To many, Provo, Utah might seem an unusual choice to follow on the heels of Google’s earlier announcement its gigabit fiber network was headed to Austin, Tex.

To many, Provo, Utah might seem an unusual choice to follow on the heels of Google’s earlier announcement its gigabit fiber network was headed to Austin, Tex.

Provo is only the third largest community in Utah — Salt Lake City and West Valley City are bigger — and the community already has a fiber network called iProvo. So why build another one?

Google won’t have to.

But first some background:

iProvo was envisioned a decade ago as a public-private partnership — a fiber to the home network owned by the public with private service providers using it to sell broadband and other services . iProvo taught an early lesson about municipal broadband — large cable and phone companies routinely boycott participation in any network they do not own and control themselves.

In 2003, the president of Qwest’s Utah division made clear their intentions: “Fiber optic’s capabilities are way more than what most consumers need in their homes. Why provide a Rolls Royce when a Chevrolet will do?”

Comcast, the dominant local cable operator, also “went ballistic” according to former mayor Lewis Billings.

iProvo can be yours for just $1.

“One hired a PR firm and a telemarketing company to make calls to citizens,” Billings recalled. “They also placed full-page ads and ultimately hired people to picket City Hall. It was a bruising fight. My favorite picket sign had a piece of telephone wire taped to it and read that I and one of my key staff members were, ‘a Twisted Pair.’”

With both Qwest and Comcast wanting nothing to do with the project, smaller independent ISPs had to fill the gap. It was a difficult sell, particularly because Qwest and Comcast blanketed Provo residents with a misinformation campaign about the network and pitched highly aggressive retention offers to keep customers with the phone and cable company. iProvo has been in financial distress ever since.

Former Provo city councilwoman Cynthia Dayton remembers being on the council when iProvo was approved and believes the public-private network was a decade before its time.

“Ten years ago it was worth the vote on iProvo,” she told the Daily Herald. It was one of the most difficult decisions but it was for the future.”

More than a year ago, Google noticed the city of Provo issued a request for proposals on what to ultimately do with iProvo.

Google became interested because Provo is seen as a city with hundreds of technology start-up companies and maintains a vibrant tech hub. The city also ranked highly for the enormous value it places on connectivity and community — something the approval and construction of iProvo demonstrated.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Provo Google Fiber 4-13.mp4[/flv]

Why Provo? Google considers the city’s rankings. (1 minute)

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

Val Hale, President of the Utah Valley Chamber of Commerce, said a quick “back of the envelope” estimate put Google’s anticipated investment in iProvo network upgrades at $18 million, according to the Deseret News. Unfortunately, taxpayers will still need to pay off about $40 million in bonds the city accumulated for iProvo’s initial construction costs.

Curtis

Current Mayor John Curtis says he has made the best out of a difficult situation.

“We have maximized what we have here today,” said Curtis. “It’s about maximizing what we have. I believe in the long-term it will pay dividends many times greater than what we paid into it, but it’s going to take a while to realize that dream.”

Google promised free gigabit Internet service to 25 local public institutions including schools, hospitals, and libraries. Residential customers will be expected to pay $70 a month for 1,000Mbps service or get 5Mbps broadband service for free up to seven years.

Google’s investment in Provo is anticipated to be far lower than in Austin and Kansas City — cities where it needs to build a considerable amount of fiber infrastructure from scratch. With existing fiber already in place in Provo, Google’s gigabit service will be available by the end of this year, at least six months faster than in Austin.

With reduced construction costs, Google will only ask new customers for a $30 activation fee, far less than the $300 Google will ask Austin and Kansas City residents to pay if they do not sign a multi-year service contract or only want basic 5Mbps service.

Google sees the opportunity to use its fiber network in an ongoing effort to embarrass other broadband providers into investing in speed upgrades.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/KSL Salt Lake City Google Fiber Coming to Provo 4-17-13.flv[/flv]

KSL in Salt Lake City reports Google Fiber is coming to Provo. Last year Google began talking with the city to acquire its iProvo municipal fiber network. (3 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/KSTU Salt Lake City Google Fiber coming to Provo 4-17-13.flv[/flv]

KSTU in Salt Lake City reports taxpayers are still on the hook for around $40 million in bond payments to cover the construction costs of iProvo. But Google Fiber will stop other Internet providers from “cheating everyone” says one local Provo resident. “[Other ISPs] give you the slowest connection possible and charge you a ridiculous amount for it,” said Haley Cano. (4 minutes)

[flv width=”480″ height=”380″]http://www.phillipdampier.com/video/KTVX Salt Lake City Google Fiber in Provo 4-17-13.mp4[/flv]

KTVX in Salt Lake had some trouble navigating the difference between a gigabit and a gigabyte, and confused what Google services will be sold and which will be available for free in this report, but the ABC affiliate covered the unveiling with both city and Google company officials on hand. (2 minutes)

[flv width=”480″ height=”380″]http://www.phillipdampier.com/video/KTVX Salt Lake City Google Fiber Details in Provo 4-18-13.mp4[/flv]

This morning, KTVX did a better job in this interview with the mayor of Provo and Google’s Matt Dunne, who says Google believes speed matters and current ISPs simply don’t offer enough. A key factor to attract Google’s interest is a close working relationship with the cities that want the service. (2 minutes)

Subscribe

Subscribe Provo, Utah will be the third city in the country to get Google’s gigabit fiber network, in part because fiber infrastructure installed by a defunct provider that ran into money problems is now likely available for Google’s use.

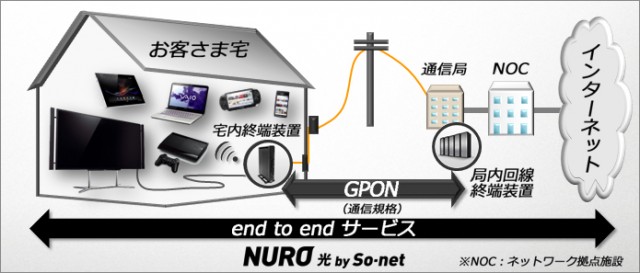

Provo, Utah will be the third city in the country to get Google’s gigabit fiber network, in part because fiber infrastructure installed by a defunct provider that ran into money problems is now likely available for Google’s use. Japan has leapfrogged over Google’s revolutionary 1Gbps broadband service with twice the speed for roughly $20 less a month.

Japan has leapfrogged over Google’s revolutionary 1Gbps broadband service with twice the speed for roughly $20 less a month.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Ergen’s vision would include a bundled package of satellite television, broadband wireless Internet and cellular telephone service. Providing suitable wireless broadband Internet in rural areas may be the biggest challenge because of Sprint’s more limited network coverage, but a marketing deal combining satellite television from Dish and Sprint cell phone service would be easier to carry out.

Ergen’s vision would include a bundled package of satellite television, broadband wireless Internet and cellular telephone service. Providing suitable wireless broadband Internet in rural areas may be the biggest challenge because of Sprint’s more limited network coverage, but a marketing deal combining satellite television from Dish and Sprint cell phone service would be easier to carry out.