And then there were three?

Deutsche Telekom has held talks about a possible merger with Sprint in exchange for a major stake in the combined entity, according to people with knowledge of the matter.

The German phone company, owner of T-Mobile, America’s fourth-largest cell phone company, has been pounded by analysts after revealing its earnings for 2011 were likely to be below expectations. T-Mobile, DT’s American brand, has faced harsh criticism for its stagnant performance, declining earnings, and bleak future.

Michael Kovacocy, director of Equity Evolution Securities, told CNBC T-Mobile is essentially in last place among America’s major national carriers and is going to stay there so long as it targets value-conscious customers who care more about a lower bill than a robust network.

“We think in the long term, perhaps, their position is unsustainable,” Kovacocy said.

Deutsche Telekom, the German phone company, does considerably better in Europe than in the United States.

The analyst predicts T-Mobile will always be relegated to #4 status in an American market dominated by Verizon and AT&T, with Sprint behind in third place. T-Mobile is further back than that and has stagnated. Unless they make radical changes — changes Kovacocy feels will be destructive to shareholder value — such as price cuts or major infrastructure improvements, T-Mobile will remain an also-ran.

“They have the wrong customers, the wrong network, and we think their spectrum is very difficult because it’s uncompetitive versus some of the spectrum AT&T and Verizon has,” Kovacocy said.

T-Mobile saw the departure of at least 150,000 customers during the last quarter — most heading for other carriers.

Talks between the two companies have reportedly been difficult, however, over Sprint’s willingness to meet DT’s price. Sprint has seen losses erode the value of its competitor, and may want to pay less than the $25 billion estimated value of T-Mobile’s network and operations.

Sprint has experience trying to integrate customers from two incompatible networks together, with less than spectacular results.

Another problem: the two networks rely on different and incompatible standards — CDMA for Sprint and GSM for T-Mobile. Sprint experienced major integration problems once before, when it acquired Nextel from Craig McCaw in 2005. Nextel’s iDEN network enabled the popular “push-to-talk” feature beloved by construction workers and contractors, but made integrating the Nextel family into Sprint a hellish nightmare. After initially promising to phase out the iDEN network by 2009, Sprint recently announced it had pushed back the date of decommissioning to 2013.

A buyout of T-Mobile could leave Sprint serving customers on three different networks — its own customers, those still on Nextel’s network, and T-Mobile.

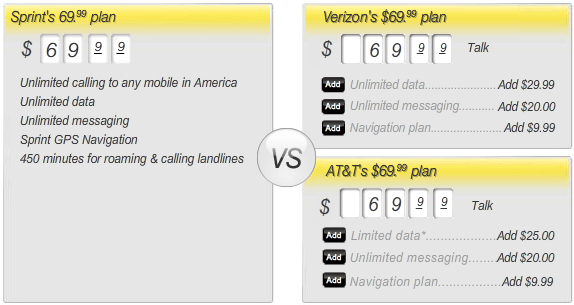

Although predictions are already being made the merger would pass muster in Washington, public policy groups concerned about the ongoing loss of competition in the wireless marketplace will have a major example to show this practice at work. Americans continue to face some of the most expensive cell phone service in the world, and T-Mobile’s aggressive pricing helped keep other carriers from raising prices much further.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Bloomberg Deutsche Telekom May Sell T-Mobile USA Unit to Sprint 3-8-11.flv[/flv]

Bloomberg News covers the possible sale of T-Mobile to Sprint. (6 minutes)

[flv]http://www.phillipdampier.com/video/CNBC Sell Deutsche Telekom 2-25-11.flv[/flv]

Back on Feb. 25, CNBC interviewed one of several analysts who were upset with T-Mobile’s likely performance in 2011. (4 minutes)

Subscribe

Subscribe