Speed bump

More than half of AT&T’s wireless customers are paying at least $100 a month for 10GB or more of wireless data on AT&T’s Mobile Share Plans at the same time AT&T continues to throttle its legacy unlimited data customers who use more than 3GB of data on its 3G network or 5GB of data on its 4G LTE network.

AT&T claimed in 2012 it implemented its “fair usage policy” for unlimited customers to assure all could receive reasonable service during peak usage times when cell towers become congested.

AT&T also blames “a serious wireless spectrum crunch” for the speed throttling, implying access to more spectrum could help ease the problem. But there is a much faster way to overcome AT&T’s “spectrum crunch:” agree to pay them more money by ditching that $30 unlimited plan for a tiered plan.

John Stephens, AT&T’s chief financial officer, told investors Wednesday that nothing boosts revenue more than pushing customers into usage-cappped data plans that customers are regularly forced to upgrade.

“On the ARPU (average revenue per user/customer) story, I think the biggest issue with the improvement is people buying the bigger [data] buckets and buying – upping plans,” said Stephens. “We had over 50% of the customer base at the 10GB or bigger plans.”

Stephens added that AT&T benefited from customers upgrading to 4G LTE devices that are handled more efficiently by AT&T’s mobile data network.

Increased usage and upgraded data plans delivered a 20% increase in data billings over the last quarter.

Since 2012 AT&T has paid out more than $50 billion to shareholders through dividends and share buybacks. The company benefited from nearly $20 billion a year in free cash flow and asset sales over the last two years and is expected to repeat those numbers this year. Consolidated revenue at AT&T grew to $33 billion, up $800 million since the same time last year.

Miraculously, despite the “alarming spectrum crunch,” AT&T found more than enough spectrum to award its best customers with a “double data” promotion that turns a 15GB data plan into a 30GB plan, a 20GB plan to 40GB, a 30GB plan to 60GB, a 40GB plan to 80GB, or a 50GB plan to 100GB. Importantly, AT&T boasts its double data promotion won’t “explode” — their language for “expire” — on customers until their contract ends.

Lowering the bar on “unlimited use” customers.

“Those exploding offers — customers hate those offers,” said AT&T Mobility CEO Ralph de la Vega at a recent investor conference. “Unless they change their mind, we won’t offer those kinds of promotions.”

But de la Vega doesn’t mind leaving the company’s most loyal legacy customers in the penalty box if they cling to their grandfathered unlimited data plans. The throttles stay and the allowances have remained unchanged since first announced, despite the bountiful spectrum obviously ready and available to serve AT&T’s deluxe customers. Unlimited customers are regularly reminded they can easily avoid the throttle — just abandon that unlimited data plan. According to Stephens, more than 80% of AT&T’s customers already have.

The excuses for wireless speed throttles and killing off unlimited data plans at AT&T and Verizon Wireless don’t seem to wash with FCC chairman Thomas Wheeler, who demanded Verizon offer the “rationale for treating customers differently based on the type of data plan to which they subscribe, rather than network architecture or technological factors,” after it announced it was planning speed throttles for its remaining unlimited data plan customers. Verizon canceled the plan after Wheeler began scrutinizing it, but the throttles are still in place at AT&T.

AT&T’s 10GB Mobile Share Plan starts with a $100 data plan. Customers also pay:

- $10 a month for each auto-based smart-locator;

- $10 a month for each tablet, camera or game device;

- $15 a month for each basic phone;

- $20 a month for each wireless home phone replacement;

- $20 a month for each connected Internet device;

- $40 a month for each connected smartphone.

A family of four with four smartphones, a tablet, and AT&T’s wireless home phone replacement would be billed $290 a month before at least $39 in taxes, fees, and surcharges — well north of $300 a month for most.

Subscribe

Subscribe T-Mobile has asked the Federal Communications Commission to investigate AT&T’s “artificially high roaming rates” charged when its customers travel outside of T-Mobile’s home service area.

T-Mobile has asked the Federal Communications Commission to investigate AT&T’s “artificially high roaming rates” charged when its customers travel outside of T-Mobile’s home service area. Because of AT&T’s artificially high roaming rates, T-Mobile wireless customers roaming in South Africa have a better user experience than customers roaming on AT&T’s network in South Dakota, argues T-Mobile. Their speed is twice as fast, and their data usage is unlimited.

Because of AT&T’s artificially high roaming rates, T-Mobile wireless customers roaming in South Africa have a better user experience than customers roaming on AT&T’s network in South Dakota, argues T-Mobile. Their speed is twice as fast, and their data usage is unlimited.

Love can be a fickle thing.

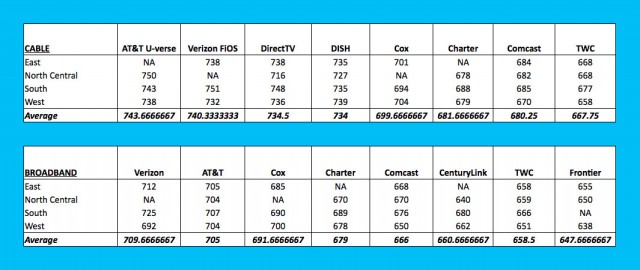

Love can be a fickle thing. The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.