A new research report issued by Time Warner Cable concludes cell phone companies like AT&T and Verizon Wireless cannot meet the future data demands of customers over their 4G LTE wireless networks without punitive usage caps and high fees to deter usage, even with new spectrum becoming available for the wireless industry’s use.

A new research report issued by Time Warner Cable concludes cell phone companies like AT&T and Verizon Wireless cannot meet the future data demands of customers over their 4G LTE wireless networks without punitive usage caps and high fees to deter usage, even with new spectrum becoming available for the wireless industry’s use.

The report, authored by Michael Calabrese of the New America Foundation, finds an answer to this problem in Wi-Fi, which can offload wireless traffic and deliver wireless service customers already prefer:

There is simply not enough exclusively licensed spectrum to meet the rapidly rising demand for wireless data, to sustain a competitive market, and to keep prices at an affordable level.

Major mobile carriers are increasingly coming to grips with this reality. The Wireless Broadband Alliance, a global industry group, reports that Wi-Fi offloading has become an industry standard as “18 of the world’s top 20 largest telcos by revenue have now publicly committed to investing in deploying their own Wi-Fi Hotspot networks.” The industry is shifting steadily toward what it calls heterogeneous networks (HetNets)—i.e., a combination of licensed and unlicensed infrastructure—in order to meet their customers’ insatiable demand for data while keeping costs down.

Alcatel-Lucent forecasts an increase of “87 times [the current] daily traffic on wireless networks” over the next five years, with 50 percent of that traffic on cellular networks “while the remaining 50 percent will be offloaded to Wi-Fi.”

Cisco’s own studies back Calabrese’s findings on consumer preference towards Wi-Fi.

“Given a choice, more than 80 percent of tablet, laptop, and eReader owners would either prefer Wi-Fi to mobile access, or have no preference,” Cisco concluded. “And, just over half of smartphone owners would prefer to use Wi-Fi, or are ambivalent about the two access networks.”

“Given a choice, more than 80 percent of tablet, laptop, and eReader owners would either prefer Wi-Fi to mobile access, or have no preference,” Cisco concluded. “And, just over half of smartphone owners would prefer to use Wi-Fi, or are ambivalent about the two access networks.”

The Cisco surveys found users are choosing Wi-Fi over mobile connectivity for reasons of cost, “because it doesn’t impose data-usage caps or reduce their mobile data plan quotas.” But the primary reason for choosing Wi-Fi “is that respondents find it much faster than mobile networks.” And since Wi-Fi traffic travels over increasingly upgraded wireline networks, that speed differential may only increase as more and more homes, businesses and retail outlets upgrade to fiber optic or other high-speed connections of 100Mbps or more.

America’s largest wireless carriers have fallen far behind offering Wi-Fi services to customers compared to their overseas colleagues:

- AT&T: More than 32,000 Wi-Fi hotspots are available at partnered retail businesses, restaurants, and high-traffic areas like stadiums and major tourist destinations;

- Verizon Wireless: Verizon has an insignificant Wi-Fi presence, with a small number of unadvertised hotspots in selected venues like airports and convention centers;

- Japan’s NTT DOCOMO: Up to 150,000 hotspots, up from only 8,400 in 2o12.

- China Mobile: More than 2 million hotspots are up and running carrying 70 percent of the company’s data traffic.

- France’s Free Mobile: More than 4 million residential hotspots are available through Free’s parent – Iliad.

Comcast could soon be the nation’s largest Wi-Fi hotspot provider.

Calabrese argues it is important for the United States to set aside significant spectrum for unlicensed wireless networks like Wi-Fi to meet future wireless demands. Currently, some Republican members of Congress are opposed to significant spectrum set asides they feel could best be monetized for private use through the spectrum auction process.

It is no coincidence that Calabrese’s findings would be released by Time Warner Cable which itself is growing a Wi-Fi presence in certain cities where it provides cable service.

The wireless carriers’ collective lack of interest in an aggressive nationwide Wi-Fi deployment may have provided a strategic opening for cable operators to fill that gap with Wi-Fi networks of their own. Cable operators consider them a useful tool to retain customer loyalty — access is typically free and unlimited for current customers.

This summer, Comcast announced a “neighborhood hotspot initiative” that will turn millions of customer cable Internet connections into shared Wi-Fi hotspots using a dual-use wireless home gateway. The equipment will offer two separate Wi-Fi signals — one intended for the customer and the other open for use by any Comcast customers in the neighborhood. The cable company will provision extra bandwidth for the open Wi-Fi network to ease concerns that guest users could theoretically slow down a customer’s own Wi-Fi channel. In a relatively short period, Comcast could become the nation’s biggest Wi-Fi network offering more than 20 million hotspots hosted by the company’s own broadband customers.

Calabrese points to the future of seamless transitions between wired, wireless 4G and Wi-Fi network access without dropping calls or data connections. Many customers won’t even know the difference.

The author recommends the FCC think about reserving space for new unlicensed “citizens band” frequencies dedicated for public and private Wi-Fi networks:

- The FCC should reorganize the UHF TV band to ensure the availability of at least 30 to 40MHz of unlicensed spectrum in every media market, perhaps including Channel 37 (now reserved for radio astronomy) and eliminating two dedicated channels reserved for wireless microphones;

- Open the grossly underutilized 3.5–3.7GHz federal band for unlicensed small cell antennas delivering a ‘Citizens Broadband Service.’ This band is now mostly used for offshore naval radar, allowing both services to co-exist without mutual interference;

- Expand unlicensed access to the 5GHz band by allocating the 5.35–5.47 and 5.85–5.925GHz bands providing contiguous, very wide channels useful for the 802.11ac Wi-Fi standard that can support very high-speed wireless services.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/XFINITY Wireless Gateway Powers Connected Home Summer 2013.flv[/flv]

Comcast talks about their new X3 Wireless Gateway which is capable of providing two separate Wi-Fi networks, one for the customer and another for the neighborhood. (2 minutes)

Subscribe

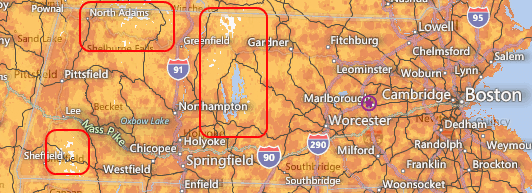

Subscribe A sweeping deregulation measure sponsored by Verizon Communications would end the telephone company’s obligation to provide landline service and remove state-mandated customer quality of service standards in Massachusetts.

A sweeping deregulation measure sponsored by Verizon Communications would end the telephone company’s obligation to provide landline service and remove state-mandated customer quality of service standards in Massachusetts.

With LightSquared’s debt trading at around 50 cents on the dollar, Charlie Ergen went shopping.

With LightSquared’s debt trading at around 50 cents on the dollar, Charlie Ergen went shopping.

A

A  Verizon Wireless discontinued offering unlimited use data plans, but has allowed customers still on those plans to keep them indefinitely. Last year, Verizon Wireless amended its policy for grandfathered unlimited customers denying them access to subsidized, discounted devices unless they switched to a usage-based plan. A website error allowed unlimited customers to bypass a usual restriction requiring them to abandon their unlimited plan to complete the upgrade order. Dozens of customers reported this morning they had received their new phones with unlimited data still intact. With the glitch fixed, customers attempting to upgrade will once again need to give up unlimited data in return for a device discount.

Verizon Wireless discontinued offering unlimited use data plans, but has allowed customers still on those plans to keep them indefinitely. Last year, Verizon Wireless amended its policy for grandfathered unlimited customers denying them access to subsidized, discounted devices unless they switched to a usage-based plan. A website error allowed unlimited customers to bypass a usual restriction requiring them to abandon their unlimited plan to complete the upgrade order. Dozens of customers reported this morning they had received their new phones with unlimited data still intact. With the glitch fixed, customers attempting to upgrade will once again need to give up unlimited data in return for a device discount. At least one Wall Street analyst agreed with Sprint.

At least one Wall Street analyst agreed with Sprint. If “follow the money” is a maxim in business, then it should come as no surprise Verizon favors the making the bulk of its investments and expansion in its enormously profitable wireless business.

If “follow the money” is a maxim in business, then it should come as no surprise Verizon favors the making the bulk of its investments and expansion in its enormously profitable wireless business.