A behind the scenes struggle between DISH Networks and Charter Communications over DISH’s online video service Sling TV has led to an admission by a Wall Street analyst that “usage-based billing” is an important tool for stifling over-the-top online video competition.

A behind the scenes struggle between DISH Networks and Charter Communications over DISH’s online video service Sling TV has led to an admission by a Wall Street analyst that “usage-based billing” is an important tool for stifling over-the-top online video competition.

On Dec. 21, DISH’s legal team sent a letter to the FCC complaining about Charter’s attempts to “address” the competitive threat of Sling TV, DISH’s online video alternative to cable television.

“Charter’s laser-like focus on Sling TV shows that it views Sling TV as a serious competitive threat rather than a benign interest,” wrote DISH’s attorneys. “Charter is focused on protecting its video subscriber base rather than enhancing the broadband Internet experience for its subscribers. Charter’s documents further reveal thinly veiled complaints to programmers about making their programming available to Sling TV and other [online video] products.”

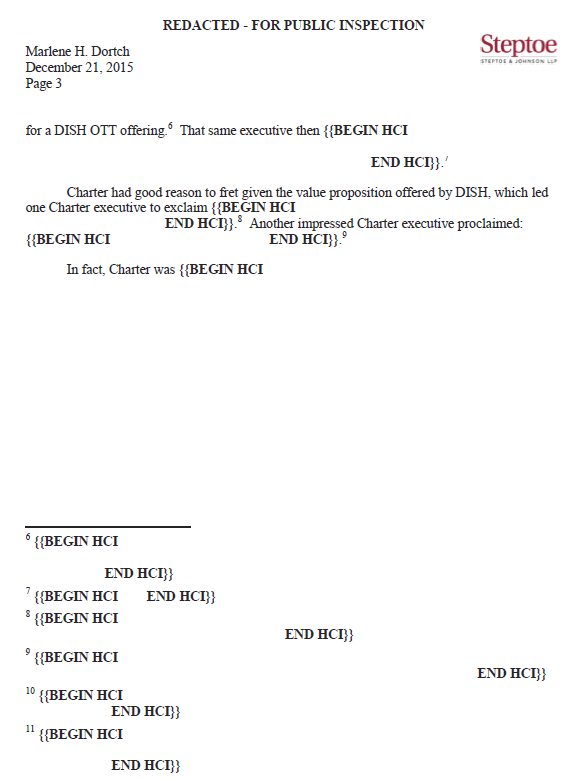

In the highly redacted filing, Dish suggested Charter was making thinly veiled threats to Disney and Scripps Networks over their willingness to allow their content to be included on Sling TV. DISH has complained to the FCC the cable company was attempting to undermine the new competitor.

A sample from DISH lawyer’s highly redacted submission to the FCC shows much of this fight is occurring out of public view.

On Thursday, the FCC also received an ex parte filing alerting the public that Time Warner (Entertainment) and HBO executives privately met with FCC staff last week, at their invitation, telling them Charter was likely threatening other programmers with unspecified action if they continued to allow their programming to appear on Sling TV.

In that meeting, HBO executives suggested “New Charter” — the combination of Charter Cable, Time Warner Cable, and Bright House Networks — “would be inclined to take action directed at programmers” if services like Sling TV continued to grow. Those threats seem to have been confirmed by Charter CEO Thomas Rutledge, who warned the company would take ‘competitive action’ against programmers selling content to the competition.

In the past, several cable executives have hinted that allowing wider distribution of cable networks over competitors’ networks or direct-to-consumer would dilute the value of those networks to cable operators. That would likely lead to demands for reduced prices when cable networks sought contract renewal. Some cable companies might also drop those networks altogether, arguing customers can get them elsewhere. Either retaliatory move would cut viewer numbers, which in turn would force networks to charge less for advertising.

That the FCC would invite further discussions on the issue of online video competition has some on Wall Street concerned about the prospects of Charter winning approval to buy Time Warner Cable and Bright House.

On Friday, BTIG analyst Richard Greenfield wrote investors, wondering if “we should be less confident in deal approval than we currently are.” With both the Justice Department and the Obama Administration pushing hard for competitive online alternatives to cable television, the FCC may be worried allowing New Charter to have 25-30 percent of the broadband market. With broadband a prerequisite for signing up for services like Sling TV, Rutledge’s “competitive action” could dissuade consumers from choosing online video instead of cable television.

New Street Research analyst Jonathan Chaplin admitted one of Charter’s strongest potential weapons against online video competitors is usage-based Internet billing. That Charter has committed to avoiding usage pricing for the next three years would seem to delay any attempt by Charter to deploy usage caps and usage pricing to stop online competition.

But three years may also not be long to wait, especially if the current “cap-free” commitment helps win merger approval. Chaplin believes Charter’s current commitment to not impose usage caps weakens DISH’s argument, but it could be the subject of special conditions from regulators if the deal is ultimately approved.

The topic appears to be sensitive enough to have provoked Charter to push back hard against DISH and Time Warner (Entertainment) in a blog post published last Friday afternoon.

We are happy to report that the vast majority of stakeholders are pleased with the merger and excited about New Charter. It’s no surprise, though, that there are some who seek to use the regulatory review process to extract concessions or conditions that further their business goals. Following the well-worn play book, to achieve that goal, they must first try to discredit the merger, but their allegations are often not based on the facts. For example, charges by Dish and Time Warner’s HBO that New Charter will harm Online Video Distributors simply do not make sense. As we have demonstrated, there is no more OVD-friendly provider than Charter, with our slowest speed at 60Mbps, no data caps, no usage-based billing, no annual contracts and no modem fees. Additionally, we’ve committed that New Charter will offering settlement-free peering to Internet companies, which means we will continue to invest in interconnection to avoid congestion. Netflix CEO Reed Hastings, a supporter of the transaction, stated “the key thing about the Charter deal is it’s all Internet companies that benefit — us, Hulu, Amazon, HBO Now — so that we can all compete for consumers’ affection.”

Subscribe

Subscribe In a sign federal regulators are taking the behemoth merger of Charter Communications, Time Warner Cable, and Bright House Networks seriously, the FCC today announced it was

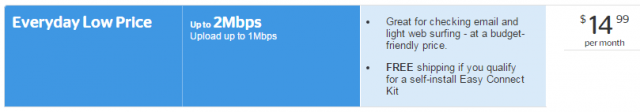

In a sign federal regulators are taking the behemoth merger of Charter Communications, Time Warner Cable, and Bright House Networks seriously, the FCC today announced it was  While planning to quietly drop Time Warner Cable’s budget-minded, unrestricted $14.99 Everyday Low Price Internet package after it acquires the company, Charter Communications is celebrating a “new and improved” low-income Internet offer that will likely discriminate against current customers while protecting company profits.

While planning to quietly drop Time Warner Cable’s budget-minded, unrestricted $14.99 Everyday Low Price Internet package after it acquires the company, Charter Communications is celebrating a “new and improved” low-income Internet offer that will likely discriminate against current customers while protecting company profits.

Among the most onerous restrictions, Charter plans to protects itself from revenue cannibalization by prohibiting existing broadband customers from paying less by signing up for Charter’s new discounted plan. Customers will have to voluntarily drop Bright House/Charter/Time Warner Cable Internet service for at least 60 days before they can apply for Charter’s new low-cost option.

Among the most onerous restrictions, Charter plans to protects itself from revenue cannibalization by prohibiting existing broadband customers from paying less by signing up for Charter’s new discounted plan. Customers will have to voluntarily drop Bright House/Charter/Time Warner Cable Internet service for at least 60 days before they can apply for Charter’s new low-cost option.