Despite endless panic about spectrum shortages and data tsunamis, even more evidence arrived this week illustrating the wireless industry and their dollar-a-holler friends have pushed the panic button prematurely.

The usual suspects are at work here:

- The CTIA – The Wireless Association is the chief lobbying group of the wireless industry, primarily representing the voices of Verizon, AT&T, Sprint, and T-Mobile. They publish regular “weather reports” predicting calamity and gnashing of teeth if Washington does not immediately cave to demands to open up new spectrum, despite the fact carriers still have not utilized all of their existing inventory;

- Cisco – Their bread is buttered when they convince everyone that constant equipment and technology upgrades (coincidentally sold by them) are necessary. Is your enterprise ready to confront the data tsunami? Call our sales office;

- The dollar-a-holler gang – D.C. based lobbying firms and their astroturf friends sing the tune AT&T and Verizon pay to hear. No cell company wants to stand alone in a public policy debate important to their bottom line, so they hire cheerleaders that masquerade as “research firms,” “independent academia,” “think tanks,” or “institutes.” Sometimes they even enlist non-profit and minority groups to perpetuate the myth that doing exactly what companies want will help advance the cause of the disenfranchised (who probably cannot afford the bills these companies mail to their customers).

Tim Farrar of Telecom, Media, and Finance Associates discovered something interesting about wireless data traffic in 2012. Despite blaring headlines from the wireless industry that “Consumer Data Traffic Increased 104 Percent” this year, statistics reveal a dramatic slowdown in wireless data traffic, primarily because wireless carriers are raising prices and capping usage.

The CTIA press release only quotes total wireless data traffic within the US during the previous 12 months up to June 2012 for a total of 1.16 trillion megabytes, but doesn’t give statistics for data traffic in each individual six-month period. That information, however, can be calculated from previous press releases (which show total traffic in the first six months of 2012 was 635 billion MB, compared to 525 billion MB in the final six months of 2011).

Counter to the CTIA’s spin, this represents growth of just 21 percent, a dramatic slowdown from the 54 percent growth in total traffic seen between the first and second half of 2011. Even more remarkably, on a per device basis (based on the CTIA’s total number of smartphones, tablets, laptops and modems, of which 131 million were in use at the end of June), the first half of 2012 saw an increase of merely 3 percent in average wireless data traffic per cellphone-network connected device, compared to 29 percent growth between the first and second half of 2011 (and 20-plus percent in prior periods).

[…] What was the cause of this dramatic slowdown in traffic growth? We can’t yet say with complete confidence, but it’s not an extravagant leap of logic to connect it with the widely announced adoption of data caps by the major wireless providers in the spring of 2012. It’s understandable that consumers would become skittish about data consumption and seek out free WiFi alternatives whenever possible.

Cisco helps feed the flames with growth forecasts that at first glance seem stunning, until one realizes that growth and technological innovation go hand in hand when solving capacity crunches.

The CTIA’s alarmist rhetoric about America being swamped by data demand is backed by wireless carriers, at least when they are not talking to their investors. Both AT&T and Verizon claim their immediate needs for wireless spectrum have been satisfied in the near-term and Verizon Wireless even intends to sell excess spectrum it has warehoused. Both companies suggest capital expenses and infrastructure upgrades are gradually declining as they finish building out their high capacity 4G LTE networks. They have even embarked on initiatives to grow wireless usage. Streamed video, machine-to-machine communications, and new pricing plans that encourage customers to increase consumption run contrary to the alarmist rhetoric that data rationing with usage caps and usage pricing is the consequence of insufficient capacity, bound to get worse if we don’t solve the “spectrum crisis” now.

So where is the fire?

AT&T’s conference call with investors this week certainly isn’t warning the spectrum-sky is falling. In fact, company executives are currently pondering ways to increase data usage on their networks to support the higher revenue numbers demanded by Wall Street.

If you ask carriers’ investor relations departments in New York, they cannot even smell smoke. But company lobbyists are screaming fire inside the D.C. beltway. A politically responsive Federal Communications Commission has certainly bought in. FCC chairman Julius Genachowski has rung the alarm bell repeatedly, notes Farrar:

Even such luminaries as FCC Chairman Julius Genachowski has stated in recent speeches that we are at a crisis point, claiming “U.S. mobile data traffic grew almost 300 percent last year” —while CTIA says it was less than half that, at 123 percent. “There were many skeptics [back in 2009] about whether we faced a spectrum crunch. Today virtually every expert confirms it.”

So how are consumers responding to the so-called spectrum crisis?

Evidence suggests they are offloading an increasing amount of their smartphone and tablet traffic to free Wi-Fi networks to avoid eroding their monthly data allowance. In fact, Farrar notes Wi-Fi traffic leads the pack in wireless data growth. Consumers will choose the lower cost or free option if given a choice.

So how did we get here?

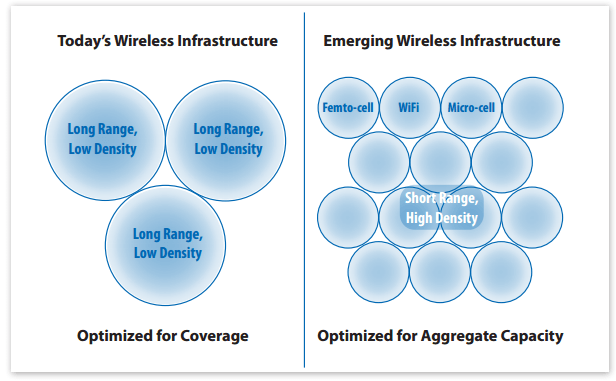

When first conceived, wireless carriers built long range, low density cellular networks. Today’s typical unsightly cell tower covers a significant geographic area that can reach customers numbering well into the thousands (or many more in dense cities). If everyone decides to use their smartphone at the same time, congestion results without a larger amount of spectrum to support a bigger wireless data “pipe.” But some network engineers recognize that additional spectrum allocated to that type of network only delays the inevitable next wave of potential congestion.

Wi-Fi hints at the smarter solution — building short range, high density networks that can deliver a robust wireless broadband experience to a much smaller number of potential users. Your wireless phone company may even offer you this solution today in the form of a femtocell which offloads your personal wireless usage to your home or business Wi-Fi network.

Some wireless carriers are adopting much smaller “cell sites” which are installed on light poles or in nearby tall buildings, designed to only serve the immediate neighborhood. The costs to run these smaller cell sites are dramatically less than a full-fledged traditional cell tower complex, and these antennas do not create as much visual pollution.

To be fair, wireless growth will eventually tap out the currently allocated airwaves designated for wireless data traffic. But more spectrum is on the way even without alarmist rhetoric that demands a faster solution more than a smart one that helps bolster spectrum -and- competition.

Running a disinformation campaign and hiring lobbyists remains cheaper than modifying today’s traditional cellular network design, at least until spectrum limits or government policy force the industry’s hand towards innovation. Turning over additional frequencies to the highest bidder that currently warehouses unused spectrum is not the way out of this. Allocating spectrum to guarantee those who need it most get it first is a better choice, especially when those allocations help promote a more competitive wireless marketplace for consumers.

[flv width=”600″ height=”358″]http://www.phillipdampier.com/video/KGO San Francisco FCC considers spectrum shortage 9-12-12.flv[/flv]

KGO in San Francisco breaks down the spectrum shortage issue in a way ordinary consumers can understand. FCC chairman Julius Genachowski and even Google’s Eric Schmidt are near panic. But the best way to navigate growing data demand isn’t just about handing over more frequencies for the exclusive use of Verizon, AT&T and others. Sharing spectrum among multiple users may offer a solution that could open up more spectrum for everyone. (2 minutes)

Subscribe

Subscribe