Despite a significant advertising campaign, Cox’s gigabit Internet service is more a public relations stunt than reality, with only a tiny number of new housing and apartment/condo complexes wired for the fiber to home service.

The high exposure ad campaign doesn’t make sense considering Cox’s new service is available to less than 1% of its customers.

A comprehensive search of addresses actually qualified for Cox’s G1GABLAST tier of service found less than 1% of Cox customers are able to get the gigabit service.

In Irvine, Calif., G1GABLAST is so rare, the Park Place apartments claim exclusivity of the service in the area. A 578-square foot studio apartment with one bedroom and bathroom starts at $1,705 a month, if interested.

Cox has staged press events at the rare locations where the service has turned up in very high-end housing developments in Phoenix, Ariz., with press releases touting the service’s imminent availability in Las Vegas and Omaha, Neb.

The company claims it will make G1GABLAST available to more than 5,000 homes in Phoenix by the end of this year, and has committed to expand that to 150,000 homes by the end of 2015, but there are growing questions whether Cox will meet those targets.

In Phoenix, an Ahwatukee Foothills homeowner was the company’s first residential gigabit subscriber in Arizona. Cox began rolling the service out in new housing developments where installing fiber is less costly than burying service lines in existing neighborhoods. Now it is focusing on other multi-dwelling units and complexes, and a limited number of existing homes in-between those developments.

In Irvine, Calif., Cox gigabit Internet is available exclusively at one complex – Park Place.

In Scottsdale, the only confirmed site where Cox offers gigabit service is the barely finished 440-unit San Travesia Luxury Apartment Complex (rent starts at $1,275 a month for an 815 square foot studio apartment).

G1GABLAST was also confirmed to be available in one extremely wealthy enclave in northwestern Las Vegas, where property values range from $6-50 million. Those who can’t afford that real estate can choose one of a handful of more affordable new housing developments in the area featuring properties valued at $500,000 and up.

The most affordable housing where customers will eventually find G1GABLAST later this spring will be high-end apartment complexes and condos in Omaha, Neb.

Further east, Cox will also be installing gigabit service in the Viridian Reserve at Hickory in Chesapeake, Va. Several hundred homes (starting at $373,000) will be the first in Virginia to qualify for the service sometime this year.

A high-priced publicity campaign for the extremely limited rollout of gigabit service would seem counter-intuitive, unless Cox was seeking an improved image of cable speed competitiveness as new entrants promise and deliver gigabit Internet service around the country. Claiming your company offers 1,000Mbps Internet costs a lot less than actually delivering it.

Subscribe

Subscribe Cox Communications has raised Internet speeds for its economy class customers in Arizona as it continues network enhancements across the state.

Cox Communications has raised Internet speeds for its economy class customers in Arizona as it continues network enhancements across the state.

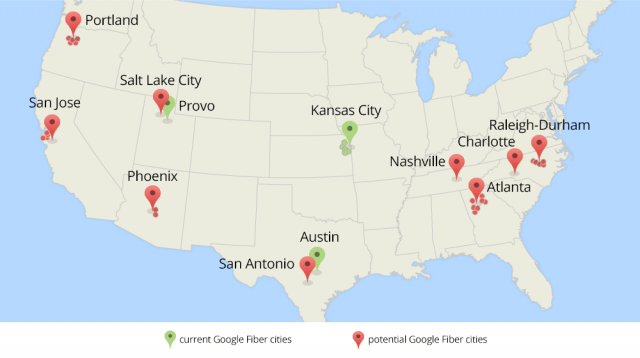

Now that we’ve learned a lot from our Google Fiber projects in

Now that we’ve learned a lot from our Google Fiber projects in