Again with the domination and control thing.

Dr. John Malone is wasting no time reacquainting the cable industry with the kinds of classic power plays he used while running Tele-Communications, Inc. (TCI), then America’s largest and most powerful cable operator. Malone’s latest salvo: proposing new broadband pricing schemes that run afoul of Net Neutrality by charging consumers higher broadband prices if they watch online video services like Netflix.

Malone, increasing his influence over Charter Communications before launching the next wave of cable company consolidation, implied the industry is hurting from the lack of power and dominance it used to enjoy when it had an unfettered, territorial monopoly back in the 1980s. Malone told an audience at the annual shareholder meeting of Liberty Global he advocates getting the industry’s mojo back by returning to “value creation” pricing models — code language for new ways to charge customers higher prices or add-on fees.

Malone sees raising prices for Internet service key to bringing the industry back to the golden profits it used to enjoy selling television subscriptions, even as customers faced massive rate increases that doubled, tripled, or even quintupled rates for certain services.

Malone’s assessment of the eight current largest cable operators wiring the country: Snow White (Comcast) and the Seven Dwarfs (Everyone Else). The disorganized agendas of various cable operators are troublesome to Malone, who wants the industry to act in lock step with a unified, cooperating voice. Consumer groups call this kind of friendly cooperation “collusion.”

Malone also thinks it is time to discard reliance on cable television to bring home the revenue and profits Wall Street expects. The industry should instead turn its earning attention to broadband, a product few Americans can live without. Malone believes the cable industry is not only positioned to control content distributed on its TV Everywhere online video platform for authenticated cable subscribers, but also have a say in competing content from Netflix, among others, which are totally reliant on the broadband pipes provided by ISPs.

Malone also thinks it is time to discard reliance on cable television to bring home the revenue and profits Wall Street expects. The industry should instead turn its earning attention to broadband, a product few Americans can live without. Malone believes the cable industry is not only positioned to control content distributed on its TV Everywhere online video platform for authenticated cable subscribers, but also have a say in competing content from Netflix, among others, which are totally reliant on the broadband pipes provided by ISPs.

With Netflix consuming a growing percentage of cable broadband resources, and possibly contributing to cable TV cord cutting, Malone does not advocate crushing its competition. Instead, he wants a piece of the action. How? By demanding online video providers pay for using cable broadband infrastructure. Consumers also face surcharges on their broadband accounts if they watch online video services like Netflix, Amazon, YouTube and other over-the-top-video. Malone also advocates the implementation of Internet Overcharging schemes like consumption billing and usage caps.

Malone’s “world of the future,” is, in reality, not much different from AT&T’s 2005 proclamation that use of AT&T’s broadband pipes should come at a cost to content producers.

Then-CEO Ed Whitacre’s public statements fueled support for Net Neutrality, which forbids broadband providers from traffic discrimination techniques like charging extra for certain content or artificially degrading service for producers who refuse to pay.

Malone’s incendiary ideas may be letting too much of the cat out of the bag, say some observers worried Malone’s rhetoric will remind people he was once labeled “the Darth Vader of Cable.” His statements could attract unnecessary attention that could be used to organize opposition.

Last week, the Wall Street Journal reported that broadband providers and content producers were already secretly cutting deals to exchange bandwidth for money without the public scrutiny Malone’s comments will generate.

The newspaper reports some of the biggest Net Neutrality proponents around, particularly Google, are quietly paying millions to large cable companies to guarantee their content reaches customers as quickly and smoothly as possible.

Among the top recipients: Comcast, which collects $25-30 million a year and Time Warner Cable, which nets “tens of millions of dollars” from Google, Microsoft, and Facebook.

Among the top recipients: Comcast, which collects $25-30 million a year and Time Warner Cable, which nets “tens of millions of dollars” from Google, Microsoft, and Facebook.

The payments are buried in the murky world of “interconnection agreements” governing the backbone pipes carrying huge amounts of web traffic from popular websites and those owned by large telecom providers. Originally, content and broadband providers agreed to peering arrangements that would trade traffic without payment to each other. But as bandwidth-heavy online video began to turn those shared connections into lopsided floods of movies and TV shows headed into subscriber homes against a trickle of content coming back from broadband customers, the cable and phone companies began crying foul.

Netflix has so far navigated around paying Internet Service Providers directly to support their video content. Instead, it is building its own specialized content distribution network intended for ISPs to more effectively and efficiently deliver high bandwidth video. Connections to the Netflix network are free of charge to participating providers, but many ISPs are demanding to be paid.

Some content providers are fearful if they don’t pay, the free “peering” links will become hopelessly overcongested and slow web pages and services to a crawl.

For Verizon customers, that may have already happened as Netflix streams began stuttering and buffering earlier this month.

Cogent, which supplies Verizon with a considerable amount of Netflix traffic, immediately pointed the finger at the phone company for artificially degrading the Netflix viewing experience. Verizon promptly shot back:

Cogent is not compliant with one of the basic and long-standing requirements for most settlement-free peering arrangements: that traffic between the providers be roughly in balance. When the traffic loads are not symmetric, the provider with the heavier load typically pays the other for transit. This isn’t a story about Netflix, or about Verizon “letting” anybody’s traffic deteriorate. This is a fairly boring story about a bandwidth provider that is unhappy that they are out of balance and will have to make alternative arrangements for capacity enhancements, just like any other interconnecting ISP.

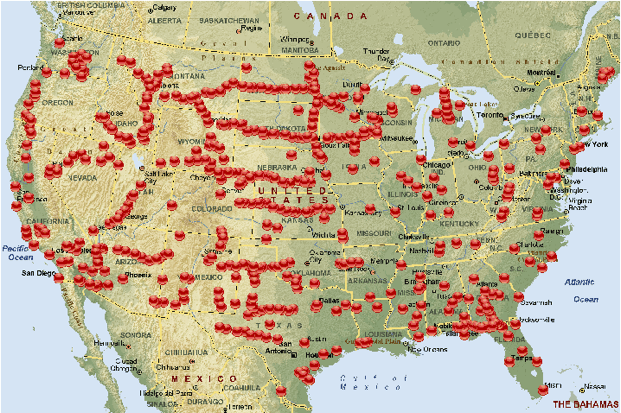

Cable giants like Malone see the battle as one the cable industry will have a hard time losing, because it is the only technology present in most communities that can handle the traffic and the growing demand for faster speeds.

Cable operators think content companies have a license to print money, especially since their success is built partly on broadband networks they don’t own or pay for delivering content to customers. At the same time, content companies fear they could be forced out of business if the cable industry decides to give itself preferential treatment.

[flv width=”504″ height=”300″]http://www.phillipdampier.com/video/WSJ Paying ISPs to Move Content 6-20-13.flv[/flv]

Reporters from The Wall Street Journal discuss the secret payment arrangements between content producers and some of America’s largest ISPs. (4 minutes)

Subscribe

Subscribe An upstart telecom company has thrown the French mobile market into competitive chaos offering customers unlimited voice, messaging, and certain data services for around $26 a month. Now the company is expanding its footprint by offering free femtocells to customers that can be shared by other customers, according to

An upstart telecom company has thrown the French mobile market into competitive chaos offering customers unlimited voice, messaging, and certain data services for around $26 a month. Now the company is expanding its footprint by offering free femtocells to customers that can be shared by other customers, according to

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future?

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future? CTB Spectrum Services

CTB Spectrum Services

AT&T U-verse broadband has not kept up with the times, limiting speed-craving customers to a comparatively slow 18-24Mbps that hasn’t changed much in a few years. But an AT&T employee

AT&T U-verse broadband has not kept up with the times, limiting speed-craving customers to a comparatively slow 18-24Mbps that hasn’t changed much in a few years. But an AT&T employee