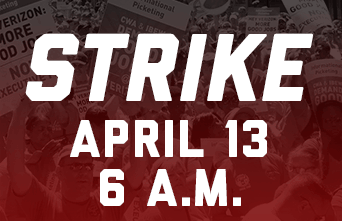

After ten months of informational picketing and on-the-job protests for a new contract agreement, nearly 40,000 Verizon workers from Massachusetts to Virginia will go on strike starting at 6:00am Wednesday, April 13 if a settlement cannot be reached.

After ten months of informational picketing and on-the-job protests for a new contract agreement, nearly 40,000 Verizon workers from Massachusetts to Virginia will go on strike starting at 6:00am Wednesday, April 13 if a settlement cannot be reached.

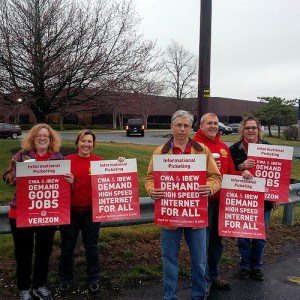

The Communications Workers of America (CWA) and the International Brotherhood of Electrical Workers (IBEW) argue Verizon has dropped the ball on customers and employees, refusing to negotiate in good faith and not investing in better broadband and phone service for millions of its customers.

The two unions are among the strongest proponents of forcing Verizon to further expand its FiOS fiber-to-the-home service, which has been effectively on hold for several years as the company pours resources into its vastly more profitable wireless division – Verizon Wireless.

In addition to refusing further upgrades, unions accuse Verizon of gutting job protection, outsourcing an increasing amount of work, freezing pensions, closing call centers, and offshoring jobs to Mexico and the Philippines. While customers endure months-long phone outages and poor DSL broadband service Verizon has only grudgingly improved, the company made $39 billion in profits over the last three years, and $1.8 billion in profits over the first three months of this year. But it won’t spend the money on expanding FiOS or its workers.

Trainor

“The company’s greed is disgusting. [CEO] Lowell McAdam made $18 million last year—more than 200 times the compensation of the average Verizon employee,” the CWA said in a statement. “Verizon’s top five executives made $233 million over the last five years. Last year alone, Verizon paid out $13.5 billion in dividends and stock buybacks to shareholders. But they claim they can’t afford a fair contract.”

The union says Verizon’s priorities are all wrong.

“It’s not just workers who are getting screwed,” the CWA wrote. “Verizon has $35 billion to invest in the failing internet company, Yahoo, but refuses to maintain its copper network, let alone build FiOS in underserved communities across the region. And even where it’s legally committed to building FiOS out for every customer, Verizon refuses to hire enough workers to get the job done right or on time.”

“We’re standing up for working families and standing up to Verizon’s corporate greed,” said CWA District 1 vice president Dennis Trainor. “If a hugely profitable corporation like Verizon can destroy the good family supporting jobs of highly skilled workers, then no worker in America will be safe from this corporate race to the bottom.”

Members of CWA District 1/Local 13500.

Democratic presidential candidate Bernie Sanders has been a close ally of the CWA and has supported the union’s fight with Verizon. The CWA has returned the favor, encouraging the Vermont senator to stay in the race against Hillary Clinton.

Verizon workers complain they are being treated like servants by the company.

“Verizon is already turning people’s lives upside down by sending us hundreds of miles from home for weeks at a time, and now they want to make it even worse,” said Dan Hylton, a technician and CWA member in Roanoke, Va., who’s been with Verizon for 20 years. “Technicians on our team have always been happy to volunteer after natural disasters when our customers needed help, but if I was forced away from home for two months, I have no idea what my wife would do. She had back surgery last year, and she needs my help. I just want to do a good job, be there for my family, and have a decent life.”

A strike could have a significant effect on service calls and maintenance of Verizon’s infrastructure, particularly its deteriorating copper wire network still in service across much of its territory outside of the largest cities in the northeast and mid-Atlantic region. Particularly vulnerable areas include upstate New York, Maryland, suburban and rural Pennsylvania, southern New Jersey and western Virginia.

Verizon recently completed a sale of its landline service areas in Florida, California, and Texas to Frontier Communications, and these three states will not be affected by a walkout.

[flv]http://www.phillipdampier.com/video/CWA Verizon Poster Child for Corporate Greed 4-2016.mp4[/flv]

The CWA released this ad depicting the income disparity between average Verizon workers and its CEO. (30 seconds)

Subscribe

Subscribe Verizon’s loyal landline customers are subsidizing corporate expenses and lavish spending on Verizon Wireless, the company’s eponymous mobile service, while their home phone service is going to pot.

Verizon’s loyal landline customers are subsidizing corporate expenses and lavish spending on Verizon Wireless, the company’s eponymous mobile service, while their home phone service is going to pot. In contrast, Time Warner Cable has sold its customers phone service with unlimited local and long distance calling (including free calls to the European Community, Canada, and Mexico) with a bundle of multiple phone features for just $10 a month. That, and the ubiquitous cell phone, may explain why about 11 million New Yorkers disconnected landline service between 2000-2016. There are about two million remaining customers across the state.

In contrast, Time Warner Cable has sold its customers phone service with unlimited local and long distance calling (including free calls to the European Community, Canada, and Mexico) with a bundle of multiple phone features for just $10 a month. That, and the ubiquitous cell phone, may explain why about 11 million New Yorkers disconnected landline service between 2000-2016. There are about two million remaining customers across the state. In the darkness of night, Congress on Tuesday handed some of America’s largest telecom companies

In the darkness of night, Congress on Tuesday handed some of America’s largest telecom companies  Despite denials Verizon Communications was interested in selling off more of its wireline network to companies like Frontier Communications, the company’s chief financial officer reminded investors Verizon is willing to sell just about anything if it will return value to its shareholders.

Despite denials Verizon Communications was interested in selling off more of its wireline network to companies like Frontier Communications, the company’s chief financial officer reminded investors Verizon is willing to sell just about anything if it will return value to its shareholders.

The communities:

The communities:

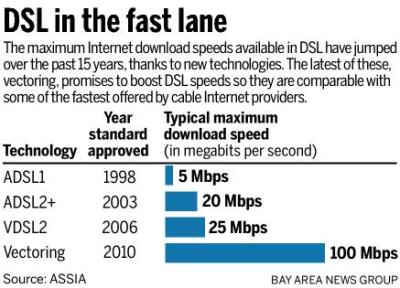

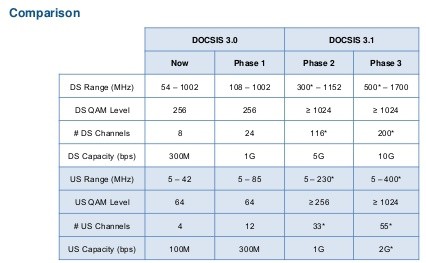

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.