The Chicago Tribune‘s advocacy for the merger of AT&T and T-Mobile leaves the facts far behind, and raises questions about just how much the newspaper understands about telecommunications company mergers.

The Chicago Tribune‘s advocacy for the merger of AT&T and T-Mobile leaves the facts far behind, and raises questions about just how much the newspaper understands about telecommunications company mergers.

In this morning’s edition, the newspaper claims efforts by the Justice Department to block the merger will “slow [wireless] progress to a crawl.” That’s a half-baked conclusion, considering AT&T’s own accidentally-public internal documents reveal a willingness to spend $39 billion on a merger while balking at spending one-tenth of that amount to upgrade its own 4G network. The injury to rural America the Tribune fears most was self-inflicted by AT&T even before the merger was announced.

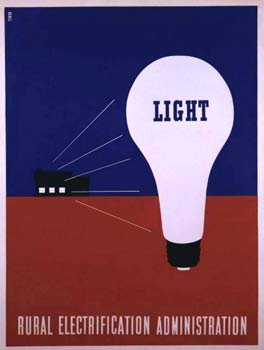

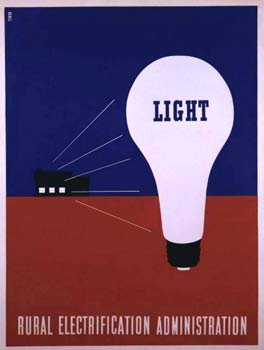

Access to advanced wireless Internet is the key. A merger of AT&T and T-Mobile would bring an under-served swath of America into the 21st century of high-speed mobile data communication. Much like the rural electrification movement of the 1930s, this deal offers a chance for many Americans to leap ahead technologically.

If Justice gets its way, progress will slow to a crawl. We think the FCC should approve the merger after obtaining appropriate concessions — and Justice should settle its case sooner, not later. Dragging out this proceeding stands to hurt a nation that can ill afford more damage from a government too often hostile to business interests.

Evidently the editorial writers at the Tribune have been drinking AT&T’s Kool-Aid. There is more to see here than AT&T’s advocacy kit, if one is willing to look beyond lucrative, saturation advertising campaigns and lobbying.

The government got the bright idea of helping wire rural America for electricity when commercial providers refused.

AT&T’s own merger announcement spoke glowingly of the “increased efficiencies” a more concentrated wireless marketplace will deliver, but said very little to investors about T-Mobile’s cellular network being the key to unlock rural wireless. The reason is simple: T-Mobile doesn’t have a rural wireless network. In fact, T-Mobile’s long-standing focus on urban markets means considerable duplication of resources in medium and large cities — resources that might help reduce the number of dropped calls in cities like New York, Chicago or San Francisco, but hardly a boon for residents of Ottumwa, Iowa, who barely get a signal today from AT&T, much less T-Mobile.

We agree with the Tribune editors when they say improved advanced wireless Internet is important to rural America. But nothing within AT&T’s massive document dump guarantees rural 4G service, especially after four national companies judged it didn’t make much business sense. Three national carriers hardly strengthens the case. In fact, investors will expect AT&T to use precisely the same Return on Investment-formulas that have always ruled rural 4G wireless out of bounds.

The Tribune forgets rural electrification came in spite of private power companies, who viciously opposed government electrification projects (unless they benefited from them). The reason rural Americans went without electrical service until the late 1930s was the same reason rural Iowa doesn’t have lightning-fast 4G service — it doesn’t make much business sense to provide it.

When President Franklin D. Roosevelt declared electricity an essential utility service every American should be able to access at a fair price, government resources picked up where Wall Street left off — financing electric generation projects and encouraging the development of power cooperatives and municipal utilities. It often took more than 20 years to pay off the costs of the infrastructure — at a price (and wait) unwilling to be covered by giant power companies like Chicago’s Commonwealth Edison at the time.

It’s much the same story for AT&T today. The enormous telecommunications company was provided an estimate of $4 billion to upgrade its network to 4G service nationwide. Company executives refused, suggesting the time required to recoup that investment was too far out for their tastes. But a $39 billion dollar merger with T-Mobile, despite the much higher price tag, delivers immediate benefits they can take to the bank: decreased competition and pricing innovation. T-Mobile delivers both on its own, and even in fourth place influenced the service plans and pricing at other wireless carriers. By eliminating that competition, the pressure to reduce prices or enhance service is diminished. The ability to raise prices, or reduce the number of services, is enhanced.

Astonishingly, the Tribune writers completely ignore the biggest reason why AT&T cannot afford to slow progress to a crawl. Its name is Verizon Wireless, and AT&T ignores its own network at its peril. That’s why competition, even from America’s #4 carrier, remains critically important.

While the Chicago Tribune seems comfortable rallying for the cause of one of their advertisers — a multi-billion dollar corporation it sees as a victim of government “anti-business” hostility, we’re more concerned about protecting American wireless consumers from the results of AT&T’s efforts to cut competition (and consumer-friendly services) to a bare minimum. AT&T’s carrot is the illusory promise of enhanced wireless service in rural communities the company routinely ignores. The Justice Department, thankfully, prefers the stick — recognizing an anti-competitive, anti-trust feeding frenzy when it sees one, and is correct when it gives it a good whack.

Verizon Communications was supposed to have a “neutral” position regarding the takeover bid by AT&T to absorb T-Mobile, but Lowell McAdam, CEO could sit on his hands no longer, and told the Wall Street Journal “the match had to occur” and cautioned if the government blocks the merger, it needs to cough up more spectrum for wireless companies like his, and fast.

Verizon Communications was supposed to have a “neutral” position regarding the takeover bid by AT&T to absorb T-Mobile, but Lowell McAdam, CEO could sit on his hands no longer, and told the Wall Street Journal “the match had to occur” and cautioned if the government blocks the merger, it needs to cough up more spectrum for wireless companies like his, and fast.

Subscribe

Subscribe