When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

Most cell phone companies offer insurance plans that often carry expensive monthly premiums and high deductibles, but many also cover the loss or theft of a phone. With independent insurers including Squaretrade taking a bite out of their business, large carriers have been forced to respond with improved plans of their own.

Last week, AT&T quietly launched a new Multi-Device Protection Pack ($30/month) that covers up to three devices (including phones, tablets, laptops) against loss, theft, damage, or out of warranty defects for as long as customers stay enrolled in the plan. The primary limitation: the device must run Windows Vista, OSX, Android or iOS or newer operating systems. Customers can add their two additional devices at any time the insurance is in effect. Asurion provides the coverage and warranty service.

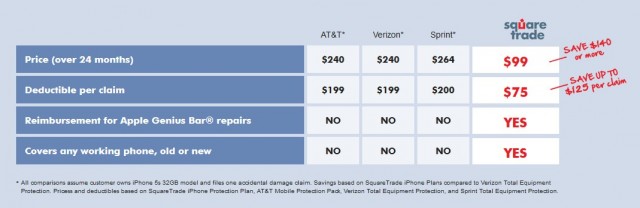

Squaretrade says it offers better value than traditional cell company insurance plans.

AT&T’s $30 a month price tag will seem high when compared against competing offers from Squaretrade running as low as $5 a month per device for up to three years, but AT&T argues its insurance plan covers loss or theft, while Squaretrade does not.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

“Research has shown that people are 10 times more likely to have their phone break due to malfunctions or accidents like drops and spills (which SquareTrade covers better than anyone else) than lose it or have it stolen,” Squaretrade argues. “And yet, loss & theft coverage can cost twice as much as accident protection. Meanwhile, there are free apps to help find your phone if you ever do misplace it.”

Customers who find themselves needing to file a claim will find significant differences between AT&T’s plan and competitors like Squaretrade.

Both charge deductibles, but AT&T’s drops the longer you don’t file a claim. Squaretrade charges a flat $75 deductible after returning your damaged device in a postage-paid box. Many Squaretrade customers report they typically receive reimbursement — not a repaired phone — for the full retail (no-contract) value of the phone, minus the deductible. Most cell company insurance plans send customers a previously refurbished phone of the same or better model.

AT&T’s declining deductible varies depending on the device. For the first six consecutive months without a claim, AT&T charges these deductibles:

- Devices connected to AT&T’s network (phones, 4G-enabled tablets, etc.): $50/125/199 depending on device model;

- Approved repair of a laptop or tablet: $89;

- Replacement of lost/stolen/non-repairable laptop or tablet: $199

After the first six months but less than one year with no claims, customers get a 25% discount on their deductible. After 12 months, the discount increases to almost 50%. There is a limit of six shared claims between all three devices within any consecutive 12-month period with a maximum replacement value of $1,500 per claim. There is a 30-day waiting period before AT&T starts coverage of non-connected devices (laptops, etc.).

AT&T also provides technical support for customers via phone or online chat to set up and back up devices and deal with basic troubleshooting.

There are some devices AT&T won’t cover:

- Galaxy Camera (EK-GC100A)

- Blackberry Playbook

- Phones on GoPhone® accounts

- Tablets with pre-paid data plans

- PlayStation® Vita

- AT&T 3G MicroCell

- Phone or device models not sold by AT&T (e.g., Dell Streak, Google Nexus One, TerreStar Genus)

- Docks (such as for the Motorola ATRIX 4G)

- Amazon Kindle

A complete list of covered devices is available from AT&T’s website and is subject to change.

[flv]http://www.phillipdampier.com/video/ATT Cell Phone Insurance – Multi-Device Insurance Protection from ATT 5-23-14.flv[/flv]

AT&T explains its new Multi-Device Protection Pack, priced at $30 a month, covering up to three devices. (1:35)

Subscribe

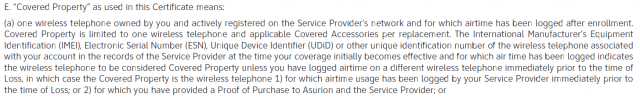

Subscribe If you thought AT&T Mobile Insurance would bring you peace of mind if your expensive smartphone is ever lost, stolen, or damaged, think again.

If you thought AT&T Mobile Insurance would bring you peace of mind if your expensive smartphone is ever lost, stolen, or damaged, think again.

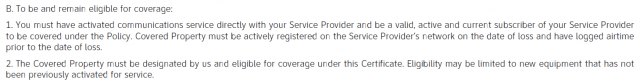

Translation: You have to do something on your carrier’s wireless network after coverage begins for coverage to begin.

Translation: You have to do something on your carrier’s wireless network after coverage begins for coverage to begin.