Problem: Solved?

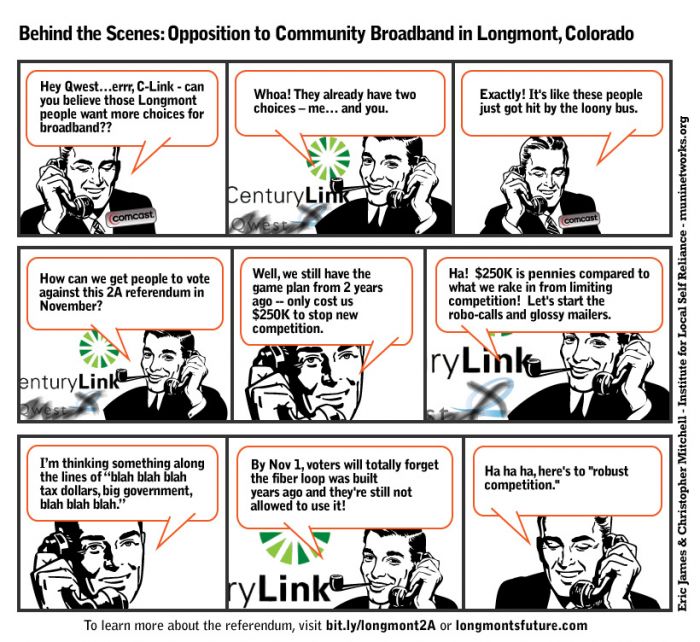

The Federal Communications Commission last Friday unanimously voted to free cable operators from their obligation to sell cable channels they own to rival satellite and phone companies.

In a bizarre justification, FCC chairman Julius Genachowski said ending the unambiguous rules would prevent anti-competitive activity in the market because the FCC would retain the right to review industry abuses on a case-by-case basis. Lawmakers called that an invitation for endless, time consuming litigation that will deprive consumers of competitive choice and favor the still-dominant cable television industry.

“The sunset of the program access rules could lead to a new dawn of less choice and higher prices for consumers,” said Rep. Ed Markey (D-Mass.), one of the original authors of the rules. “If we do not extend the program access rules, the largest cable companies could withhold popular sports and entertainment programming from their competitors, reducing the competition and choice that has benefited consumers. I urge Chairman Genachowski and the FCC commissioners to extend the program access rules that have helped to level the playing field in the paid television marketplace.”

The FCC’s decision could have profound implications on would-be competitors, particularly start-ups like Google Fiber that could find itself without access to popular cable networks at any price.

At a time when cable companies and programmers are constantly pitted against each other in contract/carriage disputes, the deregulatory spirit at the FCC is likely to irritate consumers even more.

The FCC claims it will continue to protect sports programming from exclusive carriage agreements — a potentially critical concession considering the history of “exclusive, only on cable” programming contracts was largely focused on regional sports channel PRISM.

Comcast successfully kept the popular Philadelphia-based network (today known as Comcast SportsNet Philadephia) off competing satellite services and cable operators by only distributing the network terrestrially. A controversial FCC rule (known as the “terrestrial exception”) states that a television channel does not have to make its shows available to satellite companies if it does not use satellites to transmit its programs. Cox Cable has its own implementation of that loophole running in San Diego.

Derek Chang, executive vice-president of DirecTV, says Comcast’s local market share dominance is a direct consequence of SportsNet. More importantly, Chang believes even if Comcast says it will sell the network to competitors, it is free to set prices for SportsNet as high as it wants.

“They win either way,” Chang said. “They’re either going to gouge our customers, or they’re going to withhold it from our customers.”

Verizon FiOS has secured the right to carry the channel on its system, but won’t say how much it pays.

The PRISM case is today’s best evidence that exclusive agreements do hamper competition — Philadelphia is hardly a hotbed of satellite dishes, with a 40-50% reduced satellite subscriber rate attributable to the lack of popular regional sports on satellite.

FCC Chairman Julius Genachowski’s cowardly lion act is back. Will anyone at the FCC stand up to Big Telecom companies while busy watering down pro-competitive policies?

Historically, satellite dish owners and wireless cable customers were the most likely victims of exclusive or predatory programming contracts, with some cable networks refusing to sell their programming to competing technologies at any price. Others charged enormous, unjustified mark-ups that made the technology non-competitive. Today, wireless cable television is mostly defunct and home satellite dish service has largely been replaced with direct broadcast satellite providers DirecTV and Dish.

Today’s programming landscape is more complicated. The FCC would argue that unlike in the 1980s, most cable programmers are no longer directly controlled by yesteryear’s Tele-Communications, Inc. (TCI) and Time Warner (Time Warner Cable was spun off into an independent, unaffiliated entity in March, 2009), which collectively controlled dozens of popular cable networks. But programmers’ know their best customers remain cable operators which maintain a dominant market share in every major American city.

Friday’s ruling has implications for telco-TV providers and satellite dish companies that may find programming negotiations more complicated than ever. AT&T U-verse and Verizon FiOS may find access to cable-owned programming difficult or even impossible to obtain if cable operators decide their unwanted competition is harmful to their business interests.

But an even larger challenge looms for the next generation of video competition: Google Fiber TV and “over the top” online video.

Nobody is complaining about Google’s robust gigabit broadband offering, but Kansas City residents originally expressed concern about the company’s proposed television lineup. As originally announced, Google Fiber TV was missing HBO and ESPN.

A competing cable system without ESPN is dead in the water for sports enthusiasts.

Google has since managed to sign agreements that expand their channel lineup (although it is still missing HBO). But nothing prevents channel owners from dramatically raising the price at renewal. That is a concern for smaller cable operators as well, who want protection from discriminatory pricing that awards the best prices to giant multi-system operators like Comcast and Time Warner Cable.

The most important impact of the FCC’s decision may be for those waiting to launch virtual cable systems delivering online programming to customers who want to pick and choose from a list of networks.

The FCC’s “new rules” give programmers who depend on tens of millions of cable subscribers even more ammunition to kill competing distribution models like over the top video. Start-up providers who cannot obtain reasonable and fair access to cable programming will have to depend on the vague policies the FCC claims it will enforce to prevent egregious abuse. But the FCC is not known for its speed and start-up companies may face enormous legal fees fighting for fair access that is now open to subjective interpretation.

Subscribe

Subscribe