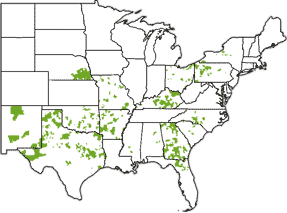

Winstream provides 3,000,000 access lines in 16 states, and is headquartered in Little Rock, Arkansas

Windstream Corporation has announced a massive 9.4 percent dividend, one of the largest among S&P 500 companies. Big dividends are a trait common with independent phone companies that have used dividend payouts to fuel their stock value, making shares valuable to income investors. Michael Nelson, a Soleil Securities analyst told Investors Business Daily Windstream’s preoccupation with mergers and acquisitions has been the primary reason the company has been growing, even as landlines continue to be a dying business.

“The CEO is embarking on a roll-up strategy of smaller disconnected companies; there are literally hundreds of them.”

He adds that CEO Jeff Gardner has a history of successfully executing a strategy of mergers and acquisitions while he was the chief financial officer of Alltel, the company from which Windstream spun off.

By growing a company through mergers and acquisitions, even as consumers disconnect their core product – landline phones, providers can still demonstrate growth to shareholders. But once industry consolidation slows, any evidence of a decline in revenue is likely to prove punishing to the stock’s price.

Windstream’s latest acquisition, NuVox, Inc., is preparing for significant layoffs once the transaction closes in early February. Most of NuVox’s senior management are rapidly departing the soon-to-be-merged company.

The rest of the company’s 1,700 employees are concerned about their future employment. Some 700 workers at the company’s headquarters in Greenville, South Carolina are likely to bear the brunt of downsizing NuVox’s administrative functions.

Windstream COO Brent Whittington told the Charleston Regional Business Journal that the company’s headquarters building and many employees will be retained, at least at the outset.

“How much will we need going forward, I don’t know,” Whittington said.

Much of NuVox’s IT and customer service departments will remain in place, though some administrative functions in Greenville, such as accounting and human resources, could be lost, Whittington said.

“What that will mean for the ultimate headcount in Greenville, I don’t know right now,” he said.

Most prior mergers have resulted in significant job losses as a result of consolidation, in an effort to realize “cost savings.” The worst losses occur in offices dealing with administrative functions, often deemed redundant by the new owners.

Subscribe

Subscribe