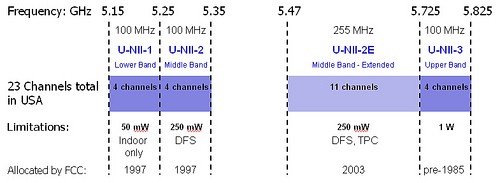

The 5GHz spectrum at issue used to require limited transmitting power and indoor-use only.

The Federal Communications Commission voted unanimously to expand the 5GHz unlicensed Wi-Fi band with an extra 100MHz of spectrum that will open the door to faster connections with less interference.

Manufacturers will also be permitted to raise the transmitting power wireless devices can use in the 5.15-5.25GHz band, lifting restrictions that were in place to protect mobile and fixed satellite services that occupy nearby frequencies. The relaxed rules also now permit outdoor use of 5GHz spectrum. Previously only indoor devices were allowed to occupy those frequencies.

“This change will have real impact, because we are doubling the unlicensed bandwidth in the 5 GHz band overnight,” FCC commissioner Jessica Rosenworcel said. “The power of unlicensed goes beyond on-ramps to the Internet and off-loading for licensed [mobile] services,” she said. “It is the power of setting aside more of our airwaves for experiment and innovation without license. It is bound to yield new and exciting developments. It is also bound to be an economic boon.”

Manufacturers are expected to support the extra frequencies and increase transmitting power on the next generation of Wi-Fi equipment likely to be on sale by the end of the year, including more 1Gbps Wi-Fi routers.

Wireless ISPs will also be permitted to use the 5GHz spectrum to expand available bandwidth for customers as use of the Internet continues to grow. Congestion from shared Wi-Fi connections can present problems for small wireless providers because connection speeds will slow for customers.

The FCC also opened up an extra 65MHz of spectrum for mobile broadband and other licensed wireless users. The expanded AWS band between 1695-2180MHz will be shared with federal agency users that now occupy some of the frequencies.

Subscribe

Subscribe CenturyLink’s philosophy about offering gigabit fiber broadband speeds in Idaho can be summed up simply as “for business-use only.”

CenturyLink’s philosophy about offering gigabit fiber broadband speeds in Idaho can be summed up simply as “for business-use only.” Idaho could find itself a bystander in the growing movement to deploy gigabit fiber to the premise broadband, despite the fact CenturyLink already has fiber infrastructure available nearby.

Idaho could find itself a bystander in the growing movement to deploy gigabit fiber to the premise broadband, despite the fact CenturyLink already has fiber infrastructure available nearby. Despite the fact cable companies routinely claim customers don’t want or need gigabit broadband speeds, property developers seeking an edge in the real estate market do.

Despite the fact cable companies routinely claim customers don’t want or need gigabit broadband speeds, property developers seeking an edge in the real estate market do. MDG is branding the fiber service as ULTRAFi. It will be accompanied by a gigabit Wi-Fi network accessible throughout the community. In addition to providing fast broadband, the service will include home automation and security services.

MDG is branding the fiber service as ULTRAFi. It will be accompanied by a gigabit Wi-Fi network accessible throughout the community. In addition to providing fast broadband, the service will include home automation and security services. Bright House president Nomi Bergman acknowledged the project is a special deal with MDG and it will be years before average consumers need anything close to gigabit broadband speeds. Bergman said there is insufficient demand to justify upgrading Bright House Networks’ broadband speed offerings to other customers.

Bright House president Nomi Bergman acknowledged the project is a special deal with MDG and it will be years before average consumers need anything close to gigabit broadband speeds. Bergman said there is insufficient demand to justify upgrading Bright House Networks’ broadband speed offerings to other customers. A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings.

A Wall Street research firm is asking questions about the “mixed messages” AT&T is sending consumers over its broadband offerings. AT&T says it intends to boost part of its Project VIP footprint to 75Mbps or 100Mbps with VDSL2 vectoring, but the extent of this is unknown. It has also deployed a small amount of GPON FTTH in greenfield markets, typically designed to support 80–100Mbps to each household. Also as part of Project VIP, it plans to reach 1 million businesses with symmetric 1Gbps FTTH.

AT&T says it intends to boost part of its Project VIP footprint to 75Mbps or 100Mbps with VDSL2 vectoring, but the extent of this is unknown. It has also deployed a small amount of GPON FTTH in greenfield markets, typically designed to support 80–100Mbps to each household. Also as part of Project VIP, it plans to reach 1 million businesses with symmetric 1Gbps FTTH. Cincinnati Bell is an island in the middle of a sea of AT&T — offering over 258,000 southwestern Ohio residents and businesses access to a fiber to the home network that has kept customer disconnects down and broadband speeds up.

Cincinnati Bell is an island in the middle of a sea of AT&T — offering over 258,000 southwestern Ohio residents and businesses access to a fiber to the home network that has kept customer disconnects down and broadband speeds up. The company has plans to bring Fioptics to 35 percent of Cincinnati by the end of this year, according to Leigh Fox, chief technology officer for Cincinnati Bell. The company has successfully upgraded its fiber network to offer 53,000 more homes a fiber alternative to Time Warner Cable during the first nine months of this year. At least 29 percent of Cincinnati residents have cut Time Warner Cable’s cord at least once, trying the fiber to the home service.

The company has plans to bring Fioptics to 35 percent of Cincinnati by the end of this year, according to Leigh Fox, chief technology officer for Cincinnati Bell. The company has successfully upgraded its fiber network to offer 53,000 more homes a fiber alternative to Time Warner Cable during the first nine months of this year. At least 29 percent of Cincinnati residents have cut Time Warner Cable’s cord at least once, trying the fiber to the home service.