It's "Return of the Astroturf Groups"

It did not take more than a few hours for the first non-profit and “minority advocacy” groups to hurry out press releases applauding the announced merger intentions of AT&T and T-Mobile.

Winning approval of the merger in Washington will take a full court press by lobbyists and organizations that claim to represent “the public interest,” even if the merger will likely raise prices for the constituents they ostensibly represent. Too often, these groups also fail to openly disclose they have board members that work for the telecommunications industry or welcome large financial contributions made by one or both companies. That makes it difficult for the average consumer to discern whether matters of arcane telecommunications policy are truly of interest to these organizations or whether they are simply returning a favor to the companies that write them checks.

The Communications Workers of America, the union representing many AT&T employees, has been applauding the announced merger on their website, “Speed Matters.” It’s hard to blame the union for supporting the merger — it opens the door to union membership for T-Mobile employees. The union does a good job representing their workers, and their interests often are shared by consumers. For instance, the CWA has smartly opposed Verizon landline sell-0ffs to third party companies, which have tended to bring bad results for ratepayers. But their website does trumpet some sketchy organizations not well known outside of the dollar-a-holler advocacy industry.

Take “The Hispanic Institute” (THI). This obscure “group” chose a name for itself suspiciously similar to the much larger and more prominent National Hispanic Institute. That’s where the similarity ends, however.

The Hispanic Institute believes the AT&T and T-Mobile merger will bring harmony and joy to the Latino community clamoring for mobile broadband:

“The proposed merger of AT&T and T-Mobile will move us closer to universal mobile broadband deployment. When we consider how essential mobile technology is to empowering communities, we conclude that this proposal is good for Hispanic America. It provides an opportunity to amplify the growth in mobile broadband adoption by both English and Spanish speaking Americans.”

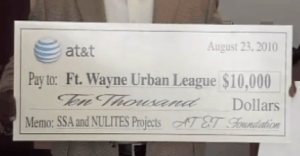

AT&T regularly contributes substantially to Urban League programs.

In fact, the only thing most Latinos will find after the merger is higher prices for reduced levels of service. T-Mobile’s aggressive pricing and innovative (and sometimes disruptive) packages are well-known in the industry, and they are a frequent choice of budget-minded consumers, including many members of the Latino community. It does little good to expand mobile broadband service that many cannot afford. Reduced competition always leads to higher prices, a fact of life missed by THI.

Perhaps THI’s misguided support for the merger was an aberration. But then again, maybe not. The group also promotes a pharmaceutical industry-funded scare site designed to convince Americans that prescription drugs imported from Canada are dangerous and unsafe. Calgary is apparently the new Calcutta, when you have a vested interest in stopping people from saving a fortune on their medication by buying it north of the border.

Perhaps that was also just “an error in judgment.” But little doubt remains after you read their spirited defense of the bottom-feeding payday loan industry (even though they claim they are not.)

Friends of Big Pharma, Payday Loan Gougers, and A Bigger AT&T are no friends of mine… or yours.

The Urban League is a regular recipient of AT&T cash. In return, the group is no stranger to advocating for the phone company’s political agenda. One of their chapters belongs to the ultimate in Astroturf groups — Broadband for America. How many organizations cautiously optimistic about a telecom industry merger would rush out a press release about it? They did:

“The pending merger of AT&T and T-Mobile USA holds potential opportunity for an expanded, diverse workforce … We plan to carefully observe the upcoming regulatory process and look forward to a transition that is guided by AT&T’s commitment to diversity and equal opportunity. We have every reason to be optimistic,” said Marc Morial, president and CEO.

Speed Matters somehow forgot to mention AT&T is a major member of the Alliance they quote in support of the merger.

Of course he does.

Then there is the ultimate in echo chamber advocacy courtesy of the Alliance for Digital Equality:

“The merger of T-Mobile USA and AT&T will enable rapid broadband coverage for most of the nation — including many lower-income and rural communities that have been largely underserved — through an expanded 4G LTE deployment to 95% of the U.S. population within six years. This is a huge step forward in making President Obama’s vision of reaching 98% of Americans a reality.

“What’s more, wireless broadband has shown tremendous promise in bringing our communities of color into the digital age — something that an increasing number of studies and reports have shown we have got to improve upon if we are going to bridge the digital divide that exists in this country. This merger puts the right technologies into the communities that need it, at the right time… and at the right price.” — Julius Hollis, Chief Executive Officer

Missing from these glowing words is an admission that AT&T is a major member of the Alliance.

It’s the coalition of the willing to sell out consumers.

Subscribe

Subscribe