Frontier Communications is seeking to slow or block rural broadband funding for tens of thousands of rural Americans that live inside Frontier service areas but cannot subscribe to broadband service because the company does not offer it.

Frontier Communications is seeking to slow or block rural broadband funding for tens of thousands of rural Americans that live inside Frontier service areas but cannot subscribe to broadband service because the company does not offer it.

Frontier is currently embroiled in a controversy over its regulatory filings with the FCC that sought to block or delay public funding of competing broadband projects in its territories by claiming such funding might be unfair and redundant, since Frontier is already supplying (or will supply) service in those communities.

The FCC’s Rural Digital Opportunity Fund (RDOF) will eventually spend $20.4 billion on rural broadband expansion, but the Commission is bending over backwards to protect incumbent cable, phone, and wireless companies from possible competition that potentially could be funded with public money. The Commission has invited providers to cross check “census blocks” — small geographic areas it has identified as eligible for rural broadband funding and report back if any should be excluded from the first phase of the program.

Incumbent phone and cable companies can protect their service areas from interlopers by claiming broadband service already exists in areas designated for rural broadband funding. Since the FCC continues to depend on voluntary disclosures of service areas by cable and phone companies, there is no immediate consequence if those providers take a more favorable view of what constitutes “service,” even if it ultimately results in long, further delays in rural broadband coverage for tens of thousands of Americans.

In early April, Frontier filed a lengthy submission objecting to the inclusion of 16,987 census blocks where it claims it already provides suitable broadband service. The majority of RDOF funding — $16 billion of the available $20.4 billion will be spent in the first funding phase, and only on census blocks where no provider offers high speed internet. If Frontier gets the FCC to block potential new entrants from qualifying for Phase One funding, it could spare the company from facing competition and leave a lot of homes with no internet service for years.

In early April, Frontier filed a lengthy submission objecting to the inclusion of 16,987 census blocks where it claims it already provides suitable broadband service. The majority of RDOF funding — $16 billion of the available $20.4 billion will be spent in the first funding phase, and only on census blocks where no provider offers high speed internet. If Frontier gets the FCC to block potential new entrants from qualifying for Phase One funding, it could spare the company from facing competition and leave a lot of homes with no internet service for years.

Immediate concerns were raised with the FCC regarding Frontier’s filing, including independent research that suggested Frontier was not being entirely honest about providing broadband at speeds at or exceeding 25 Mbps.

NTCA-The Rural Broadband Association:

Simply put, as the Wireless Internet Service Providers Association and the National Rural Electric Cooperative Association noted, “it is difficult to believe that Frontier was able to provide voice and 25/3 Mbps service in each of these 16,000 census blocks in just eight months.” Such incredulity is compounded by the fact that Frontier operated under the specter of a looming bankruptcy during this period, making it difficult to envision deployment to such a large number of locations within just several months’ time after years with little meaningful progress. Indeed, as WISPA and NRECA correctly point out, Frontier just four months ago alerted the Commission to the likelihood that it would be unable to meet its interim deployment milestones to which it was beholden pursuant to broadband commitments made in 2015. Moreover, Frontier’s financial disclosures, again as WIPSA and NRECA reference, showed an operator losing subscribers and working with a financial structure that would appear to have severely limited its ability to invest capital in broadband deployment.

The Institute for Local Self-Reliance also shared its concerns with the FCC, reminding the agency of Frontier’s lengthy track record of misrepresenting its service performance:

Frontier’s record in recent years offers numerous warning flags that the Commission should consider before accepting its nearly 17,000 challenges. The company has been the subject of numerous official complaints and investigations in the states in which it operates and has settled investigations in several states after extremely lengthy records were compiled showing its inability to regularly provide basic services. Consider this nonexhaustive list in just recent years:

California

CPUC investigating Frontier outages after transfer from Verizon in 2016 (2020)

Connecticut

AG and Dept. of Consumer Protection investigating Frontier for bad quality and billing (2019)

Florida

AG sent letter to Frontier after hearing complaints after transfer from Verizon (2016) and collected complaints (2016)

Ohio

PUC filed complaint that Frontier didn’t maintain service quality (2019)

Minnesota

PUC organized public hearings (2018) and settled with Commerce Department (2019)

Commerce launched a second investigation into billing and customer service (2019)

New York

PSC requested review after complaints of poor quality and outages (2019)

Nevada

Cited by AG’s Bureau of Consumer protection for misrepresenting speeds and service quality (2019)

North Carolina

AG issued civil investigative demand (2019)

Pennsylvania

AG Bureau of Consumer Protection settled with Frontier after investigation into poor quality and speeds (2020)

Utah

PSC investigated telephone outages (2019)

West Virginia

Settlement with AG for misrepresenting speeds (2015)

PSC ordered independent audit after complaints of poor quality and outages (2018)

The Commission faces a crisis of credibility on matters of broadband and telecommunications data collection, with two significant scandals in just the past 6 months.

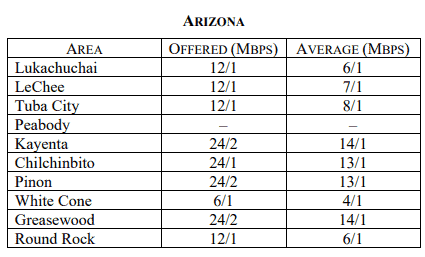

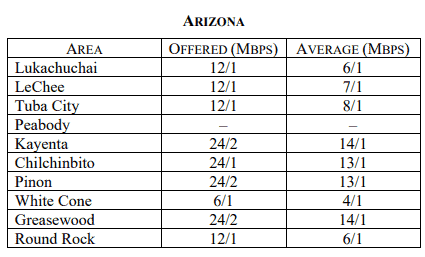

Frontier’s claimed DSL speeds compared with actual average speeds (Courtesy: Smith Bagley, Inc.)

One company, Smith Bagley, Inc., went even further, building a spreadsheet of several disputed census blocks in an independent investigation. The company called Frontier repeatedly, posing as potential new broadband customers to test Frontier’s claims it supplied 25/3 Mbps service in several rural census blocks in New Mexico and Arizona. It found no instance where Frontier was ready to sell 25 Mbps service to any of the locations requested.

“Frontier either does not offer broadband service, or offers service at below 25/3 Mbps, in every one of the 1,300 census blocks it challenged in Arizona and New Mexico,” Smith Bagely noted in its letter to the FCC, citing another third party broadband availability database.

In a haughty response to the FCC dated May 26, Frontier waved off the criticism, claiming it was based on “a scattershot challenge to one-off census blocks, ad hominem attacks, and irrelevant sources.”

But the company also made a crucial admission about the broadband speeds it claims to offer that is worthy of a closer look:

“Frontier does not claim it serves every location in each census block at 25/3 Mbps. Under the Commission’s rules, carriers report the fastest speed available for sale in that census block, even if it is only available in one or a handful of locations.”

In other words, if Frontier found in its own internal testing, unverified by an independent third party, that it managed to provide 25 Mbps to even one out of hundreds of households, it can ignore the rest of the area’s much slower DSL speeds and petition the FCC to exclude funding for a new, more capable service provider. In fact, it need not disclose the abysmal speeds other homes might be enduring from Frontier and declare that census block to be adequately served by broadband and unworthy of additional funding, at least during Phase One.

Frontier also suddenly announced on May 23 it was now open to RDOF Phase One funding in its contested census blocks, which appeared to be a significant concession. But the company also noted the FCC’s established rules are the rules, regardless of what Frontier thinks:

“But to the extent the Commission decides to maintain its decision to include partially served census blocks in RDOF Phase II, SBI, Frontier, and any other company will be able to bid on those locations after mapping is complete and Phase II is implemented.”

Rosenworcel

The end impact of that could be a concession without any meaningful change.

Frontier also asked the FCC to dismiss concerned public interest groups and consumer complaints about its service because they are anecdotal. Besides, Frontier argued, companies seeking to enter Frontier-served areas can always apply for Phase Two funding, which will only be a small fraction of the funding available in Phase One. Because Phase Two is designed to help providers pay for improving existing service, sizeable portions of that funding will likely be awarded to companies like Frontier.

That the FCC plans to spend billions on broadband improvements based on flawed broadband availability data and imprecise census block criteria has infuriated Democratic FCC Commissioner Jessica Rosenworcel.

“Time and again this agency has acknowledged the grave limitations of the data we collect to assess broadband deployment. If a service provider claims that they serve a single customer in a census block, our existing data practices assume that there is service throughout the census block. This is not right. It means the claim in this report that there are only 21 million people in the United States without broadband is fundamentally flawed. Consider that another recent analysis concluded that as many as 162 million people across the country do not use internet service at broadband speeds,” Rosenworcel said in 2019. “Adding insult to injury, the same flawed data we rely on here is used to populate FCC broadband maps. For those keeping track, one cabinet official has described those maps as ‘fake news’ and one Senator has suggested they be shredded and thrown into a lake.”

This year, her Democratic colleague Commissioner Geoffrey Starks added his own concerns.

“I have zero tolerance for continuing to spend precious universal service funds based on bad data,” Starks said. “There is bipartisan—and nearly universal—agreement that our existing broadband deployment data contains fundamental flaws. And yet today’s order presses ahead with funding decisions based on mapping data that doesn’t reflect reality.”

Comcast on Wednesday said it will give its customers a six month reprieve on implementing its 1.2 TB data cap after state legislators in Massachusetts and Pennsylvania’s attorney general complained about the prospect of families paying more for internet access during a pandemic.

Comcast on Wednesday said it will give its customers a six month reprieve on implementing its 1.2 TB data cap after state legislators in Massachusetts and Pennsylvania’s attorney general complained about the prospect of families paying more for internet access during a pandemic.

Subscribe

Subscribe

Frontier Communications is seeking to slow or block rural broadband funding for tens of thousands of rural Americans that live inside Frontier service areas but cannot subscribe to broadband service because the company does not offer it.

Frontier Communications is seeking to slow or block rural broadband funding for tens of thousands of rural Americans that live inside Frontier service areas but cannot subscribe to broadband service because the company does not offer it. In early April, Frontier

In early April, Frontier

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall.

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall. Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with