Reuters reported this week that a wave of consolidation in the rural telephone marketplace is about to begin as telephone companies fight continued declines in the telephone access line business.

The biggest target for a takeover? “Frontier Communications,” says Stanford Group analyst Michael Nelson. “They’re really the only one that would move the needle significantly,” he said.

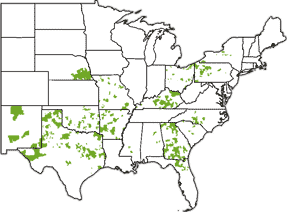

Frontier, based in Stamford, Connecticut, is the nation’s fourth largest independent largely-rural telephone company, with 2.3 million telephone lines.

In the market for merger opportunities, and speculated to be looking closely at Frontier, is Little Rock, Arkansas-based Windstream Communications. Windstream, the nation’s second largest rural telephone company, announced it was aggressively interested in pursuing merger opportunities.

Windstream’s takeover of Frontier is seen by some industry observers as practically a done deal.

Nelson sees a Frontier deal in about six months, costing Windstream $9 billion, including the assumption of about $4.6 billion in debt.

Big deals that maximize cost savings would make sense for Windstream, according to Jefferies analyst Jonathan Levine, who said closing even small deals require a lot of money and time as they involve reviews from the regulators of each state where the target companies have operations.

“I think they’re going to probably look at some of the larger players,” Levine told the Reuters wire service.

Such a merger would likely leave Windstream in charge of the merged company. Windstream has aggressively deployed broadband DSL services into their rural service areas, with speeds dependent on the infrastructure available in different areas.

Windstream has no plans to implement usage caps on broadband customers at this time, nor does it charge customers for company-supplied modems. It is too early to speculate about the impact a merger would have on existing Frontier employees. Windstream already provides customer and technical support from call centers in India and Georgia and has a track record of eliminating or reducing staff at call centers formerly run by its acquisition targets.

Windstream was created primarily from the old Alltel network of local telephone companies, mixing in customers from VALOR/GTE Southwest, GTE Georgia, Standard Group, Aliant, and CT Communications. From a series of acquisitions, it rebranded itself as Windstream Corporation in 2006, dropping the Alltel name.

Consolidation is expected to become a growing factor in the independent telephone company marketplace, as companies face significant challenges from cable systems and wireless phone companies.

The nation’s number three independent telephone company, CenturyTel of Monroe, Louisiana, may also be interested in Frontier, and could spark a bidding war for Frontier’s assets. CenturyTel is also reportedly looking at Iowa Telecom or Consolidated Communications as potential merger targets.

Only one independent telephone company, the nation’s largest, Embarq, spun off by Sprint-Nextel, is not likely to be in a position to begin a shopping spree. Analysts report the company’s poorly positioned to embark on a merger adventure because of the company’s perceived lower value. Analysts have urged Embarq to begin cost-cutting and improve earnings.

Frontier Communications stock has been progressively increasing in value since merger speculation began. The company is currently trading at 12.72 per share.

Subscribe

Subscribe