Shhh… Don’t tell anyone except the newspapers, trade journals, everyone else….

Well-placed sources inside Verizon are leaking like a sieve to the media about the phone giant’s ambition to own and operate a large cable company.

In what may be a trial balloon to test the waters with the incoming Trump Administration, at least two “well-placed sources” have told the New York Post Verizon CEO Lowell McAdam is seriously contemplating countering AT&T’s buy of DirecTV and its attempted acquisition of content company Time Warner, Inc., with the buyout of a major national cable operator.

Verizon’s primary interest, according to multiple sources, is expanding available content to fill its current and future wireless platforms, especially 5G. Acquiring a cable operator would make content deals easier and more affordable because of volume discounting. It would also allow Verizon to directly sell cable products and services without investing in further FiOS expansion.

The CEO told friends at the Consumer Electronic Show in Las Vegas that he “wants to buy into cable.”

The most likely targets would have to be large cable operators with a national footprint, and a source told the tabloid two companies qualified: Charter or Comcast.

“Altice is too small,” the source speculated. That would also count out other medium-sized companies like Cox and Mediacom, because they have too limited a service area to be of much use to Verizon.

No final decision has been made, the newspaper notes, adding no talks are underway between Verizon and any cable company at present. Should Mr. Trump repeat the earlier objections to the AT&T-Time Warner, Inc., merger he made last October, any marriage of Verizon with a cable operator would be unlikely. Trump cited unchecked media consolidation as his primary reason for opposing AT&T’s latest acquisition deal, but he has not repeated those objections recently. Last week Trump met with AT&T CEO Randall Stephenson in New York.

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

A deal with Charter is more likely than a buyout of Comcast because Charter’s most significant shareholder – John Malone, has no allegiance to keeping Charter Communications independent. Charter also lacks the kind of complications that an acquisition of Comcast could bring – notably Comcast’s ownership of NBC and its dozen owned-and-operated TV stations.

Malone has a long history of dispassionately buying and selling large telecom assets, including the cable company Tele-Communications, Inc. (TCI) he helped build from a handful of cable systems into what used to be the nation’s largest cable operator. In 1999, TCI was sold and rebranded as AT&T Broadband and Internet Services. Three years later, most of those cable systems were again sold to their present owner Comcast.

Verizon may argue it has already divested significant amounts of its FiOS service to Frontier Communications in the Pacific Northwest, Indiana, Texas, California, and Florida, limiting antitrust concerns. But state regulators, particularly in New York, are likely to raise serious objections if Verizon, already the dominant telephone company in New York (except Rochester) attempts to acquire Charter, the only significant cable operator in upstate New York and Manhattan. That would leave the vast majority of New York with a classic telecom monopoly, with only one provider for landline and broadband service.

Subscribe

Subscribe When the Berkshire Eagle asked readers to test their internet speeds and share the results, along with opinions about their broadband options, the newspaper hit a nerve.

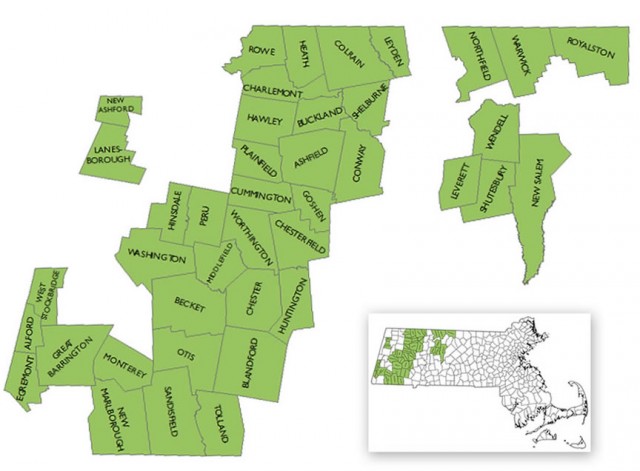

When the Berkshire Eagle asked readers to test their internet speeds and share the results, along with opinions about their broadband options, the newspaper hit a nerve. Unfortunately, as customer demand for bandwidth grows, performance drops unless providers continually invest in new equipment to manage demand appropriately. Customers in western Massachusetts report Verizon seems to be making do with what they already have, and speeds have suffered.

Unfortunately, as customer demand for bandwidth grows, performance drops unless providers continually invest in new equipment to manage demand appropriately. Customers in western Massachusetts report Verizon seems to be making do with what they already have, and speeds have suffered.