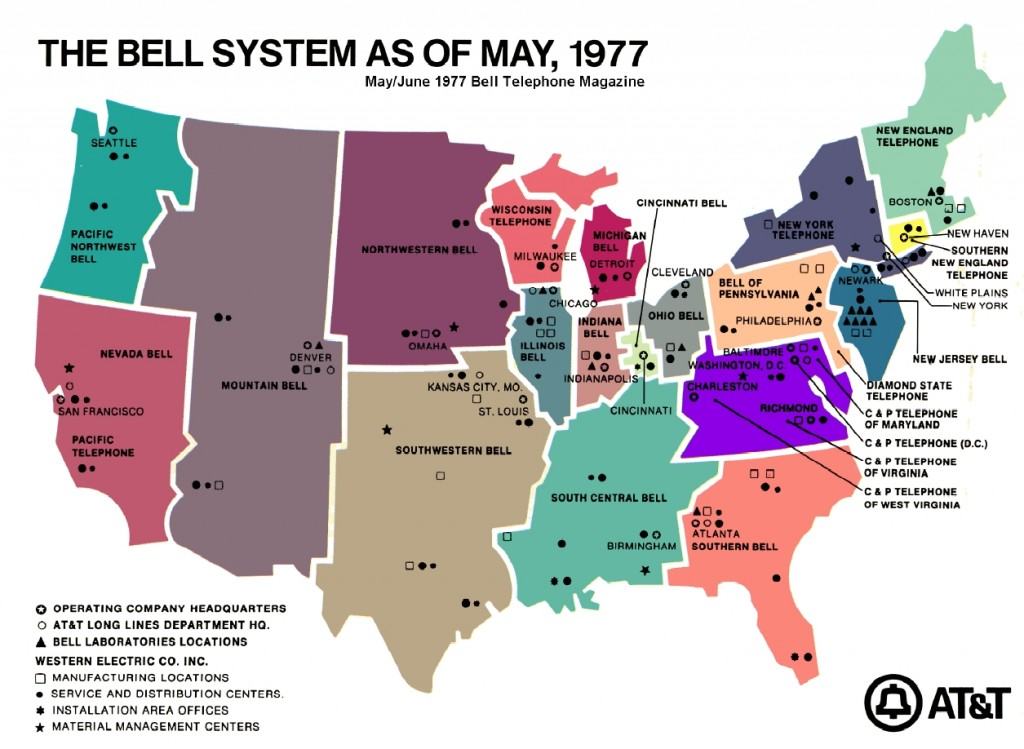

One of the promised benefits of permitting the Verizon-Frontier spinoff is that Frontier will bring more and better broadband service to areas Verizon has ignored for years. The company has been running television ads in West Virginia promoting Frontier’s promised “next generation” of broadband. But what does that mean?

[flv]http://www.phillipdampier.com/video/Frontier Verizon Deal Advertisement West Virginia.flv[/flv]

Frontier Communications is running this advertisement in West Virginia.

The West Virginia Consumer Advocate Division of the Public Service Commission brought in Trevor R. Roycroft, PhD., former Associate Professor at the J. Warren McClure School of Communication Systems Management, Ohio University, to examine the details behind the marketing and public relations push to promote the deal.

He was not impressed.

After an extensive review of confidential and public documents from Frontier, his conclusion was that Frontier’s DSL service is just plain bad, and for plenty of West Virginians who may only have one choice for broadband in the foreseeable future, being stuck with Frontier’s idea of broadband is particularly bad.

Indeed, Frontier’s idea of what defines “next generation broadband” would be true, if this was the year 1992.

“Frontier has made no commitment regarding improved broadband deployment in West Virginia. Frontier, while achieving higher levels of DSL availability in West Virginia, generally offers its broadband services at higher prices and provides lower quality than those associated with Verizon’s DSL. Frontier’s ability to increase broadband deployment in West Virginia will depend on the condition of the outside plant that it has acquired, which may negatively impact Frontier’s costs of deployment. Furthermore, Frontier must upgrade substantial numbers of customer locations outside of West Virginia, and West Virginia will be competing with this larger priority,” Roycroft writes in his testimony to the West Virginia Public Service Commission.

The infrastructure Frontier utilizes to deliver its broadband service is revealing even to those Frontier customers not directly impacted by this transaction. Some of the documents Roycroft reviewed laid bare the nonsense the company has used to defend its Acceptable Use Policy language defining an “acceptable amount” of monthly broadband usage at just five gigabytes. Company officials have said for more than a year that they were concerned about the growth of usage on their network, and its potential to slow service for other customers. But company documents, included within the scope of Roycroft’s testimony, tell a very different story:

Frontier plans to increase its core backbone from its current level of 10 Gbps to a capacity of 20 Gbps (should the spinoff be approved). With regard to the capacity of its existing backbone, Frontier states:

Frontier expanded the backbone from OC 48 to 10 Gigabit Ethernet during the first half of 2009. Because of this network expansion we do not have peak usage for the past 12 months. No backbone link has peaked above 2.8 Gigabit/second or 28% of the capacity of a link since the augment was completed in 2009.

Thus, Frontier’s current backbone configuration appears to have excess capacity. With the expansion of its backbone network to 20 Gbps, the company’s current data traffic load results in about 14% of capacity being utilized at peak.

Potentially limiting customers to just five gigabytes of usage is so unjustified, in Roycroft’s analysis, its potential imposition on West Virginian customers should be a deal-breaker.

Roycroft ponders whether Frontier will invest enough resources to make sure capacity is not an issue. The only way Frontier’s network will show signs of strain is if the company makes a conscious decision not to sufficiently upgrade their network as they take on millions of new Verizon customers, or they dramatically underestimate the average Verizon customer’s usage.

Roycroft was also asked to evaluate whether Frontier’s claims of 90% broadband availability in its overall service area and 92% in its West Virginia territory rang true.

Roycroft writes that Frontier’s numbers don’t tell the whole story. In five states, Frontier admits the percentages are notably lower, so no guarantee can be inferred for West Virginia based on Frontier’s talking points.

Frontier’s “Advanced” Broadband Network Is Hardly Advanced and Barely Qualifies As Broadband

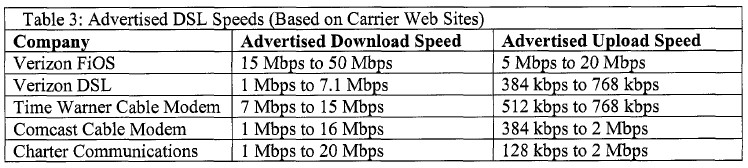

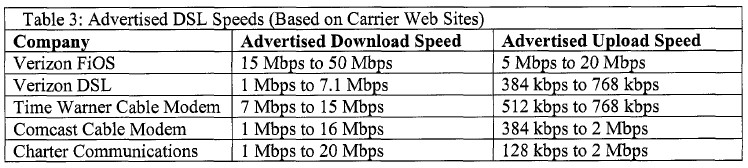

Heavy criticism was leveled at Frontier for its “advanced” broadband service. Roycroft compared Frontier DSL with several other providers and was unimpressed with the company’s broadband speeds.

Roycroft's table illustrates what's on offer from the competition

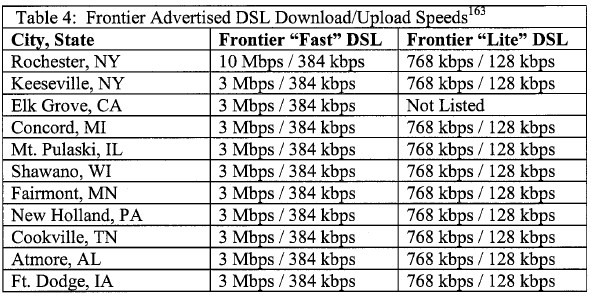

“Frontier’s advertised DSL speeds are generally much lower than those available from Verizon and other carriers. Based on a location-based search of Frontier DSL service offerings, it appears that Frontier’s most prevalent DSL speeds are 3 Mbps and 768 kbps (for download),” Roycroft said.

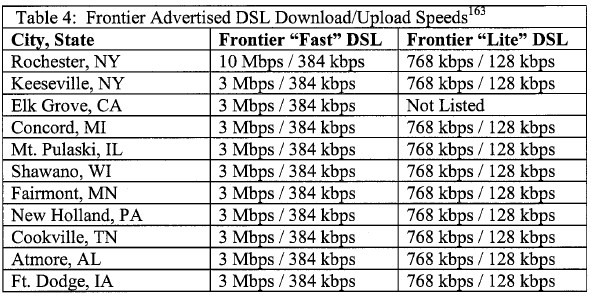

Frontier's DSL Speeds in Selected Cities

Although the expressed upload speed for Rochester should be listed at a higher rate (I managed around 512kbps myself), Roycroft is correct when he says, “it can be seen that outside of Rochester, NY, the DSL speeds associated with Frontier offerings cannot be considered ‘cutting edge.'”

Even while noting Rochester’s potential DSL speeds, real-world speeds are another matter entirely.

[flv width=”640″ height=”405″]http://www.phillipdampier.com/video/Real World Frontier vs Road Runner Speeds.flv[/flv]

One New York customer provided real world evidence of the significant differences in speed offered by Road Runner from Time Warner Cable and Frontier’s DSL (courtesy: 1ComputerSavvyGuy) (1 minute)

Frontier’s DSL offerings in West Virginia are of even lower quality. Frontier indicates that it offers three grades of DSL service in West Virginia:

Up to 256 kbps download/128 kbps upload;

Up to 1 Mbps download/200 kbps upload;

Up to 3 Mbps download/200 kbps upload.

These data transmission speeds, especially upload speeds, are at the very low end of commercial offerings that I have observed.

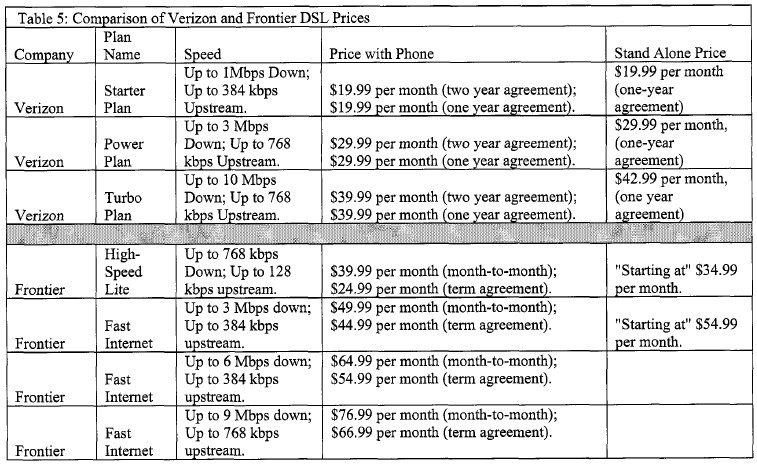

Comparing Verizon DSL vs. Frontier DSL Pricing & Gotchas, Contracts, and Internet Overcharging Schemes

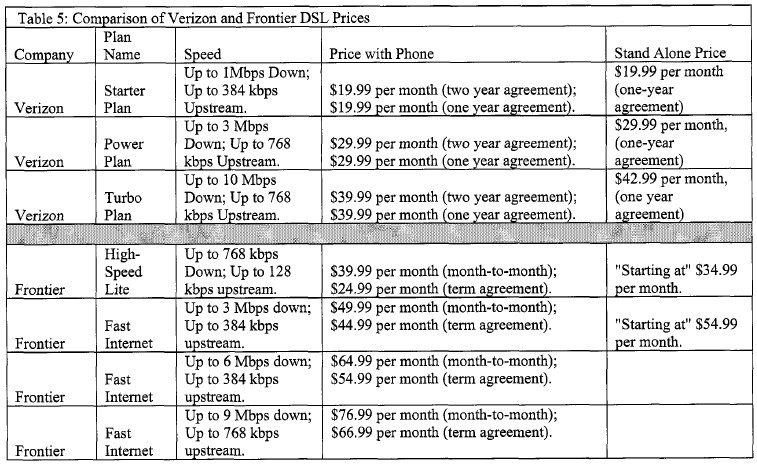

Roycroft’s study found Frontier’s pricing significantly higher than Verizon for DSL service.

Frontier’s DSL prices, either with telephone service, or on a stand-alone basis, are significantly higher than are Verizon’s. For example, the entry-level Frontier plan has a nominal price that is 100% higher than Verizon’s.

However, when considering the per Mbps price, Frontier’s price is 160% higher. It is also notable that Frontier’s upload speeds are also low when compared to Verizon’s. Consumers are increasingly relying on upload capabilities to share large files, such as videos. Overall, Frontier’s DSL products are low quality.

Comparing Prices

Roycroft also gave special attention to Frontier’s infamous 5GB Acceptable Use Policy, which he suggested was a major negative for West Virginia’s online experience.

Frontier indicates that it monitors network usage if “it receives a complaint of slow service or if it discovers that network bandwidth utilization is unusually high in a particular area.

Frontier was asked to identify any action taken against a customer associated with its acceptable use policy and, in response, the company stated that it has not “terminated a customer’s service based on exceeding the 5 GB threshold identified in the AUP.” However, the restriction on usage further raises the relative cost of Frontier’s service. Frontier indicates that consumers may face action by the company if they exceed the usage cap, thus indicating that the prices reflect both speed and volume. Verizon’s DSL service does not include a similar limit.

Frontier’s DSL pricing policies and usage restrictions will represent a significant negative impact on West Virginia consumers, should these policies be implemented in Verizon’s service area in West Virginia.

Even more importantly, Roycroft considered the argument for imposing such Internet Overcharging schemes as unwarranted.

“While DSL provides dedicated bandwidth to the customer in the last mile, DSL subscribers will share network capacity in the ‘middle mile.’ For example, shared data networks will carry consumer traffic from the telephone company central office to an Internet gateway. I believe that Frontier’s policy is more likely to reflect an unwillingness on Frontier’s part to invest in ‘middle mile’ Internet access facilities that would require capacity additions as customer demand increases, and choose to restrict customer usage instead of investing in the capacity needed to meet customer demand,” Roycroft writes.

“Furthermore, Comcast’s download-cap policy includes limits that are dramatically higher than Frontier’s. Comcast’s acceptable use policy identifies 250 gigabytes as the threshold at which Comcast may take action against a customer, which is fifty times the usage associated with Frontier’s policy,” he added.

Roycroft was also concerned about the many ‘gotchas’ that are part of Frontier’s marketing efforts which bring even higher prices to consumers choosing to have DSL service installed.

“To receive the services of Frontier’s technician, the consumer will incur a $134 fee unless the consumer signs up for a term service contract. Even with the term service contract, the customer must pay a $34 fee for the on-site set-up. Furthermore, the technicians that Frontier dispatches to new broadband customers’ homes are also sales agents. Thus, while it may be that these individuals can help with system set-up and the like, they also are part of Frontier’s overall up-selling strategy,” said Roycroft.

Frontier markets a variety of services to customers as part of their promotions and service offerings. For instance, recent Dell Netbook promotions required customers to sign multi-year contracts for service, with an early termination fee up to $400 if the consumer chooses to cancel service. Such promotions do not come out of the goodness of Frontier’s heart. Indeed, such promotions provide even more revenue potential by pitching customers on its “Peace of Mind” services, which include computer technical support, backups, and inside wire maintenance for an additional monthly fee.

Customers don’t even qualify for many Frontier promotions unless they accept a bundled service package combining broadband with traditional phone service and a multi-year service contract.

Roycroft says West Virginia should demand modifications to Frontier’s proposal before it should even consider accepting it. Among the changes:

- Frontier should be required to make broadband services available in 100% of its wire centers, and to 90% of its West Virginia customers by the end of 2013. Frontier should expand broadband availability to 100% of its customers by 2015.

- Frontier should be required to deploy and promote broadband services in West Virginia so that, by the end of 2013, at least 90% of its customers can achieve download speeds of 3 Mbps; 75% of its customers can achieve download speeds of 6 Mbps; and 50% of customers can achieve download speeds of 10 Mbps.

- To achieve these broadband objectives, Frontier should be required to exceed Verizon’s baseline level of capital investment by at least $117 million during the period ending December 31, 2013, or by an amount sufficient to meet the broadband objectives.

- Frontier should be required to offer broadband services at prices that do not exceed those currently offered by Verizon for 1 Mbps and 3 Mbps services, i.e., Frontier should offer services at Verizon’s advertised prices for 1 Mbps and 3 Mbps service (respectively, $19.99 per month and $29.99 per month) for a period of 24 months following the merger.

- Frontier should be prohibited from imposing its broadband “download cap” in West Virginia.

- Frontier should be required to provide individual written notice to its customers regarding the merger, and should notify customers of any change in services that result from the merger. Changes in billing format should also be clearly explained to customers, both in writing, and through a web-based tutorial.

- Frontier should be prohibited from migrating any Verizon customer to a Frontier plan that either increases the customer’s rates, diminishes the level of service, or has a materially adverse impact on any of the terms and conditions of the customer’s service. West Virginia customers should experience a rate freeze for a period of 24 months.

- Frontier should be required to allow former Verizon customers to take a “fresh look” at their purchases, including those customers who have term contracts with Verizon. All early termination charges should be waived for a period of 90 days following the merger, and the long distance PIC charge should also be waived for Verizon long-distance customers who select a long-distance provider other than Frontier.

The action, originally brought by the New Jersey Attorney General’s office this past March, came in response to complaints from state residents who failed to receive promised flat-screen televisions offered as part of a sign-up promotion the company ran last year. The company was also accused of running advertising campaigns quoting prices that did not come close to reflecting the actual total cost of service. The Attorney General also documented instances of setup and installation fees that were promised to be waived by Verizon representatives, but were billed anyway.

The action, originally brought by the New Jersey Attorney General’s office this past March, came in response to complaints from state residents who failed to receive promised flat-screen televisions offered as part of a sign-up promotion the company ran last year. The company was also accused of running advertising campaigns quoting prices that did not come close to reflecting the actual total cost of service. The Attorney General also documented instances of setup and installation fees that were promised to be waived by Verizon representatives, but were billed anyway.

Subscribe

Subscribe