AT&T customers are getting no bars in more places in the state of Connecticut as the wireless company deals with 150-200 cell towers that are either without power or were damaged by a weekend storm that brought more than 20 inches of snow to some parts of New England. But some customers are questioning why AT&T has suffered damage to their cell tower network while other carriers report no significant damage at all.

AT&T customers are getting no bars in more places in the state of Connecticut as the wireless company deals with 150-200 cell towers that are either without power or were damaged by a weekend storm that brought more than 20 inches of snow to some parts of New England. But some customers are questioning why AT&T has suffered damage to their cell tower network while other carriers report no significant damage at all.

“As of Wednesday afternoon, we still have no AT&T wireless service and it takes miles of driving to find a cell tower that is still working,” reports Sam, a Stop the Cap! reader outside of Hartford. “My friends’ Verizon Wireless and Sprint phones work as if the storm never happened. In fact, I can’t find any Verizon customer who is impacted by the storm, but that’s sure not true with AT&T.”

On Sunday, Connecticut Gov. Dannel P. Malloy noted AT&T told state officials that 152 cell towers had been damaged by the storm and that cell phone service would likely be disrupted in some portions of the state for some time to come. But Verizon Wireless reports outside of some power outages, they sustained absolutely no damage to any of their towers and backup generators are expected to provide uninterrupted service even in areas where extended power outages are occurring. A Verizon spokesman reported at least 93 percent of its network was operating as of Tuesday, with most of the sporadic outages due to backup batteries depleting their stored energy before technicians arrive to fire up backup generators.

Sprint also reports only minor interruptions to its service in Connecticut, mostly due to power failures.

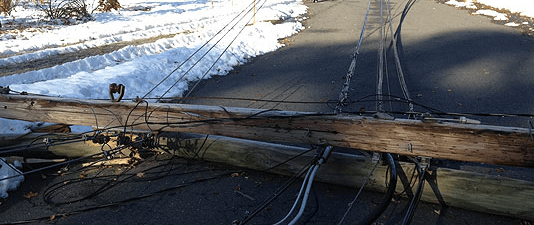

In most cases, extended power interruptions are responsible for cell tower service failure. When power is restored, cell service generally is as well. But this outage proved more extensive because AT&T’s backhaul network between towers and their own facilities was also damaged by falling tree limbs and power poles.

Residents tell the Hartford Courant AT&T has made some progress as the week wears on, with slowly improving service as towers are brought back online.

“We continue to make progress in restoring service to our customers in the wake of the recent snowstorm,” Kate McKinnon, AT&T spokeswoman for the northeast region told the newspaper. “We have deployed generators and crews across the storm-impacted areas and are working around the clock to address service issues. We also continue to work with local Connecticut utility companies as they restore commercial power to affected cell sites and facilities.”

Power utility companies have first priority in service restoration. Connecticut Light & Power reports 77 percent of their customers lost power during the snowstorm. As of this afternoon, at least 544,000 are still waiting for power to be restored.

Subscribe

Subscribe