“If you are a voice copper customer and you call in [with] trouble on your line, when we go out to repair that we are actually moving you to the FiOS product. We are not repairing the copper anymore.” — Fran Shammo, Verizon’s executive vice-president and chief financial officer

“If you are a voice copper customer and you call in [with] trouble on your line, when we go out to repair that we are actually moving you to the FiOS product. We are not repairing the copper anymore.” — Fran Shammo, Verizon’s executive vice-president and chief financial officer

Verizon has declared the end of the copper wire phone line, at least in areas where the company’s companion fiber optic network FiOS is available. Fran Shammo, chief financial officer of Verizon Communications spoke about the death of the copper-based landline and the company’s strategic plans for its wired and wireless networks in the coming quarter at Oppenheimer’s 15th Annual Technology, Internet & Communications Conference last Wednesday.

Verizon’s quiet and involuntary switch-out to fiber service is part of the company’s grander marketing effort to push customers towards upgrading service.

“The benefit we are getting […] if you are a voice customer and we move you to [fiber] we now can upsell you to the Internet,” Shammo explained. “If you come over as a voice and DSL customer and we move you to FiOS, you now are a candidate for the video product. So there is an upsell which is definitely a benefit to this.”

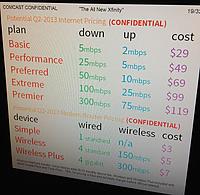

Verizon earlier announced it would no longer sell standalone DSL service to customers, and has stopped selling copper-based DSL products in areas where Verizon FiOS is available. It even discourages customers from considering standalone FiOS broadband, with a budget-busting price of $64.99 for stand-alone 15/5Mbps service with a two-year contract or $69.99 on a month-to-month basis. Verizon offers considerably better value when customers sign up for multiple FiOS services.

Scrap heap

Verizon says the reliability of fiber makes maintaining older copper wire networks pointless.

“The bigger benefit is we are transforming the cost structure of our copper business because the copper fails two to three times more than fiber, which means we have two to three more times we have a tech and a truck rolling out to that copper connection. So we are eliminating that,” Frammo said.

Frammo added decreasing repair and maintenance expenses will help improve profit margins for the company.

Both CEO Lowell McAdam and Frammo have made profit margins a much higher priority for Verizon Communications than ever before.

“If you look at the [landline] side of the business, […] we have made a shift that said we are going to focus more on the profitability of FiOS this year. And that is important for us to do, because we need to generate the cash flow so that we can reinvest in those platforms,” Frammo said. “But I think as an industry as a whole you are seeing a different focus now, that it is more on returns, it is more on profitability. Can that continue? Sure. Obviously, you might have your blips here and there based on how fast something grows in one quarter versus another, but if you look at Verizon Wireless and you look at Verizon we are expanding our margins.”

Frammo addressed several key plans Verizon has for both its wired and wireless businesses, and what political priorities the company has for the rest of the year:

Verizon Wireless’ 4G LTE Network is a Platform for Profits

Shammo told investors Verizon’s 4G LTE platform is now available to 76 percent of its customers in 337 markets. LTE, Shammo said, delivers not only the speed customers want but reduced operating costs for the cell phone provider. But Shammo said that will not bring reduced prices for customers — Verizon intends to use its LTE network as a platform for increasing profitability.

Shammo told investors Verizon’s 4G LTE platform is now available to 76 percent of its customers in 337 markets. LTE, Shammo said, delivers not only the speed customers want but reduced operating costs for the cell phone provider. But Shammo said that will not bring reduced prices for customers — Verizon intends to use its LTE network as a platform for increasing profitability.

“When you take that network and you overlay our shared plan with that and now others are following with that shared plan, the entire industry from a shared perspective has a lot of room for growth because when you think about that network and the speed it provides, and then you take all these devices and you think about the number of tablets that have been sold in the United States that are not connected to a wireless network, you now enable people to connect those devices much easier.

“So when you think about that speed and that price plan that pools those data minutes, the growth profile here is really good for the industry and very, very good for Verizon Wireless because we think we have a strategic lead here.

“We are going to have to wait to see what the usage profile of this is. But can we expand our data, our data pricing? Of course we can, so you just add in more tiers. But that is part of where we think the future is going because when you think about the speeds and the video capability of LTE we do project out that that usage is going to continue to substantially increase which then folks will buy up.

“So it is going to be very, very easy for people to attach devices to just go beyond what we know today as a smartphone, a dongle, or a tablet. Now take it to your car, now take it inside your home for remote medical monitoring or whatever else that can happen in that house. Those can also now be attached to that price plan and everything can run off of that network.”

Frammo also hinted Verizon Wireless may be prepared to bring back an old concept from the days of long distance dialing — peak and off-peak data usage rates. Use Verizon’s network during peak usage periods and the company could charge a premium. But its LTE 4G platform also allows it to offer reduced rates when the network is being used less.

Shammo

Killing Off Your Phone Subsidy One Dollar at a Time

Shammo said Verizon Wireless is moving forward (along with other carriers) to gradually reduce equipment subsidies customers get when they upgrade their phones at contract renewal time. Verizon earlier discontinued customer loyalty discounts like its “New Every Two” plan and has stopped offering early upgrade incentives. Now the company is eliminating subsidies for some customers altogether and won’t offer them on several different types of devices.

“The industry has done a lot around trying to reform the upgrade policies and implement upgrade fees to try to strengthen the financial capability of that subsidy on a smartphone,” Shammo said. “We have also taken the track of not subsidizing tablets, less subsidy on dongles. It really is now all around the attachment of those devices into those price plans.”

Shammo added as competitors reduce subsidies, Verizon can continue to bring them down further over time. Shammo said that will improve the company’s margins.

Verizon Prepaid vs. Contract (Postpaid) Customers: “The religious belief is you can’t do anything that is going to deteriorate the postpaid base.”

Despite the company’s improved margins and declining costs from its 4G LTE platform, Frammo said Verizon has no plans to reduce prepaid pricing, because it could erode revenue from customers on two year contracts who might consider switching to a no-contract, prepaid plan.

“Obviously we are a postpaid carrier so anything we do — the religious belief is you can’t do anything that is going to deteriorate the postpaid base,” Frammo said. “I think people are willing to pay a slight premium to get on [Verizon’s] most reliable network and what we are finding is people are coming to that network. I think at this point we are very, very satisfied with where the prepaid market is. We are a premium to that prepaid market and, based on our growth trajectory right now, we are very comfortable with that price point.”

Verizon’s Political Priority for 2012: Where is our corporate tax cut?

While Shammo would not answer a question about which presidential candidate he feels would best serve Verizon’s interests if elected, Shammo made it clear the company is terrified of a so-called “tax cliff” — the expiration of the Bush-era tax cuts and a capital gains tax increase that would raise taxes on the wealthiest corporations from the current 15 percent to up to 25 percent — still lower than the tax rate paid by many middle class workers.

“Whoever is elected needs to deal with that tax cliff because that tax cliff could be detrimental to the economic performance of the U.S.,” Shammo said. “Then on a longer-term we definitely need corporate tax reform in the United States. We are not competitive with the rest of the world and I think everyone understands that. That is going to be harder to achieve, but I think that Washington understands that there needs to be some change within the corporate tax structure.”

Insiders at the Federal Communications Commission have leaked word all five commissioners have cast their votes in favor of a controversial partnership deal between Verizon Wireless and the nation’s largest cable operators to cross-market products and services to customers.

Insiders at the Federal Communications Commission have leaked word all five commissioners have cast their votes in favor of a controversial partnership deal between Verizon Wireless and the nation’s largest cable operators to cross-market products and services to customers.

Subscribe

Subscribe