Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

In an effort to appease Washington, Comcast is voluntarily abiding by a 30% market share cap the company itself successfully sued to overturn in federal court. That means Comcast plans to voluntarily shed the three million Time Warner Cable customers that would put the company over its self-imposed limit.

Comcast is so confident its merger will win approval, the company is already contemplating what to do with the orphaned customers. Bloomberg News reports Comcast is considering launching a new publicly traded independent cable company to manage the ex-Time Warner customers. It would automatically be the fourth largest cable company in the country, behind the super-sized Comcast, Cox Communications, and Charter Cable. Comcast would use the new entity to claim it was creating a new “cable competitor” in the industry, despite the fact it would almost certainly never compete in markets where other cable companies already offer service.

Other cable companies are already expressing interest in picking up the stranded TWC customers. Among the suitors:

- Charter Communications, which lost its original bid to take over Time Warner Cable;

- Bright House Networks, which now serves markets in the southern U.S.;

- Suddenlink Communications, which primarily serves rural communities and small cities ignored by larger providers.

Comcast hasn’t announced what cities will not be included in the Comcast-TWC merger, and does not plan to decide until at least late spring. Financial strategists are recommending Comcast “spinout” the subscribers to a new entity that would be loaded up with debt to win significant tax savings from the transaction. The new cable company would likely be worth at least $17 billion.

[flv]http://www.phillipdampier.com/video/Bloomberg Comcast Might Spin Off TWC Subs 2-28-14.flv[/flv]

Bloomberg News reports Comcast would be in the enviable position of creating its own “competitor” by spinning off certain Time Warner Cable customers into a new company Comcast would launch. (2:45)

Subscribe

Subscribe Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover. Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that.

Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that. Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell. Two years after energy conservation groups revealed many television set-top boxes use almost as much electricity as a typical refrigerator, a voluntary agreement has been reached to cut the energy use of the devices 10-45 percent by 2017.

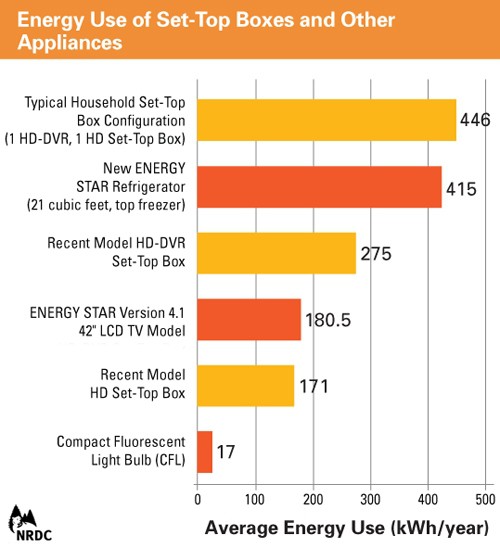

Two years after energy conservation groups revealed many television set-top boxes use almost as much electricity as a typical refrigerator, a voluntary agreement has been reached to cut the energy use of the devices 10-45 percent by 2017.

That $1 billion could be a key part of any blockbuster buyout deal because Malone can leverage that and other money with an even larger infusion from today’s easy access capital market. He has done it before, leveraging countless buyouts of other cable operators that built Malone’s Tele-Communications, Inc. (TCI) into the country’s largest cable operator by the early 1990s.

That $1 billion could be a key part of any blockbuster buyout deal because Malone can leverage that and other money with an even larger infusion from today’s easy access capital market. He has done it before, leveraging countless buyouts of other cable operators that built Malone’s Tele-Communications, Inc. (TCI) into the country’s largest cable operator by the early 1990s. Khan believes Malone laid his consolidation foundation with Liberty’s significant ownership interest in Charter Communications, from which he can build a new cable empire.

Khan believes Malone laid his consolidation foundation with Liberty’s significant ownership interest in Charter Communications, from which he can build a new cable empire.