A traditional metrocell, designed to be installed on a utility pole or side of building.

AT&T’s wireless network expansion plans include more than 10,000 new HSPA+/LTE cell sites, 40,000 small “metrocells,” and 1,000 distributed antenna systems (DAS) that will improve network performance, broaden Wi-Fi service, and reduce traffic on its traditional cell tower network.

With much of urban and suburban America (and the roads that connect communities) already covered by cellular networks, AT&T has embarked on an effort to more efficiently manage its wireless traffic.

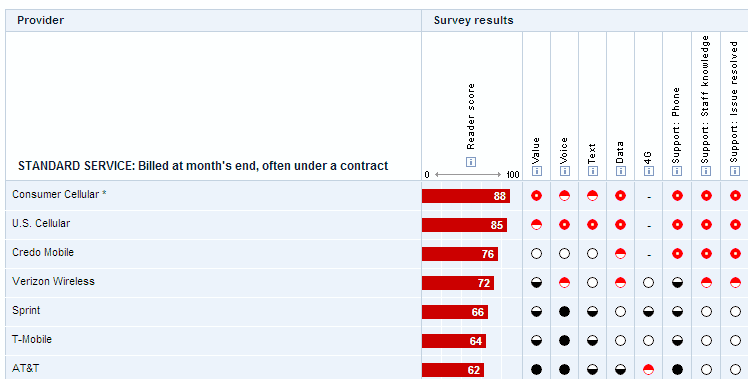

AT&T, the lowest-rated wireless carrier by Consumer Reports, has suffered from a reputation for dropped calls and inadequate network infrastructure investment. The company has sought to correct those mistakes with the implementation of its multi-billion dollar Project Velocity IP (VIP) program that will expand capacity and bring Wi-Fi to new places.

John Donovan, senior executive vice president of AT&T’s Technology and Network Operations division told attendees at the Citi Global Internet, Media & Communications conference in Las Vegas the company was shifting investment towards deploying small cell technology like “metrocells” that provides service to 32 or 64 concurrent users in a small geographic area. These fiber-fed, low-power small cells traditionally cover areas less than 1.2 miles wide, and can be hidden on utility poles or on buildings.

AT&T intends to leverage its U-verse fiber to the neighborhood network to provide much of the expanded network’s backhaul connectivity, at least in cities where AT&T provides landline service.

With an in-house fiber network, AT&T can more cheaply deploy expanded Wi-Fi that will help the company offload cellular data traffic. AT&T says customers will benefit because Wi-Fi use currently does not count against a customer’s monthly data usage allowance. With Wi-Fi accompanying new metrocell and DAS installations, AT&T customers will eventually see a much larger area of Wi-Fi service on their wireless devices, especially in urban areas.

AT&T’s fall announcement of a renewed push for U-verse compliments plans to expand its wireless network. In cities where AT&T is not the landline provider, the company often contracts with other telecom companies to handle traffic to and from cell sites.

Donovan noted a crucial key to the plan’s success is to demand a more seamless transition to and from Wi-Fi from device manufacturers, automatically switching customers off the cellular network in favor of Wi-Fi, where available. At present, customers make the choice. In the future, the device itself could ultimately become the final arbiter, choosing the strongest, most reliable wireless technology available automatically.

The company has not given up on traditional cell tower networks.

AT&T intends to expand its HSPA+ footprint to 300 million homes by the end of 2014. It reaches around 288 million homes at present, with LTE service available to around 170 million. The company intends to provide both its slower HSPA+ and faster LTE 4G service.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Metrocells.flv[/flv]

Alcatel-Lucent is a supplier of metrocell technology and produced this video explaining why offloading network traffic was important, particularly in large congested cities and at major event venues. (2 minutes)

Subscribe

Subscribe