AT&T aids and abets cramming fraud by making it hard to find on customer bills.

More than five years after complaints began rolling into AT&T from wireless customers finding unauthorized charges on their monthly bills, the Federal Trade Commission and Federal Communications Commission today announced those customers deserve a refund, and AT&T has agreed to pay $80 million towards restitution for their complicity in bill cramming.

As part of a $105 million settlement with federal and state law enforcement officials, AT&T Mobility LLC will pay $80 million to the Federal Trade Commission to provide refunds to consumers the company unlawfully billed for unauthorized third-party charges, a practice known as mobile cramming. The refunds are part of a multi-agency settlement that also includes $20 million in penalties and fees paid to 50 states and the District of Columbia, as well as a $5 million penalty to the Federal Communications Commission.

In its complaint against AT&T, the FTC alleges that AT&T billed its customers for hundreds of millions of dollars in charges originated by other companies, usually in amounts of $9.99 per month, for subscriptions for ringtones and text messages containing love tips, horoscopes, and “fun facts.” In its complaint, the FTC alleges that AT&T kept at least 35 percent of the charges it imposed on its customers, a lucrative incentive for AT&T to keep the cramming charges coming.

“I am very pleased that this settlement will put tens of millions of dollars back in the pockets of consumers harmed by AT&T’s cramming of its mobile customers,” said FTC chairwoman Edith Ramirez. “This case underscores the important fact that basic consumer protections – including that consumers should not be billed for charges they did not authorize – are fully applicable in the mobile environment.”

Beginning today, consumers who believe they were charged by AT&T without their authorization can visit www.ftc.gov/att to submit a refund claim and find out more about the FTC’s refund program under the settlement. If consumers are unsure about whether they are eligible for a refund, they can visit the claims website or contact the settlement administrator at 1-877-819-9692 for more information.

This case is part of a larger FTC effort to clamp down on mobile cramming. This is the FTC’s seventh mobile cramming case since 2013, and its second against a mobile phone carrier this year. The FTC filed a complaint against T-Mobile in July, and that case is ongoing. The Commission also issued a staff report on mobile cramming in July. The FTC mobile cramming cases build on the FTC’s extensive law enforcement work over the last decade to combat cramming on landline phone bills.

The FTC’s investigation into AT&T showed that the company received very high volumes of consumer complaints related to the unauthorized third-party charges placed on consumer’s phone bills. For some third-party content providers, complaints reached as high as 40 percent of subscriptions charged to AT&T consumers in a given month. In 2011 alone, the FTC’s complaint states, AT&T received more than 1.3 million calls to its customer service department about the charges.

According to the complaint, in October 2011, AT&T altered its refund policy so that customer service representatives could only offer to refund two months’ worth of charges to consumers who sought a refund, no matter how long the company had been billing customers for the unauthorized charges. Prior to that time, AT&T had offered refunds of up to three months’ worth of charges. At that time, AT&T characterized its change in policy as designed to “help lower refunds.”

In February 2012, one AT&T employee said in an e-mail that “Cramming/Spamming has increased to a new level that cannot be tolerated from an AT&T or industry perspective,” but according to the complaint, the company did not act to determine whether third parties had in fact gotten authorization from consumers for the charges placed on their bills. In fact, the company denied refunds to many consumers, and in other cases referred the consumers to third-parties to seek refunds for the money consumers paid to AT&T.

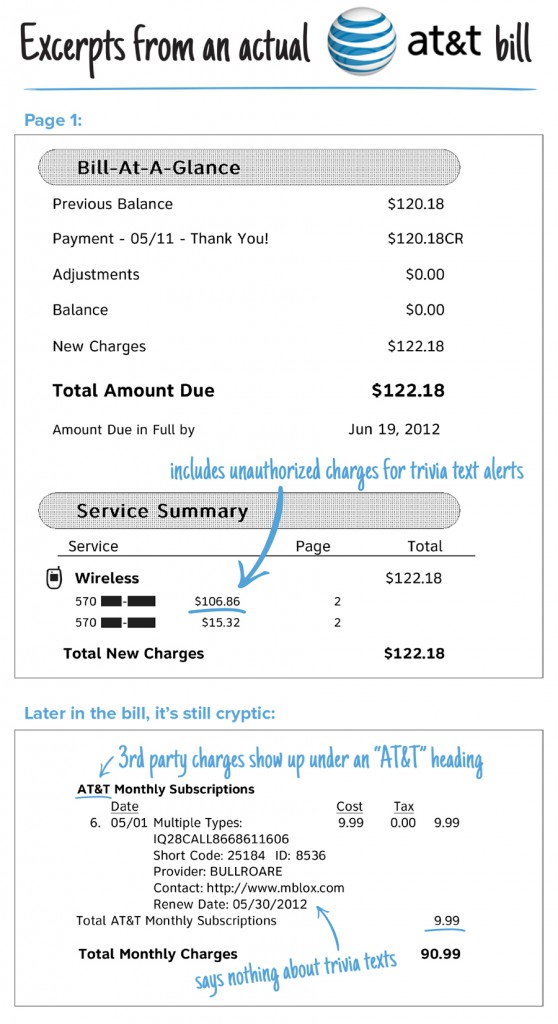

The structure of AT&T’s consumer bills compounded the problem of the unauthorized charges, according to the complaint, by making it very difficult for customers to know that third-party charges were being placed on their bills. On both the first page of printed bills and the summary of bills viewed online, consumers saw only a total amount due and due date with no indication the amount included charges placed on their bill by a third party. The complaint alleges that within online and printed bills, the fees were listed as “AT&T Monthly Subscriptions,” leaving consumers to believe the charges were part of services provided by AT&T.

Under the terms of its settlement with the FTC, AT&T must notify all of its current customers who were billed for unauthorized third-party charges of the settlement and the refund program by text message, e-mail, paper bill insert and notification on an online bill. Former customers may be contacted by the FTC’s refund administrator.

In addition to the refund requirements, AT&T is also required to obtain consumers’ express, informed consent before placing any third-party charges on a consumer’s mobile phone bill. In addition, the company must clearly indicate any third-party charges on the consumers’ bill and provide consumers with the option to block third-party charges from being placed on their bill.

The Commission vote authorizing the staff to file the complaint and approving the proposed stipulated order was 5-0. The FTC filed the complaint and proposed stipulated order in the U.S. District Court for the Northern District of Georgia. The proposed stipulated order is subject to court approval.

Subscribe

Subscribe The New York Public Service Commission needs to hear from you about the Comcast-Time Warner Cable merger. Unlike some of the southern and midwestern states that have utility commissions that basically rubber stamp the agenda of Big Telecom companies, New York’s PSC has a reputation for being tougher and more customer-oriented. But the PSC cannot act in your interest if you don’t share your views.

The New York Public Service Commission needs to hear from you about the Comcast-Time Warner Cable merger. Unlike some of the southern and midwestern states that have utility commissions that basically rubber stamp the agenda of Big Telecom companies, New York’s PSC has a reputation for being tougher and more customer-oriented. But the PSC cannot act in your interest if you don’t share your views.

Bigger discounts can be had for television and Internet service — cable television remains immensely profitable in Canada and broadband is cheap to offer, especially in cities. Americans often pay $80 or more for digital cable television packages, Canadians pay an average of $60.

Bigger discounts can be had for television and Internet service — cable television remains immensely profitable in Canada and broadband is cheap to offer, especially in cities. Americans often pay $80 or more for digital cable television packages, Canadians pay an average of $60. AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.

AT&T’s investment in U-verse expansion is expected to peak this year as part of its “Project VIP” effort to bring the fiber to the neighborhood service to more areas and offer faster broadband speeds to current customers.