Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.

But thanks to a combination of management incompetence, cord-cutting, and Frontier’s competitors, the phone company’s dreams have turned bad in Connecticut, where the company lost hundreds of millions in the last three years along with at least 22% of its customers in the state. As a result, Frontier has turned a business that made AT&T $1.3 billion four years ago into one that earned Frontier $901.9 million last year.

Hartford Business notes Frontier’s biggest challenge is holding on to customers once they disconnect their landline service. In Connecticut between 2014 and 2016, Frontier lost 154,000 landline customers in the state, leaving just under 522,000 remaining landline customers. That is way down from the 675,000 customers AT&T had just before it sold the service area to Frontier. AT&T struggled with a similar problem, having more than one million landline customers in 2011, according to numbers from Connecticut’s Public Utilities Regulatory Commission (PURA). What made AT&T different is its investment in U-verse — AT&T’s answer to the challenge of lost landline customers. AT&T invested in a new fiber to the neighborhood network to boost broadband speeds and sell television service, giving departing landline customers a reason to continue doing business with AT&T.

For millions of Frontier Communications customers in its “legacy service areas” — owned and operated by Frontier for years, if not decades, those upgrades have been slow to come, if they have come at all. As a result, dropping Frontier service in favor of a wireless or cable company is not a difficult decision for many customers, and cable operators report significant growth where their only competition is DSL service from Verizon or Frontier.

Frontier’s own executives admit broadband upgrades are essential if Frontier is to survive the challenges of landline disconnects.

Customers are increasingly taking a pass on landline service.

“It’s a surprise to no one that we have voiceline declines in Connecticut,” Mark Nielsen, Frontier’s general counsel and executive vice president told the business newspaper. “The challenge is to build our internet and video business so as to offset the declines in voice. We are very committed to the Connecticut operation, we see great potential in it.”

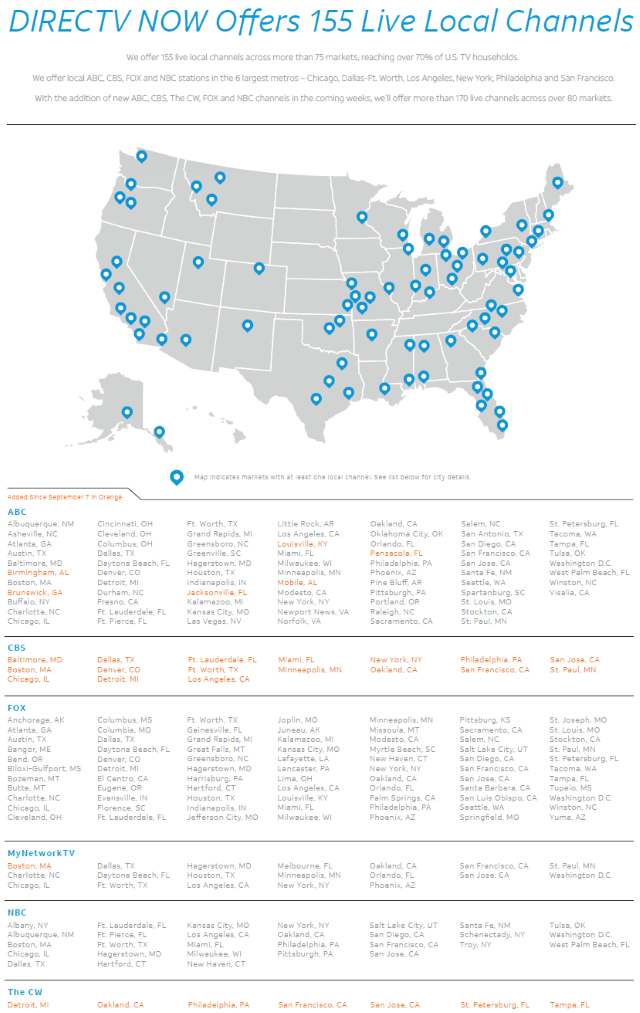

That commitment is coming in the form of internet speed upgrades. Frontier’s primary competitors in the state are cable operators Comcast, Charter, and Cox, some offering speeds as high as a gigabit. Frontier is trying to compete by introducing speeds at or greater than 100Mbps, but so far only in a few parts of the state.

According to Nielsen, Frontier’s profitability is less important to investors than maintaining positive cash flow, which means assuring more money is coming into the operation than going out.

“Cash is what’s available to make investments to return capital to shareholders,” Nielsen said.

But that represents a conflict for Frontier, because many shareholders are attracted to the stock’s long history of returning money to shareholders in the form of dividend payouts. If Frontier has to invest more of its capital on upgrades and network upkeep, that can result in a dividend cut, which usually causes the share price to decline, sometimes dramatically. If Frontier can manage to invest less and cut costs, that frees up more money that can be paid to investors.

For the past several years, Frontier’s business plan has been to avoid spending large sums on network upgrades. But the company was willing to spend handsomely to acquire more customers from a three-state deal with Verizon that cost $10.5 billion. Frontier’s acquisition of Verizon landline customers in Florida, California, and Texas made sense for many shareholders because it would dramatically increase the number of customers served by Frontier, and that in turn would boost revenue and cash flow, from which Frontier’s dividend to shareholders would be paid. Frontier acquired a fiber rich, FiOS service area in all three states, which automatically meant the company would not need to undertake its own significant and costly upgrades.

But Frontier did have to transfer its newest customers from Verizon’s systems to those operated by Frontier. If a company spends enough time and money to protect customer data during such “flash cutovers,” they are usually successful. A company that attempts it without careful planning causes service to be disrupted, sometimes for weeks, which is exactly what happened after Frontier switched customers in the three states to its systems. Customers have never forgotten, and have left every quarter since the deal was first announced.

Financial analysts see where this is headed.

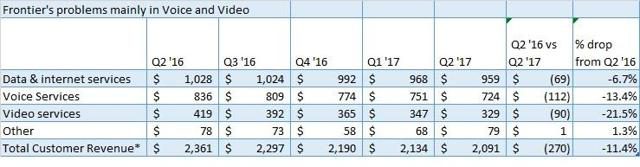

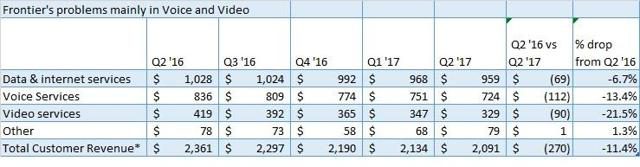

“Each and every quarter their revenues decline, and each and every quarter their customer totals decline,” David Burks, a financial analyst at Hilliard Lyons, told the newspaper. He called Frontier a company that is struggling. He added Frontier needs to stem revenue erosion. He downgraded Frontier’s stock last month after the company reported a second-quarter net loss of $662 million. He could not ignore what he called “disturbing trends,” such as an 11.5 percent year-over-year decline in total customers across Frontier’s entire operation.

To win new customers Frontier must improve its network with upgrades that will cost the company billions — spending that is certain to affect Frontier’s shareholder dividend. Even if it does spend money to upgrade, some analysts are wondering whether it is too late.

“The time to play catch up has passed, given the time to market advantage that cable has, and we expect continued pressures from cable as DOCSIS 3.1 steps up the speed advantage that cable already enjoys,” wrote Jeffries in a a report written about by FierceTelecom. “In our view, it is far too late for the ILECs to ramp spend to compete, particularly given high leverage and the significant cost required to expeditiously play catch up.”

U.S. cell phone providers are facing increasing criticism they are dragging their feet on restoring cell service in Puerto Rico while Mexican-owned Claro has now successfully restored service in 28 of the territory’s 78 municipalities.

U.S. cell phone providers are facing increasing criticism they are dragging their feet on restoring cell service in Puerto Rico while Mexican-owned Claro has now successfully restored service in 28 of the territory’s 78 municipalities.

Subscribe

Subscribe Less than a decade ago, AT&T was one of El Paso’s largest private employers, with 2,400 employees. Next month, it will be a shadow of its former self with fewer than 500 local workers after a series of layoffs and call center closures.

Less than a decade ago, AT&T was one of El Paso’s largest private employers, with 2,400 employees. Next month, it will be a shadow of its former self with fewer than 500 local workers after a series of layoffs and call center closures. The union reports the annual salaries for those jobs ranged from $32,000 to $65,000 per year, plus commissions and health and retirement benefits. Offshore customer care centers pay a fraction of those salaries and many third-party contractors do not pay benefits because they designate many employees as part-time workers.

The union reports the annual salaries for those jobs ranged from $32,000 to $65,000 per year, plus commissions and health and retirement benefits. Offshore customer care centers pay a fraction of those salaries and many third-party contractors do not pay benefits because they designate many employees as part-time workers. Despite claims from some industry-backed researchers and former members of Congress that Net Neutrality

Despite claims from some industry-backed researchers and former members of Congress that Net Neutrality

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.

Frontier Communications spent $2 billion in 2014 to purchase AT&T’s Connecticut wireline business, believing it could make a fortune selling internet and cable television service to wealthy Nutmeg State residents over a network AT&T upgraded to fiber-to-the-neighborhood service several years earlier.