Phillip “More empty promises from the cable industry” Dampier

Listening to Time Warner Cable’s “Here today and gone much richer tomorrow” CEO-in-passing Rob Marcus prattle on endlessly about improving “the customer experience” on analyst conference calls, the cable company’s blog, and in various press statements always makes me pinch myself to be certain I am not dreaming.

I’m focused on ensuring we establish a customer-centric, performance-oriented, values-driven culture defined by four basic tenets:

- We put our customers first,

- We are empowered and accountable,

- We do the right thing, and

- We are passionate about winning

What does that mean for customers? If we expect customers to trust us to connect them to what matters most, we must put them at the center of everything we do.

How is that working out for you?

Based on consumer surveys, many of Marcus’ customers may have a different sentiment:

- Time Warner puts what is best for Time Warner first,

- Time Warner is empowered to raise rates for no clear reason and as a deregulated entity is accountable to no one,

- Time Warner does the right thing for Time Warner executives and shareholders,

- Charlie Sheen was also passionate about “winning.”

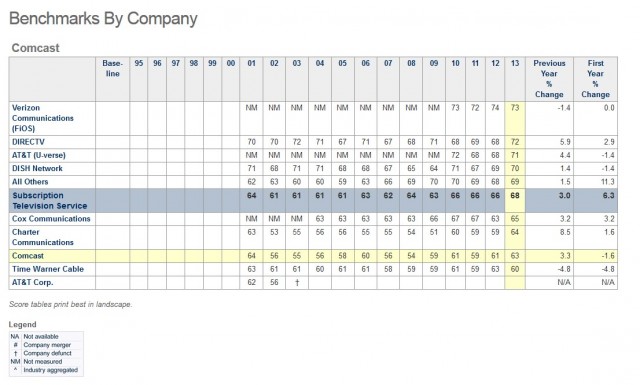

So much for Comcast’s customer service improvement project promised back in 2007. (Source: ACSI)

There is nowhere to go but up when it comes to improving the abusive relationship most Americans have with the local cable or phone company. CNN asked the question, “do you hate your Internet provider,” and within hours more than 600 customers sang “yes!”

Marcus

This is hardly a new problem. Karl Bode at Broadband Reports reminds us that Comcast broke its promises for major improvements in customer service more than five years ago. CEO Brian Roberts at the time blamed the troubles on Comcast’s enormity — taking 250 million calls a year handling orders, customer complaints, etc., is a lot for one company to handle.

“With that many calls, you are going to have failures,” Roberts admitted.

With more than 10 million Time Warner Cable customers waiting to move in at Comcast, if what Roberts says is true, things are about to get much worse. In fact, even before the merger was announced Comcast was just as despised as ever, thanks to rate hikes, usage caps, and poor service often delivered from their notorious sub-contractors that appear on the news for falling asleep, murder, digging in the wrong yard or blowing up laptops, dishwashers or homes.

Judging from the enormous negative reaction customers of both Time Warner Cable and Comcast had to the news the two were combining, it’s clear this merger isn’t the exciting opportunity Marcus and Roberts would have you believe.

‘If you despise Comcast today, your hate will know no bounds tomorrow as Comcast spends the next two years distracted with digesting Time Warner Cable,’ suggested one customer.

Another asked whether Americans have resigned themselves to a trap of low expectations, seeking out one abusive telecom company relationship after another.

“After twenty years of Time Warner’s broken promises, service you can’t count on, and price hikes you can, I made the fatal mistake of running away from one bad relationship into the arms of another with the Bernie Madoff of broadband: AT&T,” wrote another. “Slower service, an unnecessary allowance on broadband usage, and one rate increase too many is hardly the improvement we were promised in the shiny brochure. But we have nowhere else to go.”

“After twenty years of Time Warner’s broken promises, service you can’t count on, and price hikes you can, I made the fatal mistake of running away from one bad relationship into the arms of another with the Bernie Madoff of broadband: AT&T,” wrote another. “Slower service, an unnecessary allowance on broadband usage, and one rate increase too many is hardly the improvement we were promised in the shiny brochure. But we have nowhere else to go.”

Being stuck with an independent phone company with no cable provider nearby can mean even worse service.

“I live in Seattle, and the only option in my neighborhood is CenturyLink DSL,” wrote Jen Wilson.

CenturyLink’s top speed in Wilson’s neighborhood? 1Mbps. At night, speeds drop to 122kbps — just twice the speed of dial-up Internet.

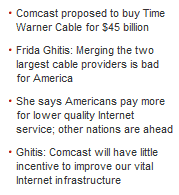

CNN’s Frida Ghitis observed the current state of broadband in the United States is alarmingly bad, and allowing Comcast and Time Warner Cable to merge won’t fix it:

Americans are divided on many issues, but resentment against these telecom giants is so pervasive that it may just be the most heartwarming symbol of national unity. And that’s as it should be. Except that the resentment should extend to politicians who have made this disastrous system possible and allow political contributions to prevent them from fixing it. The problem is not just one of dismal customer service. Instead, it is a growing threat to the country’s economic and strategic position.

If you travel overseas, you will quickly notice that Web access in much of the developed world is light years ahead of America’s. You may also be irritated to discover that far better Internet is much, much cheaper in other countries.

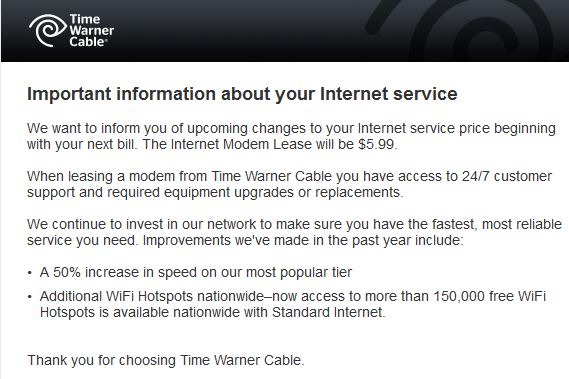

Time Warner’s notorious modem rental fee was just a hidden rate hike, according to the ex-CEO.

Thus far, Time Warner’s remedy to improve service is yet another rate increase. Broadband prices are rising an average of $3 a month — $36 a year, with no speed enhancements on the horizon except in New York, Los Angeles, and cities where Google Fiber is threatening to kick the cable company in the pants. That means Time Warner’s 11.1 million broadband customers will deliver as much as $33.3 million more in revenue each month for broadband service alone. What will you get in return? In most cases, nothing.

Television customers will be pick-pocketed for the newly-“enhanced” on-screen guide many still loathe, which carries a new surcharge applied to the cost of set-top boxes and DVRs. This “enhancement” alone will cost most customers with two boxes an extra $30 a year. It will provide Time Warner with more than $170 million each year in revenue enhancement.

The cable company that fought a battle with CBS last summer “on behalf of customers” faced with paying extortionist pricing for CBS-owned cable networks and local stations will instead send their extortion payment direct to Time Warner, thanks to a new $2.25/mo “Broadcast TV Fee” imposed this spring by the cable company.

But Time Warner is unlikely to hang on to that money for long.

If it wanted to discourage programmers from demanding double-digit percentage rate increases, the plan is likely to backfire once the networks smell the money — more than $25 million a month, $300 million a year — Time Warner claims to be collecting on their behalf.

Subscribe

Subscribe

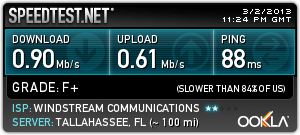

Customers who called to complain about the poor performance of their connection received empty promises from Windstream representatives that misrepresented the time frame within which broadband speeds would improve. In some cases, customers were not told their speed issues would likely never be resolved. In rural Georgia communities, DSL broadband is often the only available option.

Customers who called to complain about the poor performance of their connection received empty promises from Windstream representatives that misrepresented the time frame within which broadband speeds would improve. In some cases, customers were not told their speed issues would likely never be resolved. In rural Georgia communities, DSL broadband is often the only available option. “Windstream … has cooperated fully throughout the inquiry by the Governor’s Office of Consumer Protection,” wrote a company spokesperson in a statement. “Windstream is pleased to resolve this inquiry by entering an assurance of voluntary compliance with all applicable advertising laws. That agreement includes no finding or admission of violation by the company.”

“Windstream … has cooperated fully throughout the inquiry by the Governor’s Office of Consumer Protection,” wrote a company spokesperson in a statement. “Windstream is pleased to resolve this inquiry by entering an assurance of voluntary compliance with all applicable advertising laws. That agreement includes no finding or admission of violation by the company.” Time Warner Cable lost another 215,000 video subscribers during the fourth quarter of 2013, leaving the company with 825,000 fewer subscribers than it had one year ago.

Time Warner Cable lost another 215,000 video subscribers during the fourth quarter of 2013, leaving the company with 825,000 fewer subscribers than it had one year ago. News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

News that there were two potential rivals for Time Warner Cable excited investors, particularly when it was revealed possible suitor Comcast is also separately talking to Charter about a possible joint bid that would split up Time Warner Cable customers while minimizing potential regulatory scrutiny.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.

Ironically, when Malone sold TCI to AT&T, the telephone company would later sell its cable assets to Comcast, run by… and Brian Roberts.