Verizon Communications formally closed its acquisition of Alltel in January 2009, but some former customers are only now feeling the impact as they transition to… AT&T.

Verizon Communications formally closed its acquisition of Alltel in January 2009, but some former customers are only now feeling the impact as they transition to… AT&T.

That’s right, AT&T.

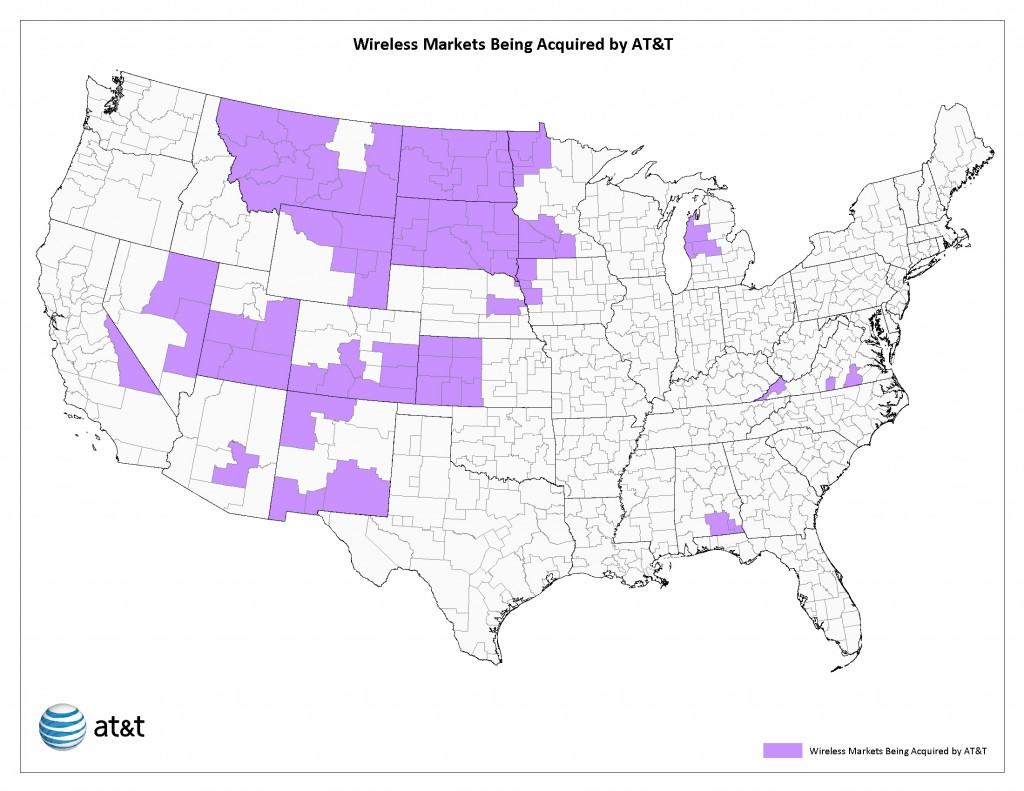

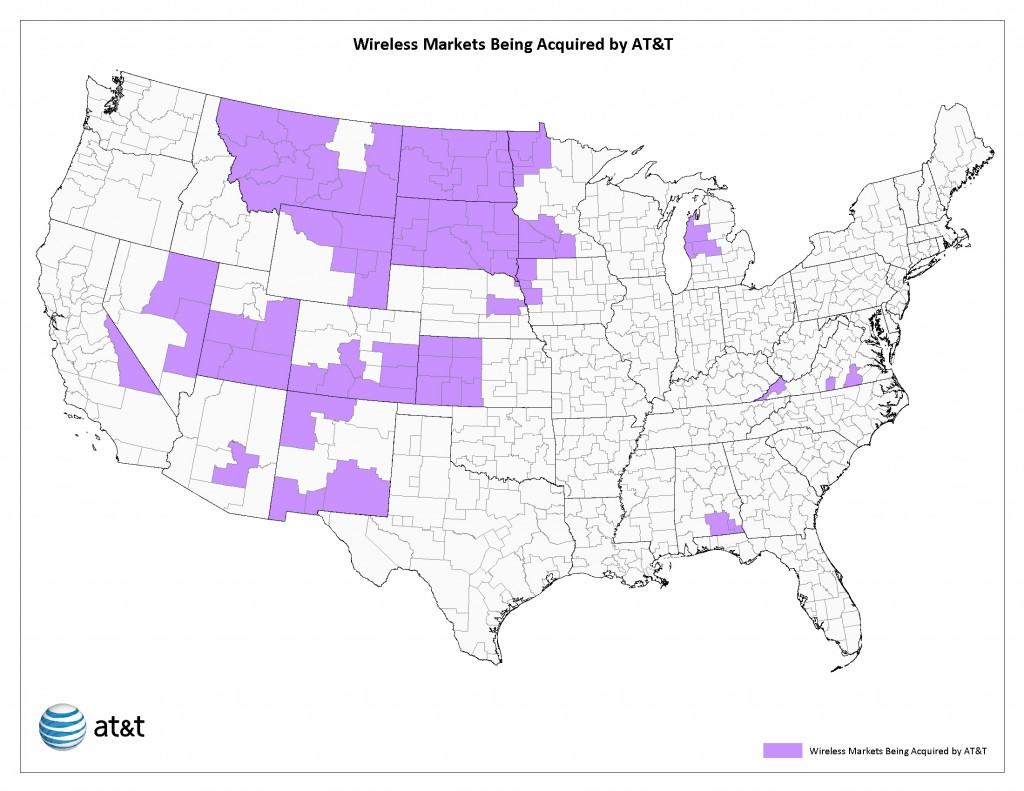

Although Verizon acquired the bulk of Alltel’s national customer base, the federal government ordered Verizon to sell off its future Alltel customers in communities where the company would likely be the overwhelmingly dominant player. Verizon sold off most of these orphaned customers, numbering over a million, especially in the Mountain Time Zone, to AT&T.

The transition from Alltel to AT&T would be a bumpy one because the two companies use different wireless technologies, meaning every customer would have to be provided with a new phone. Alltel’s customers remaining with Verizon didn’t experience this, because both companies use CDMA technology.

AT&T agreed, as part of the deal, to supply every one of its new postpaid/contract Alltel customers with brand new GSM phones (although AT&T was unwilling to provide free advanced smartphones like Apple’s iPhone). Prepaid customers were less lucky — they only received discounts off new phones.

Stop the Cap! has talked with more than a dozen affected customers in Arizona, New Mexico, Michigan, Utah, Wyoming, Iowa and Colorado about their experiences as they transition to AT&T service. With AT&T now proposing to merge with T-Mobile, which could also mean some new phones for T-Mobile customers, we wanted to learn what customers thought about being moved from one carrier to another, what their experience was before the transition and after, and whether they intend to stay with AT&T.

Our panel included a young man from Utah who used his phone at home and outside of the state as he performed mission work for the Mormon Church in rural Florida. We also spoke with a retired couple living in Arizona who chose Alltel because of their unlimited calling circle option to stay in touch with friends and family in Minnesota. Also participating: a travel agent in Michigan, a realtor in New Mexico, a self-employed contractor in Colorado, a farmer in Iowa, and several others who shared their stories with us in e-mail. By mutual agreement, we’re keeping their last names private because some have pending disputes with AT&T.

Our panel included a young man from Utah who used his phone at home and outside of the state as he performed mission work for the Mormon Church in rural Florida. We also spoke with a retired couple living in Arizona who chose Alltel because of their unlimited calling circle option to stay in touch with friends and family in Minnesota. Also participating: a travel agent in Michigan, a realtor in New Mexico, a self-employed contractor in Colorado, a farmer in Iowa, and several others who shared their stories with us in e-mail. By mutual agreement, we’re keeping their last names private because some have pending disputes with AT&T.

Breaking the News: Alltel Sells Out Their Customers to Verizon

When Karen, a realtor from New Mexico first heard word that Alltel was selling out to Verizon, she wasn’t sure exactly what that meant. There was considerable confusion in her part of southern New Mexico mostly because the local media does a poor job of covering telecommunications stories.

“In New Mexico, everything in the media is centered around what is going on in Albuquerque and everything else is given little attention, except in the local newspaper,” Karen says. “But whether you are in Las Cruces or Roswell, the quality of the story depends on the quality of the poorly paid reporter.”

Karen was not worried about the sale at first, because she was aware Verizon had a good reputation for cell phone service. She had originally selected Alltel because they had good rates and friendly customer service.

“If I ever had a problem with my phone, Alltel would always fix it, even if it was out of warranty,” Karen explains. “That meant a lot to me because they didn’t have to do that, but it was why I always renewed my contract.”

Heath, who runs a home-based contracting business in southern Colorado, didn’t like what he was hearing from the start. Neither did Marion and Will, a retired couple living outside of Phoenix.

“We had our dealings with Verizon back in Minnesota when we lived there and we never liked them because they cost too much,” Will says. “Alltel was a great choice for us because they had a calling circle plan that let you make unlimited calls to certain numbers, and we talked with our daughter back in Minnesota daily using our cell phone.”

“We had our dealings with Verizon back in Minnesota when we lived there and we never liked them because they cost too much,” Will says. “Alltel was a great choice for us because they had a calling circle plan that let you make unlimited calls to certain numbers, and we talked with our daughter back in Minnesota daily using our cell phone.”

Confusion about the deal only got worse when Alltel (and in some cases Verizon) notified our panel members they would not be Verizon customers after all — they were being sold off to another cell phone company.

Alltel -> Verizon -> AT&T -> Frustration

Micah, our reader in Utah first contacted us more than a year ago to express his confusion about why he was not only losing his Alltel account, but now he was somehow ending up as a customer of AT&T, a carrier he definitely wants nothing to do with.

“I figured I could at least live with Verizon because they are everywhere, but as I started performing my mission work for the church in rural central Florida, I learned from my parents I was actually going to end up a customer of AT&T, something I definitely never wanted,” Micah says. “AT&T is terrible in Utah and worse here — nobody wants AT&T unless you are in Orlando or Daytona Beach.”

Alltel Markets Sold to AT&T (click to enlarge)

“At first we thought, cool, new phones for everyone,” Shanie told Stop the Cap! from her home in Muskegon, Mich. “AT&T has been promising major expansion of service here in western Michigan since they notified us they were taking over for Alltel, but then we started learning the details.”

While Shanie’s family of four would be given four new phones, their choices of new phones were limited, although AT&T called them “comparable.” Many of AT&T’s smartphones were not covered, even if families already owned smartphones purchased from Alltel.

“We also discovered if you wanted one of these advanced phones, it meant a new two-year contract with AT&T, effectively forcing us to stay with them longer,” Shanie says.

Jed, a farmer outside of Sioux City, Iowa says AT&T did a poor job keeping him informed. Jed stopped receiving all communication from Alltel (other than a bill) and never heard a word from AT&T. Instead, one of his neighbors warned him that his Alltel phone was going to quit working by the middle of May. Jed was upset because the deadline for him to choose a new free phone had passed and he never had the opportunity to make a choice, never having been notified about any of the changes.

“The newspaper might have said something about it, but we don’t get the paper here and nobody has much time to spend watching television,” Jed shared. “We would have thought AT&T would have notified us, but they apparently forgot we were here.”

Last week, a new phone arrived from AT&T in the mail, unsolicited.

“What a way of doing business — we thought at first it was some sort of fraudulent purchase and we almost didn’t accept it from the driver,” Jed said.

AT&T has been sending out new phones all month to customers across several states, encouraging them to call and activate them on AT&T’s network. Once customers do that, their old Alltel phones will quit working. That was a problem for Shanie’s daughter at college in Grand Rapids. When mom activated her phone, the primary one on the account, her daughter’s Alltel phone stopped working.

“AT&T has you call a toll-free number to activate the phone, but first they require y0u to accept the terms and conditions for doing business with AT&T, which can include contract extensions for some people,” Shanie said. “I had no idea activating my phone would end service on all of the other Alltel phones on the account.”

Alltel customers in these states had new AT&T phones shipped to them on this schedule. The second date refers to the service transition cutoff date:

| Arizona |

January 27, 2011 |

February 10, 2011

|

| Southern New Mexico |

February 7-8, 2011 |

March 2-3, 2011

|

| Michigan and Montana |

February 16-21, 2011 |

April 6-12, 2011

|

| Colorado, Northern New Mexico |

February 23-28, 2011 |

April 13-18, 2011

|

| Iowa and South Dakota |

March 4-14, 2011 |

April 19-28, 2011

|

| North Dakota |

March 15-21, 2011 |

April 29-May 5, 2011

|

| Utah and Wyoming |

April 1-6, 2011 |

May 9-12, 2011

|

Bailing Out for Alternatives

Jody, a soon-to-be-ex AT&T customer in New Mexico, says there was plenty of fine print to wade through when he prepared for the switch from Alltel, and he didn’t like what he saw.

“AT&T is very tricky about how they handle customers who want to depart Alltel and avoid becoming an AT&T customer,” Jody says. “You cannot cancel your Alltel contract and avoid an early termination fee, but you can cancel AT&T within 30 days of switching and escape a hefty exit fee.”

Indeed, AT&T’s transition website says Alltel customers who want to switch providers will face an early exit penalty as long as their Alltel phones remain active. Those who switch and activate their new AT&T phones get a 30 day window to drop AT&T and avoid an ETF:

If, after moving to AT&T service, you choose to discontinue your AT&T service, you will have a 30-day period to opt out of your AT&T contract without an ETF. After that 30-day period, standard AT&T terms apply including any applicable ETF.

Old name, New Company

Jody got his new phone and promptly canceled his AT&T service. He switched to CellularOne, a company with a legacy name but a very local network. It has its own cell towers only in northern Arizona and parts of New Mexico. For everywhere else, it depends on a roaming agreement with… AT&T.

Jody’s CellularOne plan still offers completely unlimited calling, texting, and data for around $80 a month, and that includes AT&T’s nationwide network.

“CellularOne offers a much better deal than AT&T, but you can only choose from three lower end smartphones — no iPhone to be had here,” Jody says.

Heath in Colorado wants out of AT&T as well.

“They drop calls all the time and their network strength is awful in my neighborhood, and I depend on my cell phone and don’t have a landline,” Heath says. “I don’t know why we had to be stuck with AT&T who apparently de-commissioned Alltel’s towers, which used to deliver a rock solid signal here.”

But not everyone is heading for other carriers. Sam in Farmington, New Mexico says AT&T is bringing 3G to his community and mobile broadband speeds have been much faster than what Alltel used to deliver.

“AT&T’s data plans are overpriced, but if you can hang onto your existing Alltel plan but use it on AT&T’s network, it’s not so bad,” Sam says. “Unfortunately, you cannot upgrade to an iPhone and keep Alltel’s plans — you have to pick one of AT&T’s.”

The Future for T-Mobile Customers

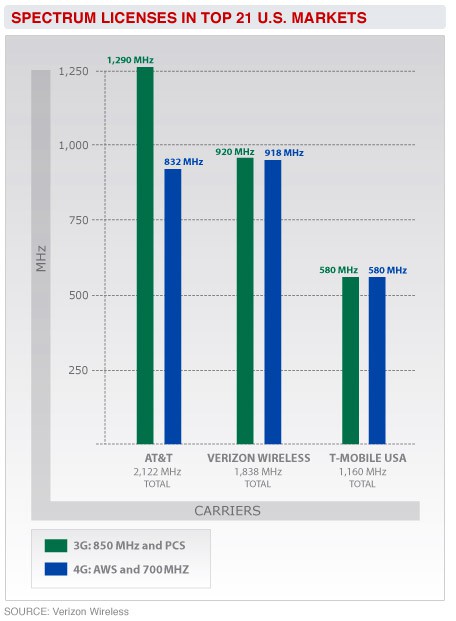

Although T-Mobile shares the same GSM network technology AT&T uses, the two companies have different frequency allocations for their respective networks. T-Mobile customers seeking access to AT&T’s network will probably need new phones to access it. While AT&T claims T-Mobile’s own largely urban network will supplement AT&T’s own coverage, customers may need new equipment for that to be true as well, unless AT&T co-locates their own cell antennas on T-Mobile towers.

Former Alltel customers tell Stop the Cap! AT&T didn’t offer the latest and most popular phones for their swap, and some customers too far away from an AT&T store had to get a new phone without being able to try it. AT&T allowed customers to exchange phones within 30 days, which helped some of our readers, but most felt the entire idea of being forced to switch to AT&T an inconvenience. Most were also disturbed that one of the competitors in their area was disappearing, and considering Alltel served largely small cities and rural areas, there was already a lack of choice for most. In total, three of our readers are staying with AT&T, two left for CellularOne, one chose to switch to a prepaid plan, and the rest went with Verizon after all. If Alltel were still around, every customer we talked with for this piece would have stayed with them.

T-Mobile has announced it is giving some of its smartphone customers unlimited free calling, when you are within range of a Wi-Fi signal.

T-Mobile has announced it is giving some of its smartphone customers unlimited free calling, when you are within range of a Wi-Fi signal. The technology differs from femtocells — small devices that connect with your broadband connection and deliver a 3G wireless signal in your home or office. Because the Smart Wi-Fi app that powers Wi-Fi Calling is software-based, there is no hardware expense and little customer configuration required. But Wi-Fi Calling is more restrictive. A femtocell delivers a 3G signal to any nearby device registered to access it; Wi-Fi Calling only works with phones pre-equipped with the feature.

The technology differs from femtocells — small devices that connect with your broadband connection and deliver a 3G wireless signal in your home or office. Because the Smart Wi-Fi app that powers Wi-Fi Calling is software-based, there is no hardware expense and little customer configuration required. But Wi-Fi Calling is more restrictive. A femtocell delivers a 3G signal to any nearby device registered to access it; Wi-Fi Calling only works with phones pre-equipped with the feature.

Subscribe

Subscribe