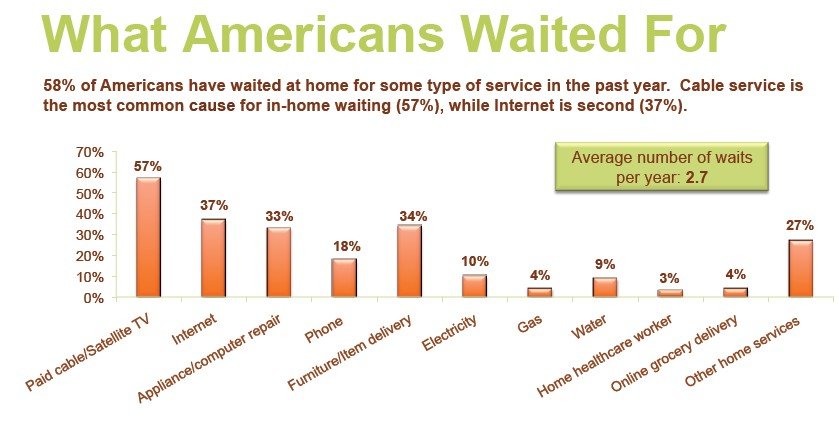

Cable and satellite companies are the worst offenders when it comes to forcing customers to wait around for scheduled service calls, wasting time and money.

Cable and satellite companies are the worst offenders when it comes to forcing customers to wait around for scheduled service calls, wasting time and money.

Who hasn’t taken time off from work for the cable installer or a repair crew, who inevitably arrive just minutes before the end of the six hour “window” the company provided.

Making people sit at home for service calls wastes money — a lot of it. A new study from TOA Technologies found Americans hang out at home an average of 4.3 hours waiting for the cable guy to arrive, much longer than most people think they should have to wait. TOA added up the cost of lost wages and reduced productivity that results when employees are absent — $37.7 billion annually. That works out to an average of two eight-hour working days off a year per person, costing $250 a year.

More infuriating: you find yourself indisposed when the cable crew finally shows up and you can’t reach the door in time before they leave, or the promised visit never materializes. That results in the dreaded “sorry we missed you” sticker attached to your front door and a rescheduled service call, often a week later.

When your cable company is also your Internet Service Provider, it can be double trouble. ISP service calls were the second worst, phone companies fourth.

The cable industry’s lousy reputation among consumers is not lost on them. More than a decade ago, the industry voluntarily offered $20 service credits for late or missed service calls to improve their image. But TOA found the longer companies keep customers waiting, the more likely it is they will consider taking their business elsewhere.

The cable industry’s lousy reputation among consumers is not lost on them. More than a decade ago, the industry voluntarily offered $20 service credits for late or missed service calls to improve their image. But TOA found the longer companies keep customers waiting, the more likely it is they will consider taking their business elsewhere.

With the advent of telephone company competition, customers infuriated by Comcast or Time Warner Cable may decide to switch to Verizon FiOS or AT&T U-verse, or vice-versa. Now the cable industry is back with new ways to placate customers and save everyone time and money. Shortened service call windows and self-install kits are increasingly common ways customers can avoid a day home from work.

Time Warner Cable is one of the cable industry’s most-improved players, reducing waiting windows, calling customers to give them a heads-up when they are on the way, and offering weekend and evening service calls. In upstate New York, Time Warner customers can, in certain circumstances, be given an estimated time of arrival accurate to within 10 minutes.

The 10-minute “Tech on the 10s” program only works on the first scheduled service call of the day. If the cable repairman starts his shift at 9am, the only guaranteed time slot will be from 9-9:10am. Because different technicians start their shifts throughout the day, the company promises that several hundred slots are available each week. If the technician blows it and still arrives late, the customer gets $20 for their troubles.

The company hopes shortening wait windows will give customers fewer reasons to use that time to shop around for a different service provider.

[flv width=”480″ height=”290″]http://www.phillipdampier.com/video/WSYR Syracuse How much does it cost you to wait 11-13-11.mp4[/flv]

WSYR in Syracuse takes a look at the impact of waiting for the cable repair man to show up and what Time Warner Cable is doing about it. (2 minutes)

Subscribe

Subscribe