Your credit worthiness now plays a more important factor in determining whether you can sign up for service with Charter Communications, and if you fail to pay the company has stepped up collection efforts to bring past due or canceled accounts up to date.

Your credit worthiness now plays a more important factor in determining whether you can sign up for service with Charter Communications, and if you fail to pay the company has stepped up collection efforts to bring past due or canceled accounts up to date.

Charter Communications reported to investors it lost more than 7,000 video customers during the first quarter of 2015, many lost to the company’s tightened credit policies. Customers with challenged credit will be asked to pay a substantial deposit before cable service will be provided and those who lost service will have to bring their accounts current before service can be restored.

Thomas Rutledge, CEO of Charter Communications, told investors on the company’s quarterly conference call Charter could no longer depend on picking up video customers that used to steal analog cable service. Charter largely terminated analog service last year, forcing unauthorized customers to subscribe legally or find another provider.

Rutledge

Charter is hoping its new Spectrum Guide software, now being tested, will help improve video service for customers. The new cloud-based user interface is supposed to make search and discovery easier and better supports Charter’s on-demand video offerings. Spectrum Guide is expected to launch in Reno and St. Louis in the next few months.

“Over the coming months, we’ll increase the number of on-demand titles we have on our set-top boxes and on the Charter TV app by a factor of three,” said Rutledge. “The coming months will also see the wider rollout of our Worldbox, our new more advanced and less expensive downloadable security infrastructure in several markets.”

Rutledge emphasized Charter intends to continue emphasizing its full video packages and will not follow others testing slimmed down packages and a-la-carte channel selection. Rutledge told investors he doubts any of the current lower-priced packages with fewer TV channels will prove compelling to customers.

Charter’s chief financial officer reported Charter spent $23 million on transition costs related to the company’s failed deal with Comcast to spin off certain customers to a new entity – GreatLand Connections, which has since been terminated. That contributed to an increase in the company’s expenses, joined by increasing cable programming costs.

Rutledge called the Comcast transaction “distracting” and its all-digital conversion project “very disruptive” to customers.

“I guess when you think about our incentives as a company, our biggest opportunity was the transaction that was in front of us,” Rutledge said. “We were about to divest 40% of our business. And so, our focus was somewhat distracted. But all in all, the operational issues of changing – credit policies changing year-over-year, outcomes as a result of the termination of the all-digital project and the management of the service issues around the all-digital project, we’re comfortable with where we are, and we are comfortable with our growth prospects for the year.”

Subscribe

Subscribe

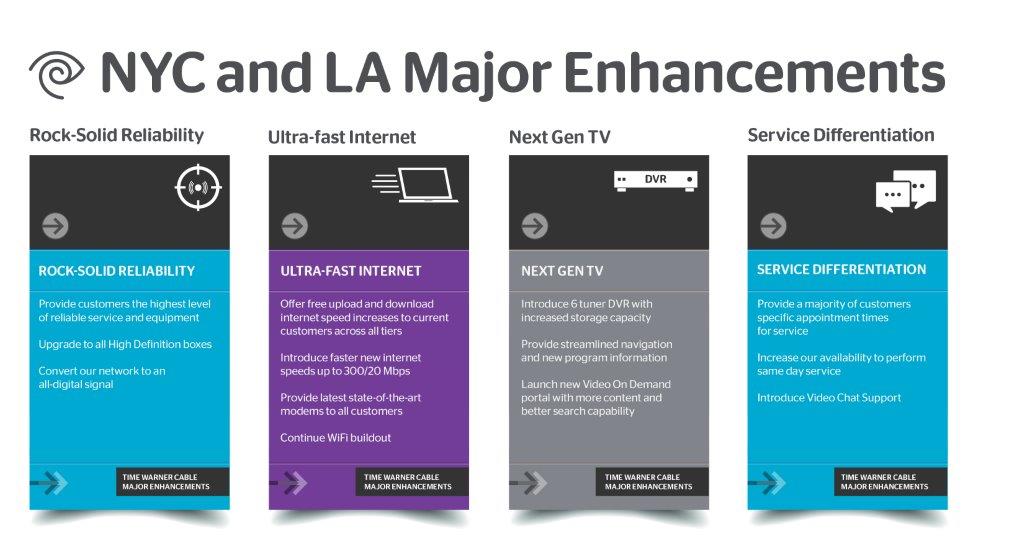

“I think its to early to say how its going to impact the traditional world,” Williamson said in response to a question about whether Boxless Homes will replace traditional MPEG-2 services or augment them. “Currently we don’t even market it or tell anyone about it. The IP video stuff has rolled out word of month. These are the early adopters who are understanding that there’s a TWC app that goes on the Roku box. They decide to go down to their kid’s room or somewhere else and make that their secondary outlet. That’s how it’s evolving now. I think as it gets more and more prevalent and we get on more and more devices, which is going to take time, then its going to be more interesting. Our app on Samsung TV is much closer to our same look and feel as on our se-sop box. Unfortunately these are the real high-end Samsung TVs with the smart hub technology and things like that. There’s not enough of them to understand what the impact is on our footprint.”

“I think its to early to say how its going to impact the traditional world,” Williamson said in response to a question about whether Boxless Homes will replace traditional MPEG-2 services or augment them. “Currently we don’t even market it or tell anyone about it. The IP video stuff has rolled out word of month. These are the early adopters who are understanding that there’s a TWC app that goes on the Roku box. They decide to go down to their kid’s room or somewhere else and make that their secondary outlet. That’s how it’s evolving now. I think as it gets more and more prevalent and we get on more and more devices, which is going to take time, then its going to be more interesting. Our app on Samsung TV is much closer to our same look and feel as on our se-sop box. Unfortunately these are the real high-end Samsung TVs with the smart hub technology and things like that. There’s not enough of them to understand what the impact is on our footprint.” Charter Communications’ march to all-digital service is one big Excedrin headache for many of the communities enduring the cable company’s conversion.

Charter Communications’ march to all-digital service is one big Excedrin headache for many of the communities enduring the cable company’s conversion. Only recently, Charter notified customers they also planned to encrypt the basic lineup, rendering the digital televisions useless without the additional cost and inconvenience of installing Charter’s digital set-top boxes. Although Charter will temporarily offer customers free rental of the boxes, after the offer expires, customers will pay Charter $6.99 a month for each box. For some upper end condos, the cost of renting multiple boxes will exceed the cost of the cable TV package.

Only recently, Charter notified customers they also planned to encrypt the basic lineup, rendering the digital televisions useless without the additional cost and inconvenience of installing Charter’s digital set-top boxes. Although Charter will temporarily offer customers free rental of the boxes, after the offer expires, customers will pay Charter $6.99 a month for each box. For some upper end condos, the cost of renting multiple boxes will exceed the cost of the cable TV package.

Set-top box-less Time Warner Cable subscribers in parts of New York City will find more than 90 percent of the basic cable lineup missing from their QAM-equipped televisions as the cable company completes a transition away from analog cable television and begins encrypting almost all its digital channels.

Set-top box-less Time Warner Cable subscribers in parts of New York City will find more than 90 percent of the basic cable lineup missing from their QAM-equipped televisions as the cable company completes a transition away from analog cable television and begins encrypting almost all its digital channels.