Verizon Wireless, facing scrutiny from FCC chairman Thomas Wheeler, today announced it has canceled plans to introduce a new “network optimization” policy that would have significantly throttled down speeds for heavy users still on grandfathered, unlimited use data plans.

Verizon Wireless, facing scrutiny from FCC chairman Thomas Wheeler, today announced it has canceled plans to introduce a new “network optimization” policy that would have significantly throttled down speeds for heavy users still on grandfathered, unlimited use data plans.

Stop the Cap! received a statement from Verizon Wireless this afternoon announcing a sudden change of heart:

Verizon is committed to providing its customers with an unparalleled mobile network experience. At a time of ever-increasing mobile broadband data usage, we not only take pride in the way we manage our network resources, but also take seriously our responsibility to deliver exceptional mobile service to every customer. We’ve greatly valued the ongoing dialogue over the past several months concerning network optimization and we’ve decided not to move forward with the planned implementation of network optimization for 4G LTE customers on unlimited plans. Exceptional network service will always be our priority and we remain committed to working closely with industry stakeholders to manage broadband issues so that American consumers get the world-class mobile service they expect and value.

Chairman Wheeler questioned Verizon’s strategy almost immediately after the company announced its “network optimization” strategy in July.

Wheeler

“‘Reasonable network management’ concerns the technical management of your network; it is not a loophole designed to enhance your revenue streams,” Wheeler wrote in a July 30 letter to Verizon Wireless CEO Dan Mead. “It is disturbing to me that Verizon Wireless would base its ‘network management’ on distinctions among its customers’ data plans, rather than on network architecture or technology.”

Wheeler reminded Mead the FCC defined network management practices to be reasonable “if it is appropriate and tailored to achieving a legitimate network management purpose, taking into account the particular network architecture and technology of the broadband Internet access service.”

Wheeler told Mead Verizon’s plans didn’t qualify.

“I know of no past FCC statement that would treat as ‘reasonable network management’ a decision to slow traffic to a user who has paid, after all, for ‘unlimited” service,'” Wheeler wrote.

Wheeler also questioned how Verizon could justify its planned speed throttling under the conditions it agreed to after winning the 700MHz “C Block.” That spectrum was accompanied by a special FCC mandate – open platform rules which prohibits Verizon Wireless from denying, limiting, or restricting the ability of end users to download and use applications of their choosing on the C Block networks. A speed throttle would make using some applications impossible.

Wheeler also questioned how Verizon could justify its planned speed throttling under the conditions it agreed to after winning the 700MHz “C Block.” That spectrum was accompanied by a special FCC mandate – open platform rules which prohibits Verizon Wireless from denying, limiting, or restricting the ability of end users to download and use applications of their choosing on the C Block networks. A speed throttle would make using some applications impossible.

In August, Wheeler hammered home his opposition to Verizon’s plans at a news conference.

“My concern in this instance–and it’s not just with Verizon, by the way, we’ve written to all the carriers–is that [network management] is moving from a technology and engineering issue to a business issue, such as choosing between different subscribers based on your economic relationship with them.”

Wheeler has expressed irritation that Verizon’s justification for congestion management only applied to its unlimited customers, while those paying on a per-gigabyte basis could use (and spend) as much as they like.

Verizon responded that other providers — notably AT&T — already have a similar network management policy in place, throttling speeds of grandfathered unlimited customers who consume more than 3GB of wireless traffic on its 3G network or 5GB on its 4G network a month.

“‘All the kids do it’ was never something that worked with me when I was growing up and didn’t work with my kids,” Wheeler responded, noting Verizon was trying to reframe the issue instead of justifying the need for speed throttles for some customers, while giving others unlimited access as long as they pay.

Subscribe

Subscribe

Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans.

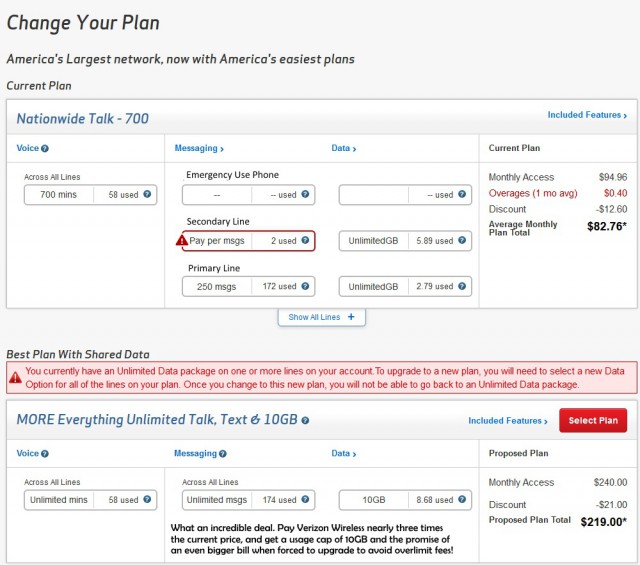

Verizon Wireless and AT&T have invested billions expanding and improving their wireless networks, telling investors that revenue from exploding wireless data usage would more than recoup their investments, but the growing availability of low-cost and free Wi-Fi is threatening to derail those plans. AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi.

AT&T and Verizon hoped customers would face upgrades to more costly plans with more generous usage allowances as data usage increased. Early efforts to monetize data usage seemed encouraging. Both carriers reported surprising success from in-store marketing efforts to push families to upgrade to deluxe 10GB+ usage plans in larger numbers than anticipated. But customers are now increasingly trying to stay within their budget and current usage allowance, with the help of Wi-Fi. Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable.

Their latest plan is to push the “Internet of Things” — machine to machine communications. Both AT&T and Verizon have invested heavily in wireless utility meter technology and are pushing manufacturers to add 4G capability to all sorts of home appliances from refrigerators, ovens, and dishwashers to home laundry centers, alarm systems, and even pet-webcams. But early efforts have not been promising. Reception in fixed indoor locations, especially basements, is often very poor to non-existent, and manufacturers don’t see much benefit adding mobile network connectivity when traditional Wi-Fi is cheaper and much more reliable. Verizon Wireless is closing several loopholes that customers have used to acquire new subsidized, on-contract smartphones and keep their unlimited data plans intact for an extra two years.

Verizon Wireless is closing several loopholes that customers have used to acquire new subsidized, on-contract smartphones and keep their unlimited data plans intact for an extra two years.