AT&T Tries to Stomp Out Class Action Rights: Supreme Court Case Could Eliminate Consumer Protections

Back in 2002 Vincent and Liza Concepcion walked into a southern California AT&T Mobility store to purchase new cellphones for themselves. AT&T advertised a buy one, get one “free” offer for cellphones. What AT&T didn’t say was that the family would end up paying more than $30 in hidden sales taxes for both phones.

More than eight years later, that purchase — and the resulting class action lawsuit it launched — threatens to sweep away important consumer protections by letting corporations ban class action cases and curtail Attorneys General from enforcing state consumer protection laws.

Oral arguments in the case AT&T Mobility v. Concepcion were heard before the U.S. Supreme Court last Tuesday in one of the most important consumer protection cases in decades. At issue is this clause, inserted into the Concepcion’s service contract with AT&T that would disallow the family from participating in a class action lawsuit:

“You and AT&T agree that each may bring claims against the other only in your or its individual capacity, and not as a plaintiff or class member in any purported class or representative proceeding.”

That clause clashes with several state laws, California’s included, which basically say consumers cannot be compelled to sign away their basic consumer protection rights. California law also says some contracts can be considered unenforceable ‘if they are built on deception, are too-one sided, or violate broader public policy.’

Hello, AT&T.

Vincent and Liza, through their attorney, argue that bringing an individual lawsuit against AT&T over $30 in sales taxes would be crazy — no lawyer would take the case and no plaintiff would front a retainer well beyond the amount in dispute.

As Justice Ruth Bader Ginsburg wrote in another class action case, “The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.”

The “class action” concept provides at outlet for aggrieved consumers who can attract legal representation if a company can be sued on behalf of every impacted customer. For AT&T, that could mean facing not just the Concepcion family, but millions of Californians — each charged sales taxes for phones the company advertised as “free.”

How AT&T’s Case Has Broadened Into a Major Dispute Over Arbitration vs. Class Action Lawsuits

It's easy to navigate AT&T's terms and conditions to achieve a good outcome from arbitration, right?

But what began as a legal argument over a “free” phone has broadened into a much larger legal case before the Supreme Court: can consumers be compelled to participate in company dispute settlement schemes and give up their legal right to petition the court system for relief? Further, what happens when those contract clauses conflict with state consumer protection laws?

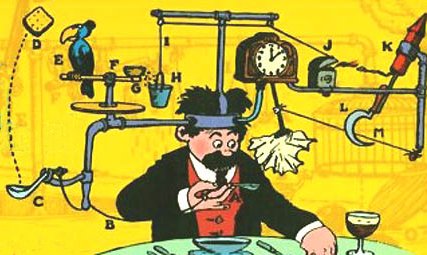

Following in the footsteps of the credit card industry, AT&T inserted a clause mandating customers stay away from class action lawsuits. By telling consumers they are forbidden to participate in such cases, AT&T pushes customers into the murky world of “arbitration” — a system where AT&T picks a private company, with whom it has a financial-business relationship, to “impartially” rule on customer complaints in secret proceedings. Consumers have to pay their own way to attend arbitration hearings, often held in cities a thousand miles away or more. They also must agree the decisions are binding and final.

AT&T argues, both directly and through its dollar-a-holler advocates, that class action cases are annoying, expensive, and do not typically deliver substantial benefits to class members. The wireless carrier argues arbitration of individual cases is much faster and potentially more lucrative to would-be class action members. Stephen J. Ware, a professor of law at the University of Kansas School of Law argues consumers have often done far better avoiding litigation and entering into arbitration programs.

But consumer advocates claim AT&T’s arbitration rules are stacked against consumers. Arthur H. Byrant, executive director of Public Justice argues:

First, AT&T’s “agreement” bars its customers from court (except small claims court) and requires them to utilize the company’s mandatory arbitration program. Its rules say that, if a customer completes the process and recovers more than the last written settlement offer AT&T made before the arbitrator was chosen, a $7,500 premium will be paid. Second, the “agreement” bans AT&T’s customers from bringing or participating in class actions against it. Third, the “agreement” provides that, if AT&T’s class action ban is found to violate the law (as 20 states have held contractual class action bans do when they effectively immunize a company from liability), the arbitration clause “blows up” and the class action must proceed in court. Then, when the class action ban is struck down under state law (as AT&T knew it would be), the company springs its wacky trap: It argues that the Federal Arbitration Act of 1925 (FAA) pre-empts — and invalidates — that state law because (believe it or not) the state law is biased against arbitration.

AT&T’s call for pre-emption suffers from a bad connection. State law is not biased against arbitration. It allows AT&T to resolve disputes in either arbitration or court. Only AT&T’s “agreement” is biased against arbitration. Its “blowup clause” precludes class actions from proceeding in arbitration, but not in court.

<

p style=”text-align: center;”>

Using the scroll bar to the right of the player, move down and click on Attorney Paul Bland’s name and watch him argue forcefully that AT&T’s motives are plain and simple — to allow them to get away with anything they want and not face accountability from the legal system. — “Arbitration is not the Candy Bridge into Rainbow Land.”

Tapping Into Consumer Discontent With Class Action Cases for the Benefit of AT&T

Ask anyone about the merits of most class action settlements and one will often get a response that the lawyers win while consumers lose. Just this week many owners of HP printers will get word a deal has been reached over a class action case involving printer ink. The multiple law firms involved will split not more than $2.9 million under the terms of the proposed settlement. Consumers will get “e-credit” worth $5, $2, or $6 redeemable at HP’s online store, which sells ink cartridges at inflated prices. In effect, HP has little to grumble about delivering “awards” to consumers that ultimately benefit its own enterprise, the only place those awards can be redeemed.

With settlements like that all too common, it is easy for AT&T’s advocates to tap into consumer discontent with class action lawyers, proclaiming AT&T’s case is actually consumer-friendly because it would cut those money-grabbers out of disputes with the company.

But consumer advocates stress class action cases do more than deliver settlements — they deter bad behavior on the part of would-be wrongdoers, bring corporations to account fiscally when they are forced to settle, and open the door to legal discovery which can uncover patterns of extensive wrongdoing that would otherwise remain secret in arbitration.

But most important of all, class actions impact every customer, not just the handful who navigate arbitration to achieve a confidential settlement. That can be critically important to stop unfair business practices.

Of course, reform is also desperately needed in the class action system. Too often, judges approve class action cases that deliver maximum benefits to the law firms that bring them, leaving consumers with peanuts. Strict limits on legal fees recouped in such cases, perhaps tied to a percentage of total recovery would be a start, as are bans on settlements that don’t provide cash refunds to consumers who choose not to conduct further business with companies that abuse them. Coupons, low value trinkets, and donations to third party groups (non-profit or otherwise) are insufficient. Attorneys that selfishly claim most of the proceeds for themselves have only themselves to blame when corporations use that fact against them under so-called “tort reform” proposals.

Some advocates of AT&T’s position also argue that government oversight can provide a more effective system of checks and balances against corporate overreach. While a noble sentiment, anyone who has watched the revolving door of lobbyists going to work for such agencies, later returning to lucrative jobs with the companies they formerly regulated, knows that is a classic case of the fox overseeing the hen house. In an era of government “oversight” that missed everything from BP’s safety lapses, salmonella-infected eggs, produce, and meat, tainted pet food ingredients from China, and indecisiveness about telecommunications reform like Net Neutrality — such proposals are not to be treated seriously.

The Supreme Court Decision

While it will be months before the Court rules, most observers suspect consumers will ultimately win the case. Liberals on the court are skeptical AT&T’s efforts to preempt state consumer protection laws are actually for the benefit of consumers, and some of the most conservative members of the court like Justice Clarence Thomas, big believers in “states’ rights” are likely to find for the Concepcion family.

“Based on what was said during the argument, I predict a 8-1 or 7-2 vote for the consumers and California, with Samuel Alito dissenting and John Roberts a toss up. Thomas, who never speaks at oral argument, will vote for the consumers and state on federalism grounds, as he always does in [arbitration] cases,” writes Lawrence Cunningham, Argument in Class Waiver Case Favors Consumers, States, Concurring Opinions.

“Based on what was said during the argument, I predict a 8-1 or 7-2 vote for the consumers and California, with Samuel Alito dissenting and John Roberts a toss up. Thomas, who never speaks at oral argument, will vote for the consumers and state on federalism grounds, as he always does in [arbitration] cases,” writes Lawrence Cunningham, Argument in Class Waiver Case Favors Consumers, States, Concurring Opinions.

“[I]t doesn’t look as though there are too many votes at the high court to do away with the right of consumers to band together to sue the great American manufacturers of fine print,” said Dahlia Lithwick, Can You Hear Them Now? The Supreme Court reads the fine print on your cell phone contract, Slate.

If these two observers are wrong, it will be open season on consumers who will be forced into arbitration agreements that deliver all of the benefits to companies like AT&T. Under such a scenario, there would be little to dissuade companies from developing new fine print to trick and overcharge consumers. Few will be willing to buy a ticket to fly halfway across the country to sit for arbitration proceedings over a $20 dispute, especially when the arbitration firm’s income depends on fees paid by the very companies that are accused of wrongdoing.

Subscribe

Subscribe