Customers sitting down to watch the local news in Louisville, Ky. on Time Warner Cable (formerly Insight) now get to see stories about ongoing bankruptcy woes at Eastman Kodak, house fires in Irondequoit, road work in Greece, and Scott Hetsko’s local forecast… for Rochester, N.Y.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WLKY Louisville WLKY Remains Off the Air 7-16-12.flv[/flv]

WLKY in Louisville is no longer seen on former Insight cable systems (now owned by Time Warner Cable). In its place, Louisville viewers are watching WROC-TV in Rochester, N.Y. Here is why. (3 minutes)

No, it is not some weird sunspot reception and nobody transported you from Kentucky to western New York while you were sleeping. It’s simply another epic battle waged in:

RETRANSMISSION CARRIAGE CONSENT WARS: 2012

“Not getting the channels you are paying for does not necessarily entitle you to a refund, but does require you to pay more when a deal is eventually struck.”

WESH-TV in Daytona Beach/Orlando, Fla. is one of the Hearst-owned stations affected in the dispute with Insight/Time Warner Cable/Bright House Networks.

These skirmishes used to be commonplace around the end of the year, when carriage agreements between cable, satellite, and telephone companies with cable networks and local stations came up for renewal. When the programmer passed a figure written on a folded up piece of paper across the table to your pay television provider, the shock and awe of that number, occasionally 100-300 percent more than the year before, was the opening shot in a battle that now increasingly leads to favorite local stations or cable channels being stripped from your lineup.

In Louisville, that is precisely what happened to WLKY-TV, one of 15 stations owned by Hearst Television, taken off the lineup when Time Warner Cable/Insight/Bright House Networks could not successfully negotiate a renewal agreement. Time Warner complained Hearst wanted 300% more for each of the affected stations, an increase sure to be passed along to cable customers already long weary of endless annual rate increases. That was the same story told in other cities affected by what is now a week-long blackout. In Greensboro/Winston-Salem, N.C., Time Warner customers are doing without WXII-TV. Kansas City customers lost two local stations owned by Hearst — KMBC and KCWE. Two stations are also missing from Bright House’s lineup in Orlando: WESH and WKCF.

[haiku url=”http://www.phillipdampier.com/audio/WHAS Louisville Interview with WLKY GM 7-16-12.mp3″ defaultpath=disabled]

Hearst Television’s general manager and president of WLKY has stopped referring to those watching the station simply as “viewers.” Glenn Haygood now calls them “subscribers.” Haygood talks with WHAS Radio about the dispute and what he thinks about Insight/Time Warner Cable. (10 minutes)

Insight/Time Warner Cable customers in Louisville, Ky. are now watching CBS shows on WROC-TV from Rochester, N.Y.

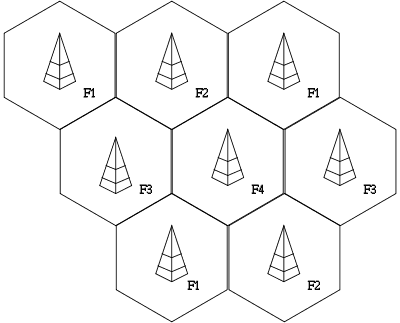

But why are Louisville viewers now watching the boating forecast for Lake Ontario, several hundred miles away? Because Time Warner Cable thinks it has a signed contract with Nexstar Broadcasting Group that lets them turn several Nexstar-owned stations into “superstations,” importing them in cities where contract disputes have knocked the local station off the cable lineup. In Louisville, WLKY, a CBS affiliate, has been replaced by WROC, the CBS affiliate in Rochester. In Greensboro and several other cities, WXII, an NBC affiliate, has been replaced with WBRE in Wilkes Barre, Penn. Some other Time Warner customers are instead watching WTWO out of Terre Haute, Ind., for NBC shows.

It represents a half-measure that Time Warner Cable’s Jeff Simmermon tells Stop the Cap! is “making the best of a tough situation.”

Viewers are naturally outraged.

“I’ve always wanted to know the weather and news in Rochester, Buffalo, Ontario and Caribou,” Kelly Grether teased. “Louisville did make [WROC’s weather] map believe it or not.”

Others are simply confused and engaged in must-flee TV.

“I saw the news coming on,” Greensboro resident Mona Wright told the News & Record. “It didn’t take me but one minute to figure out that these counties were nowhere around us; I changed the channel.”

Some Louisville viewers are even assuming the sales and discounts being advertised on WROC are good in Kentucky as well (often, they are not).

For now, it is difficult for Kentucky viewers to know what WROC is airing because the local on-screen program guide has not been updated to include listings for the Rochester station. Time Warner is pushing a lot of viewers to WROC’s website for program information.

Viewers hoping to practice their Jeopardy and Wheel of Fortune skills during the dinner hour lost that opportunity altogether in some cities, while in the Triad of North Carolina, viewers discovered the two shows on two different channels at the same time.

For now, WROC has completely ignored its new Kentucky audience, but WBRE’s morning anchors now regularly acknowledge and welcome their viewers from several states away.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WFTV Orlando WESH Disappears from Bright House 7-10-12.flv[/flv]

WFTV in Orlando reports on Bright House Networks’ customers being shut out of WESH-TV in Daytona Beach after the cable operator failed to meet Hearst Television’s demands for an increase in carriage payments. (2 minutes)

The dispute has since enlarged to bring in side players who are unimpressed with Time Warner’s creative problem-solving:

- Impacted stations now off Time Warner’s lineup think the “new” stations on the lineup are about as honorable as employing scab workers during a union strike;

- Nexstar, for the second time, declares Time Warner is illegally importing their stations to unauthorized places. They are threatening to complain to the FCC and possibly sue to stop the practice. Nexstar earlier complained about a similar dispute in upstate New York which left viewers in northern New York watching WBRE in Wilkes-Barre. But the carriage dispute was settled quickly enough for WBRE to go back to being viewable only in Pennsylvania, ending the dispute;

- Syndicated program owners sell shows like Wheel of Fortune on a “market exclusive” basis, which means competing local stations already paying for syndicated shows do not want out of area stations also carrying those shows to local audiences, diluting their audience.

- Advertisers on stations now off the lineup paid ad rates based on tens of thousands of cable viewers who are now probably watching another station. Some are demanding “make goods” or outright refunds to get the value for money they were originally promised.

But nobody is more caught in the middle than consumers, especially those paying for channels they are no longer getting.

“I want my money back,” says Orlando Bright House customer Luis Fernandez. “I have lost two stations on my lineup and my bill should be going down to compensate, but Bright House is refusing to credit me.”

Time Warner Cable does not usually give refunds either, arguing that its customers pay for a package of channels and the technology that delivers those networks to customers. Giving a refund for the loss of one or two stations would be tantamount to the industry’s worst nightmare: getting customers used to the idea of paying individually for every channel.

One customer willing to make himself a major nuisance in Wauwatosa, near Milwaukee, Wis., finally wore Time Warner down and secured a $5 a month discount on his bill for the length of the dispute that knocked Milwaukee’s WISN off his lineup.

“[I called] Time Warner to voice my disgust in them putting me (the paying customer) in the middle of their negotiation failures, and after reaching a ‘supervisor,’ I was able to get a discount on my monthly bill,” the reader told the Journal-Sentinel. “It wasn’t easy, but I did it.”

Hearst is encouraging viewers to drop Time Warner like a hot potato and switch to AT&T U-verse or a satellite provider like DirecTV. Negotiations seem to be continuing on a sporadic basis, but one week later, customers heading for the door have already left or are simply watching the local news on another channel.

Satellite Showdown — DirecTV vs. Viacom: Playing Down and Dirty With Everyone

[flv width=”426″ height=”260″]http://www.phillipdampier.com/video/Viacom Ad.mp4[/flv]

Viacom turns the tables on DirecTV’s clever ads to lambaste the satellite provider for cutting off more than two dozen cable channels owned by Viacom. (1 minute)

If a customer took Hearst’s advice, they might find themselves out of the frying pan and into the fire. Newly arriving DirecTV customers can join the Anger Party 20 million satellite customers are now throwing over a much larger, higher profile dispute between the satellite provider and Viacom. Collateral damage: the loss of networks including Palladia, Centric, Tr3s, CMT, Logo, NickToons, VH1 Classic, TeenNick, Nick Jr., Nick@Nite, Spike, BET, VH1, TV Land, Comedy Central, Nickelodeon and MTV.

Some financial analysts are calling the dispute the mother-of-all-program-fee-battles, and as they watch both sides dig in, some warn it could mean DirecTV customers won’t be watching The Daily Show with Jon Stewart until August.

DirecTV says Viacom wants a 30% rate increase to renew its contract to carry the company’s networks. That is comparatively cheap contrasted with the prices Hearst wants Time Warner Cable to now pay. Analysts expect DirecTV and Viacom will eventually settle their dispute by agreeing to a 27% rate increase, but nobody knows how long the two will battle it out before an inevitable agreement is reached.

Regardless of the timing, customers will likely pay the price. Nomura analyst Michael Nathanson informed his Wall Street clients DirecTV will end up paying Viacom $2.85 per subscriber — about 60 cents more per month than it pays today. That’s tough for DirecTV to swallow, and probably even harder to pass along to customers. Satellite TV providers have some of the country’s most-frugal pay television customers who are especially resistant to rate increases.

Regardless of the timing, customers will likely pay the price. Nomura analyst Michael Nathanson informed his Wall Street clients DirecTV will end up paying Viacom $2.85 per subscriber — about 60 cents more per month than it pays today. That’s tough for DirecTV to swallow, and probably even harder to pass along to customers. Satellite TV providers have some of the country’s most-frugal pay television customers who are especially resistant to rate increases.

The dispute is so high profile, both companies are bringing out high-powered executives and show talent to argue their respective cases.

Millions of dollars are at stake, and both Viacom and DirecTV are willing to fight to the death, even leaving customers on the battlefield.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/DirecTV Viacom Dispute 7-12-12.mp4[/flv]

Not so fast, says DirecTV CEO Michael White, seen here presenting DirecTV’s position in the Viacom dispute for the benefit of concerned customers. (1 minute)

“All we are trying to get is a fair deal for our customers and I’m sorry our customers are being forced into the middle of this,” DirecTV’s Michael White said. “We just think we pay a half a billion dollars a year and a billion dollar increase over five years, over 30 percent, is not justified by the marketplace or fair relative to our largest competitors or by their ratings.”

Viacom CEO Philippe Dauman counters, “In the last seven years since we did the last DirecTV deal, we have successfully and peacefully concluded affiliate agreements with every major distributor in the U.S. We are prepared to move forward. It’s unfortunate consumers for the first time are not able to enjoy our channels,” said Dauman, adding, “I don’t want to negotiate in public.”

Viacom CEO Philippe Dauman counters, “In the last seven years since we did the last DirecTV deal, we have successfully and peacefully concluded affiliate agreements with every major distributor in the U.S. We are prepared to move forward. It’s unfortunate consumers for the first time are not able to enjoy our channels,” said Dauman, adding, “I don’t want to negotiate in public.”

DirecTV was telling its customers it can watch many of the missing shows for free online, until Viacom reportedly began removing that direct viewing option last week. That hardball tactic could impact everyone trying to stream Viacom’s shows — DirecTV customer or not.

“We’ve temporarily slimmed down our offerings, as DirecTV markets them as an alternative to having our networks,” a Viacom spokesman told CNNMoney. “The online content is intended to serve as a complimentary marketing tool for our partners.”

“At least they were honest about the reasons why they pulled this,” said Stop the Cap! reader Dick Armlo, a DirecTV customer in Idaho. “But fortunately, you can still find a lot of the shows on Amazon’s video on demand and Hulu.”

Customers threatening to switch providers often discover the new neighborhood they move to is just as bad as the one they left.

Dish Network customers are currently enduring a long-standing dispute with Cablevision-owned AMC Networks. The result is no AMC, IFC, Sundance Channel and WeTV on Dish. AMC is telling Dish customers to turn their dish into a birdbath and head elsewhere… perhaps to AT&T U-verse which just recently averted its own blackout with AMC over the same channels. AT&T customers can expect part of their next rate increase to cover the negotiated rate hike AMC won for itself — the one AT&T agreed to on your behalf. After all, it’s your money at stake, not theirs.

[flv]http://www.phillipdampier.com/video/CNBC Viacom CEO on Dispute 7-12-12.flv[/flv]

CNBC talks with Viacom CEO Philippe Dauman to get his views about the dispute with one of his best customers — DirecTV. (2 minutes)

Subscribe

Subscribe