AT&T, Verizon, and cable companies like Comcast have quietly created the 21st century equivalent of the railroad monopoly, and are using their market power to raise rates, block competition, and supply inferior service to customers.

AT&T, Verizon, and cable companies like Comcast have quietly created the 21st century equivalent of the railroad monopoly, and are using their market power to raise rates, block competition, and supply inferior service to customers.

That conclusion comes courtesy of former telecom industry analyst Bruce Kushnick, who today serves as a consumer watchdog for the telecommunications industry’s broken promises and bad service.

Kushnick is chairman of New York-based Teletruth, a customer advocacy group that is spending a lot of time demanding Verizon finish the fiber optics network it promised would be available throughout states like New Jersey.

Kushnick has just completed a new e-book, the “$200 Billion Broadband Scandal” chronicling how the telecommunications industry has used power and influence to outmaneuver regulators and make promises they cannot or will not keep, for which they are never held accountable.

Kushnick’s view of the current state of broadband and telecommunications in the United States:

- For the last 20 years, the nation’s major telecom companies have played the public and regulatory officials for fools – wrangling dramatic rate increases while making promises about fiber-optic cable they haven’t delivered.

- The communications infrastructure is the most important thing to build back the nation’s economy.

- The caretakers of America’s essential infrastructure have scammed us, big time, and it’s going to get worse.

- The Federal Communications Commission is in the pocket of the phone companies.

Kushnick scowls over news Verizon, Comcast, and Time Warner Cable are about to cross-market cable and wireless phone service, calling it a textbook case of “Antitrust 101.”

Despite promises that the phone companies would bring extensive competition to America’s cable monopoly, the two competitors have effectively declared a truce.

In Kushnick’s view, phone companies like AT&T and Verizon are breaking their promises to regulators and consumers.

“Illinois Bell was supposed to rewire the state (with fiber-optic cable), starting in 1993 at an initial cost of $4 billion,” Kushnick said.

Instead, AT&T moved in and bought out the phone company and has dragged its feet on fiber deployment, along with most other big phone companies.

Kushnick told the Journal Star phone companies are going cheap avoiding fiber optic infrastructure while still ringing up huge profits.

“Every state is different. Pacific Bell stated they would spend $16 billion by 2000 on 5.5 million homes. Bell Atlantic claimed it would spend $11 billion on 8.75 million homes,” he said.

Verizon New Jersey said it would wire 100 percent of that state by 2010. Now there’s political action in New Jersey to hold the telecom accountable for failing to meet that goal, said Kushnick.

How do the companies get away with missing deadlines? “The phone companies have control of the regulators and a strong PR machine. The public is often unaware of what claims were made five or 10 years ago,” he said.

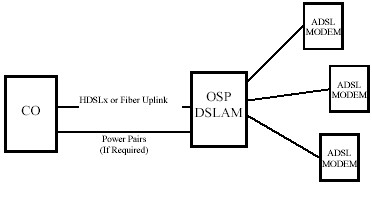

Kushnick is very aware. Take AT&T’s U-Verse service, so heavily advertised during NBA playoff games, for example. “(U-Verse) isn’t even fiber optic to the home but uses the old copper wiring,” he said.

While Kushnick puts a spotlight on the problem, the public would do well to bone up on what’s going on when it comes to the broadband services they pay so dearly for.

Subscribe

Subscribe