AT&T has begun sending out warnings to wireless customers deemed to be using too much of their “unlimited data plans” and are now subject to speed throttling that will reduce their wireless Internet experience to one more familiar for dial-up users.

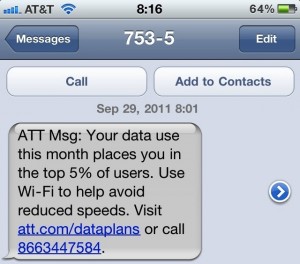

Life in the slow lane is the price AT&T customers pay for being a member of the Top 5% Data User Club. Running the numbers, that means using more than around 4GB of wireless usage per month. One customer who managed to rack up 11GB in September, even before the new speed throttle plan took effect Oct. 1, has already found himself in the speed reduction doghouse with a warning message he received Sept. 29.

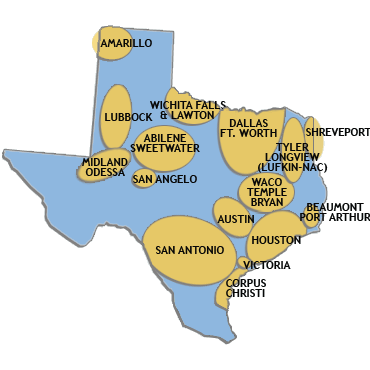

Although the customer did not reveal what he was doing to achieve 11GB of usage in one month, the two most common ways to run up usage are watching a lot of streamed video or using your phone to tether to other wireless devices, especially laptops. Some wireless customers are attempting to use their unlimited data plans as a home broadband replacement, especially in rural areas where cable or DSL service is not available. That’s an option AT&T doesn’t seem to want customers to consider.

In addition to eliminating unlimited use plans for new customers more than a year ago, the company has increasingly cracked down on existing customers grandfathered into unlimited use plans. In addition to banning third party tethering apps, AT&T is now simply reducing speeds for heavy users to make high bandwidth applications like video and even some forms of streaming audio impossible when residing in the penalty box.

But don’t worry: you can still use your data plan to read e-mail or browse simple web pages. The company also advises customers can use unlimited amounts of Wi-Fi, whether they provide it or not.

Subscribe

Subscribe