A Verizon executive told investors there is no wireless spectrum shortage in the United States and Verizon has historically purchased and warehoused spectrum it had no intention of using immediately.

Fran Shammo, chief financial officer of Verizon Communications, drew attention to Verizon’s controversial spectrum acquisition policy as part of a conversation with investors about the recent FCC auction that sold 65 megahertz of wireless frequencies for an unprecedented $44.9 billion, far and away the highest ever seen in a spectrum auction.

“In every purchase of spectrum up to this auction, the scale was that it was more efficient to buy spectrum than it was to build capacity because the scale was spectrum was cheaper to build on capacity,” Shammo said.

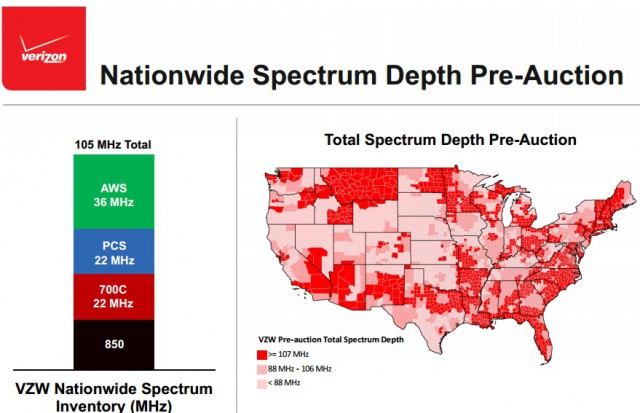

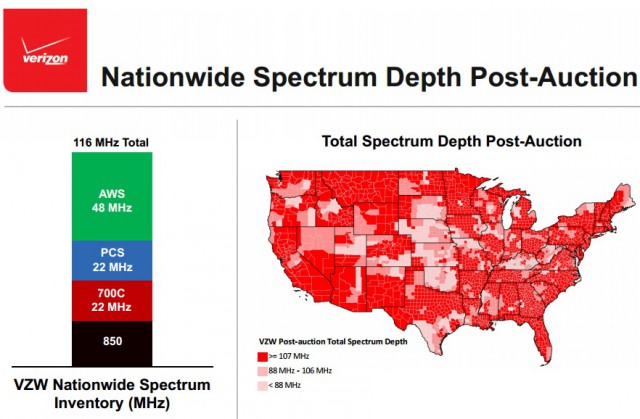

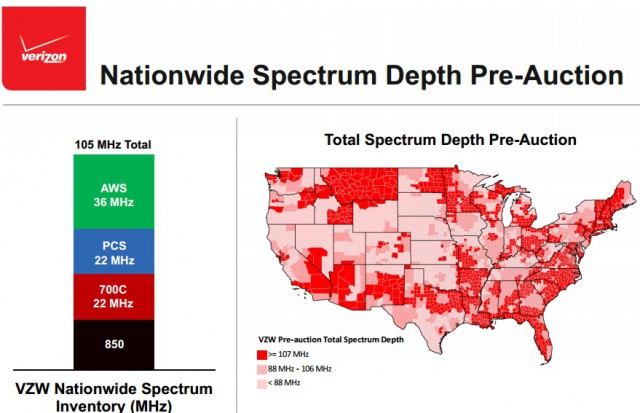

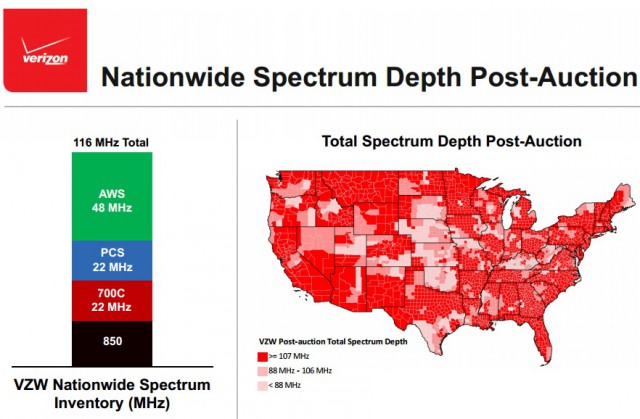

Before the auction, there were significant differences in Verizon Wireless’ network capacity in different cities. In New York City, Verizon controls 127MHz. In Los Angeles and San Francisco it manages with 107MHz, but only has 97MHz to work with in Philadelphia, San Diego and Chicago.

Verizon Wireless has always held spectrum it acquired at auction but never put into widespread use on its network. But bidding during the FCC’s most recent Auction 97 made bidding and warehousing unused frequencies an expensive proposition, more expensive than beefing up Verizon’s existing network with additional cell towers, microcells, and other technology to make the most use of existing spectrum assets.

“This auction flipped [our acquisition] equation in certain markets,” Shammo said in reference to Verizon’s bidding strategy. “And so we became much more diligent on what markets we strategically wanted and [which] we were willing to let go because when you looked at it, if I was to get what I wanted initially when I went in, I would have spent an extra $6 billion when I could create the same capacity with $1.5 billion by building it.”

In the most recent auction, Verizon Wireless considered spectrum acquisitions crucial in California, where it added frequencies in Los Angeles, San Diego and San Francisco. But Verizon gave up bidding on spectrum for densely populated New York and Boston where the asking price grew too high. That forces Verizon Wireless to increase the efficiency of its existing network in those cities. It will do so by deploying more cell towers to divide the traffic load, as well as adding microcells and other small-area solutions in high traffic urban areas.

Despite not getting everything it wanted, Verizon took the auction results in stride, claiming its network was fully capable of handling growing traffic loads even in areas where it failed to win new spectrum.

“People think that spectrum is the Holy Grail and if you don’t have enough spectrum, you can’t have the capacity,” Shammo said. “But actually that’s not true now because technology has changed so much. If you look at small cell technology, diversified antenna systems, and when you think [about] Chicago, if you walk down the street, you see small cells on lamp posts. So, the municipalities are starting to open up to that small cell technology.”

AT&T paid $18.2 billion for nearly 250 licenses, compared with $10.4 billion Verizon will spend on 181 licenses. The presence of Dish Networks in the bidding clearly irritated AT&T and Verizon, primarily because the satellite dish provider incorporated two “designated entities” — SNR Wireless LicenseCo and Northstar Wireless — as bidding partners, winning up to 25% off their bids as part of a “small business discount.” The two DEs won over $13 billion in licenses with $3 billion in savings.

AT&T accused Dish of circumventing auction activity rules and distorting the bidding.

“As a result, Dish the corporate entity won no licenses,” said Joan Marsh, AT&T’s vice president of federal regulatory matters. “The Dish DEs, who each enjoyed a 25% discount, won substantial allocations.”

Marsh complained Dish already controls around 81MHz of spectrum that remains unused for wireless telecom services.

Dish also made life difficult for large carriers who have learned to predict the likely bidding strategies of their competitors based on experience. Many were surprised Dish managed to both bid up prices and win a substantial percentage of spectrum, all for a wireless business it has yet to build.

T-Mobile was not happy either. CEO John Legere called the auction “a disaster for American wireless consumers.” T-Mobile suffered considerably in the auction, outspent by Dish & Friends 132 times for important wireless licenses.

“Three companies alone spent an insane $42 billion between them, grabbing a ridiculous 94 percent of the spectrum sold at this auction,” Legere wrote, referring to AT&T, Dish Network and Verizon Wireless. “This whole thing should scare the hell out of you and every other wireless consumer in the U.S., because there is another important auction next year, and the results have to be different if wireless competition is going to survive.”

With the auction over, Verizon Wireless will continue to shift its spectrum usage around to accommodate network changes. Verizon will continue to emphasize enlarging 4G LTE services while gradually reducing the percentage of its network used for other purposes. Verizon expects to shut off its CDMA voice network in the early 2020s and is reducing the amount of spectrum dedicated to supporting its legacy 3G network.

A week after its deal with Comcast collapsed, Time Warner Cable may be in the buying mood.

A week after its deal with Comcast collapsed, Time Warner Cable may be in the buying mood.

Subscribe

Subscribe

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval.

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval.

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.

Time Warner (Entertainment): Not affiliated with Time Warner Cable, owning Time Warner (Entertainment) would gain Comcast important cable networks like TNT, HBO, and the Warner Bros. studio.