Verizon, the country’s leading provider of millimeter wave 5G wireless broadband, is promising to expand service nationwide, but admits it will only service urban areas where the economics of small cell/fiber network infrastructure makes economic sense.

Verizon, the country’s leading provider of millimeter wave 5G wireless broadband, is promising to expand service nationwide, but admits it will only service urban areas where the economics of small cell/fiber network infrastructure makes economic sense.

At the Mobile World Congress conference in Barcelona, Spain, Verizon’s vice president of technology planning told PC that when it launches its mobile 5G network later this spring, home wireless internet service will come along for the ride.

“It is one network, based on 5G, supporting multiple use cases,” Verizon’s Adam Koeppe said. “Enterprise, small/medium business, consumer, mobility, fixed. When the 5G network is built, you have a fixed and mobile play that’s basically native to the deployment you’re doing.”

That means Verizon’s millimeter wave 5G network is designed to be shared by everyone and everything, including businesses, residential customers, cell phone users on the go, Internet of Things applications like smart meters and intelligent traffic systems, and more. But that network will not be everywhere Verizon or Verizon Wireless currently provides service.

“Our deployments of millimeter wave are focused on urban centers. It’s where the people are, where the consumption is,” Koeppe said.

Verizon faces significant costs building out its 5G wireless network in areas where it does not already offer FiOS fiber to the home service. Verizon’s 5G network is dependent on a fiber optic-fed network of small cells placed on top of utility and light poles at least every few city blocks. That means Verizon is most likely to get a reasonable return on its investment placing its 5G network in urban downtown areas and high wireless traffic suburban zones, such as around event venues, large shopping centers and entertainment districts. The company has chosen to deploy 5G in some residential areas, but only within large city limits. So far, it has generally steered clear of residential suburbs in favor of older gentrified city neighborhoods with plenty of closely-spaced multi-dwelling apartments, condos, and homes, as well as in urban centers with converted lofts or apartments.

Koeppe

Rural areas are definitely off Verizon’s list because the millimeter waves Verizon prefers to use do not travel very far, making it very expensive to deploy the technology to serve a relatively small number of customers.

Other carriers are not committing to large scale 5G deployments either.

At a debate held earlier today at Georgetown Law’s Institute for Technology Law & Policy, former FCC commissioner Mignon Clyburn, now a paid lobbyist for T-Mobile, warned that unless T-Mobile was allowed to merge with Sprint, its deployment of 5G will only happen in “very limited areas.”

Sprint has plans to introduce its own flavor of 5G, which won’t use millimeter wave frequencies, by June in nine U.S. cities. T-Mobile has talked about deploying 5G on existing large cell towers, which means one tower will serve many more customers than Verizon’s small cells. But with more customers sharing that bandwidth, the effective speed customers will see is likely to be only incrementally better than T-Mobile’s existing 4G LTE network. AT&T is initially moving in the same direction as T-Mobile, meaning many customers will be sharing the same bandwidth. That may explain why AT&T’s current 5G hotspot service plan also comes with a 15 GB data cap.

Verizon says its millimeter wave network will, by geography and design, limit the number of people sharing each small cell, making data caps unnecessary for its 5G fixed wireless home broadband replacement, which delivers download speeds of around 300 Mbps on average.

“We engineer the network to give the customer what they need when they need it, and the results speak for themselves,” Koeppe said.

Verizon is already selling its 5G service in limited areas for $50 a month to Verizon Wireless customers, $70 a month for non-customers. There are no data caps or speed throttles.

Based on the plans of all four major U.S. carriers, consumers should only expect scattered rollouts of 5G this year, and only in certain neighborhoods at first. It will take several years to build out the different iterations of 5G technology, with millimeter wave taking the longest to expand because of infrastructure and potential permitting issues.

Subscribe

Subscribe

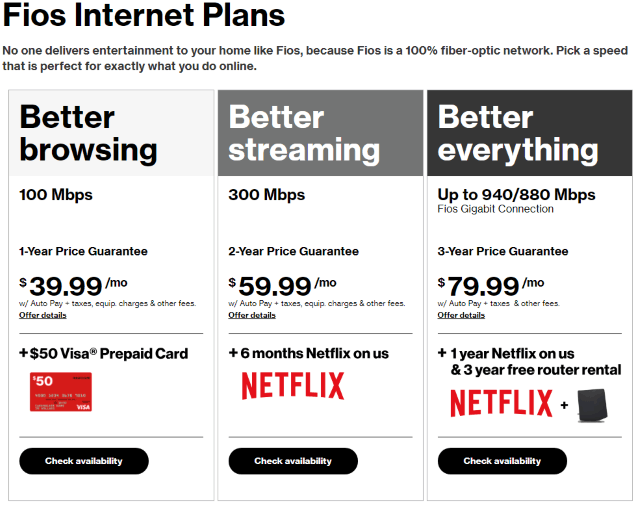

Those new or existing customers looking for faster internet-only service can choose the 300 Mbps plan for $20 more — $59.99 a month, pricelocked for two years. This plan includes six months of Netflix Premium, which supports Ultra High Definition (UHD/4K) streaming and allows up to four devices to stream at the same time. This is a $15.99/month value. These prices do not include the $12/month router charge, fees or taxes.

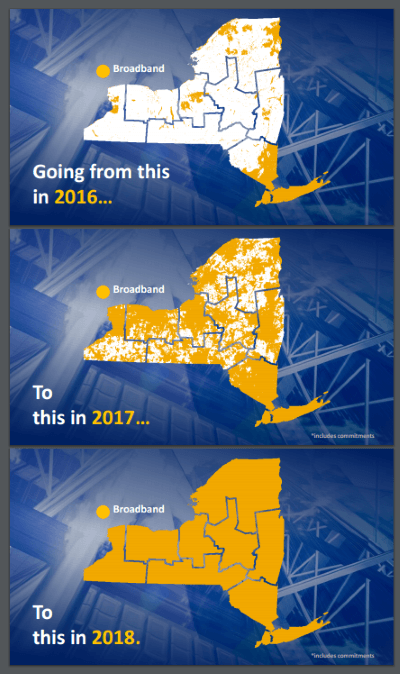

Those new or existing customers looking for faster internet-only service can choose the 300 Mbps plan for $20 more — $59.99 a month, pricelocked for two years. This plan includes six months of Netflix Premium, which supports Ultra High Definition (UHD/4K) streaming and allows up to four devices to stream at the same time. This is a $15.99/month value. These prices do not include the $12/month router charge, fees or taxes. Tens of thousands of rural New York families were hopeful after Gov. Andrew Cuomo announced in 2015 his intention to bring true broadband to every corner of the state by the year 2018. At the time, it was the largest and most ambitious broadband investment of any state in the country, putting $670 million in lawsuit settlement money and rural broadband funds from the FCC on the table to build out rural broadband service other states only talk about.

Tens of thousands of rural New York families were hopeful after Gov. Andrew Cuomo announced in 2015 his intention to bring true broadband to every corner of the state by the year 2018. At the time, it was the largest and most ambitious broadband investment of any state in the country, putting $670 million in lawsuit settlement money and rural broadband funds from the FCC on the table to build out rural broadband service other states only talk about.

D’Agostino fears that tens of thousands of additional satellite users will dramatically slow down HughesNet across upstate New York unless the company finds a way to get more shared bandwidth to serve the state’s rural broadband leftovers.

D’Agostino fears that tens of thousands of additional satellite users will dramatically slow down HughesNet across upstate New York unless the company finds a way to get more shared bandwidth to serve the state’s rural broadband leftovers.

Phone vendors are planning to tamp down customer expectations for their first 5G smartphones, claiming real world speeds will be at or slightly better than 4G LTE speeds in many markets and no better than a few hundred megabits from a barely used cell tower. The 5G technology being deployed to work with smartphones is different from the fixed 5G wireless experience some Verizon customers are getting with its wireless home broadband service.

Phone vendors are planning to tamp down customer expectations for their first 5G smartphones, claiming real world speeds will be at or slightly better than 4G LTE speeds in many markets and no better than a few hundred megabits from a barely used cell tower. The 5G technology being deployed to work with smartphones is different from the fixed 5G wireless experience some Verizon customers are getting with its wireless home broadband service. The latest findings

The latest findings  Despite a strong economy, Verizon Communications will shed 10,400 employees and cut $10 billion in costs as part of a transformation initiative promoted by the company’s newest top executive.

Despite a strong economy, Verizon Communications will shed 10,400 employees and cut $10 billion in costs as part of a transformation initiative promoted by the company’s newest top executive.