Plan on downgrading your Rogers cable, phone or Internet service? Be ready for messages injected into your web browsing sessions by the cable company trying to win back your business.

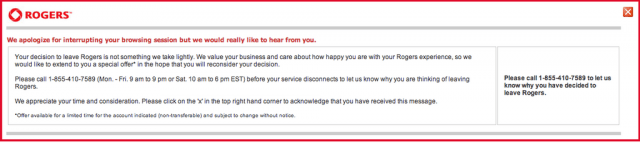

Daryl Fritz from Toronto decided to cancel his Rogers’ home phone and television service and downgrade his Internet service. Fritz soon found this banner intruding on every web page he tried to visit:

Your decision to leave Rogers is not something we take lightly. We value your business and care about how happy you are with your Rogers experience, so we would like to extend a special offer* in the hope that you will reconsider your decision. Please call 1-855-410-7589 (M-F 9am-9pm/Sat 10am-6pm ET) before your service disconnects to let us know why you are thinking of leaving Rogers. We appreciate your time and consideration. Please click on the “X” in the top right hand corner to acknowledge that you have received this message.

*-Offer available for a limited time for the account indicated (non-transferable) and subject to change without notice.

The banner usually disappears after the customer acknowledges receiving it. Stop the Cap! has learned the number directs callers to Rogers’ customer retention department where customers are pitched special discounts to change their mind. The prices are comparable, if not better, than new customer promotions found on Rogers’ website. Rogers is far less annoying than Comcast is when it faces losing a customer. If a customer rejects the offer (or never calls in to hear one), they are not bothered any longer and the representative thanks them for their time.

The banner usually disappears after the customer acknowledges receiving it. Stop the Cap! has learned the number directs callers to Rogers’ customer retention department where customers are pitched special discounts to change their mind. The prices are comparable, if not better, than new customer promotions found on Rogers’ website. Rogers is far less annoying than Comcast is when it faces losing a customer. If a customer rejects the offer (or never calls in to hear one), they are not bothered any longer and the representative thanks them for their time.

Rogers retention offers are often extremely aggressively priced, especially if mentioning you are leaving for a competitor (especially Bell). Rogers reps can slash prices, put you on a high usage broadband plan at prices lower than what regular customers pay for slower speeds, waive usage caps for a few dollars more, lock in rates for up to eight years, and offer heavy discounts off almost everything.

One current example for cable television:

- 30% off basic cable ($28/mo instead of $40)

- TFC ($15/mo)

- NextBox 2.0 set-top (free) NextBox 3.0 ($2.50/mo)

- Digital Services Fee (eliminated)

- CRTC LPIF (it’s the government — $0.50/mo)

This can knock your Rogers cable bill down to $46/month before GST and other taxes.

This can knock your Rogers cable bill down to $46/month before GST and other taxes.

Broadband customers can grab a 50% discount off plans like Hybrid Fibre 150 (GTA), normally $86 a month, but $43 on a retention plan. Customers get 150Mbps and 350GB of usage. If you don’t want a cap, demand a deal to remove it (it regularly costs $25/month extra for unlimited). The modem rental is included.

If you still want Rogers Home Phone, you are paying too much if it costs over $20 a month. Home Phone Favourites, including Call Display and one other calling feature of your choice is $15/month on retention. Add 500 long distance minutes for $5/month extra.

All three services combined should cost no more than about $104 a month before GST, which adds $13.52 in Ontario. Provincial taxes vary.

New Rogers customers can also get very aggressively priced deals. This week Rogers is selling 30/5Mbps Internet service (includes 270GB allowance and free modem) for $54.95. Regularly, it’s $61.99 with only a 70GB monthly usage allowance. That is still outrageously high by American standards, but isn’t bad for Rogers. New customers should call 1-800-605-6678 to ask about current offers.

Subscribe

Subscribe Salisbury’s community-owned fiber network has tripled its subscriber base in three years, signing up its 3,000th customer in the community of 33,000 and is already turning a profit.

Salisbury’s community-owned fiber network has tripled its subscriber base in three years, signing up its 3,000th customer in the community of 33,000 and is already turning a profit.

Powell and others made certain that Internet Service Providers would not be classified as “common carriers,” which would require them to rent their broadband pipes at a reasonable wholesale rate to competitors. The industry and their well-compensated friends in the House and Senate argued such a status would destroy investment in broadband expansion and innovation. Instead it destroyed the family budget as prices for mediocre service in uncompetitive markets soared. Today, consumers in common carrier countries including France and Britain pay a fraction of what Americans do for Internet access, and get faster speeds as well.

Powell and others made certain that Internet Service Providers would not be classified as “common carriers,” which would require them to rent their broadband pipes at a reasonable wholesale rate to competitors. The industry and their well-compensated friends in the House and Senate argued such a status would destroy investment in broadband expansion and innovation. Instead it destroyed the family budget as prices for mediocre service in uncompetitive markets soared. Today, consumers in common carrier countries including France and Britain pay a fraction of what Americans do for Internet access, and get faster speeds as well.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.