout targets. In response, Charter claimed it effectively did not have to, arguing that once the merger was approved, Charter was under no obligation to answer to the Commission’s regulatory requirements respecting broadband rollouts. Under federal deregulation laws, the state cannot regulate broadband service, Charter argued.

$12 million is a small price to pay when saving tens of millions not expanding rural service

The Commission also suspects that Charter’s $12 million Letter of Credit is a small price to pay for reneging on its broadband commitments.

“It appears that the prospect of forfeiting its right to earn back all of Settlement Agreement’s $12 million Letter of Credit does not seem to be an appropriate incentive where the company stands to save tens of millions of dollars by failing to live up to its buildout obligations in New York,” the Commission wrote.

A 4-0 Vote to Kick Charter Spectrum Out of New York

What has gotten the company’s intention is a 4-0 unanimous vote to cancel the approval of the company’s merger agreement with the state, which effectively puts Charter out of business in New York. The Commission ordered Charter to file a plan within 60 days detailing how it plans to cease service in New York and transition to another provider without causing any service disruptions for customers.

What has gotten the company’s intention is a 4-0 unanimous vote to cancel the approval of the company’s merger agreement with the state, which effectively puts Charter out of business in New York. The Commission ordered Charter to file a plan within 60 days detailing how it plans to cease service in New York and transition to another provider without causing any service disruptions for customers.

Such a move is unprecedented, but not unwarranted in the eyes of the Commission, which claims it gave Charter ample warnings to correct its bad behavior.

“Both the Commission and the DPS [PSC] Staff have repeatedly attempted to correct Charter’s behavior and secure its performance of the Approval Order’s Network Expansion Condition,” the Commission wrote. “Charter continues to show an inability or a total unwillingness to extend its network in the manner intended by the Commission to pass the requisite number of unserved or underserved homes and/or businesses, which make evident that there was not – and is not – a corporate commitment of compliance with regard to this important public interest condition.”

Now the company faces a requirement to file a six-month transition plan to end service in all areas formerly served by Time Warner Cable in New York State by early 2019. The Commission has also made it clear it is done talking and negotiating with Charter, denying all requests for a rehearing.

“Charter’s repeated, continued, and brazen non-compliance with the Commission-imposed regulatory obligations and failure to act in the public’s interest necessitates a more stringent remedy,” the Commission concluded.

The New York Public Service Commission holds a special session to fine Charter Communications and revoke its merger with Time Warner Cable. (Hearing commences at 5:00 mark) (25:24)

Subscribe

Subscribe Phone companies can beat their cable competitors, but only if they invest in fiber upgrades that can deliver as-advertised broadband service and speed.

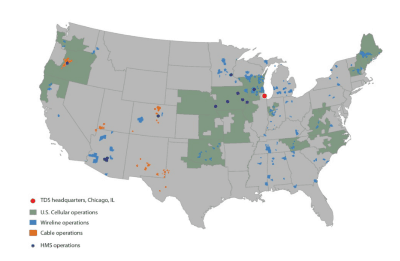

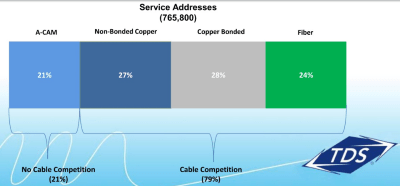

Phone companies can beat their cable competitors, but only if they invest in fiber upgrades that can deliver as-advertised broadband service and speed. TDS has been overbuilding beyond its existing telephone service areas to deliver broadband, phone, and television service to communities evaluated as:

TDS has been overbuilding beyond its existing telephone service areas to deliver broadband, phone, and television service to communities evaluated as: In rural areas, the company is combining federal Connect America Funds with its own money to deploy bonded DSL service in areas too unprofitable to serve with fiber. This typically delivers faster internet service than rural broadband rollouts from other phone companies like Windstream and Frontier.

In rural areas, the company is combining federal Connect America Funds with its own money to deploy bonded DSL service in areas too unprofitable to serve with fiber. This typically delivers faster internet service than rural broadband rollouts from other phone companies like Windstream and Frontier. It took the four commissioners of the New York Public Service Commission just 20 minutes to vote unanimously to undo the multi-billion dollar 2016 merger of Charter Communications and Time Warner Cable, by

It took the four commissioners of the New York Public Service Commission just 20 minutes to vote unanimously to undo the multi-billion dollar 2016 merger of Charter Communications and Time Warner Cable, by  After Stop the Cap! and other consumer groups participated in a detailed review of Charter Communications’ proposal to acquire Time Warner Cable, the Public Service Commission adopted many of our pro-consumer suggestions to ensure the merger benefited the people of New York at least partly as much as the executives and shareholders of the two companies. New York State law demands that telecommunications mergers must meet a public interest test to win approval. On its face, the Commission found the Charter/Time Warner Cable proposal failed to meet this test. The state received detailed evidence showing Time Warner Cable’s existing upgrade plan offered a better deal to New York residents than Charter’s own proposal. Time Warner Cable also maintained a large workforce in New York in call centers, direct hire technicians, and its corporate headquarters.

After Stop the Cap! and other consumer groups participated in a detailed review of Charter Communications’ proposal to acquire Time Warner Cable, the Public Service Commission adopted many of our pro-consumer suggestions to ensure the merger benefited the people of New York at least partly as much as the executives and shareholders of the two companies. New York State law demands that telecommunications mergers must meet a public interest test to win approval. On its face, the Commission found the Charter/Time Warner Cable proposal failed to meet this test. The state received detailed evidence showing Time Warner Cable’s existing upgrade plan offered a better deal to New York residents than Charter’s own proposal. Time Warner Cable also maintained a large workforce in New York in call centers, direct hire technicians, and its corporate headquarters.

The Commission has fined Charter $1 million for missing its December targets and another $1 million for not making good on correcting its earlier failures. On Friday, it fined Charter once again for another $1 million, reaching a total of $3 million in fines. The PSC also directed its Counsel to bring an enforcement action in State Supreme Court to seek additional penalties for past failures and ongoing non-compliance with its obligations. Earlier this month, the PSC referred a false advertising claim to the Attorney General’s office regarding Charter’s misleading ads about its progress expanding rural broadband in New York.

The Commission has fined Charter $1 million for missing its December targets and another $1 million for not making good on correcting its earlier failures. On Friday, it fined Charter once again for another $1 million, reaching a total of $3 million in fines. The PSC also directed its Counsel to bring an enforcement action in State Supreme Court to seek additional penalties for past failures and ongoing non-compliance with its obligations. Earlier this month, the PSC referred a false advertising claim to the Attorney General’s office regarding Charter’s misleading ads about its progress expanding rural broadband in New York. What has gotten the company’s intention is a 4-0 unanimous vote to cancel the approval of the company’s merger agreement with the state, which effectively puts Charter out of business in New York. The Commission ordered Charter to file a plan within 60 days detailing how it plans to cease service in New York and transition to another provider without causing any service disruptions for customers.

What has gotten the company’s intention is a 4-0 unanimous vote to cancel the approval of the company’s merger agreement with the state, which effectively puts Charter out of business in New York. The Commission ordered Charter to file a plan within 60 days detailing how it plans to cease service in New York and transition to another provider without causing any service disruptions for customers.