Canadians are opening cell phone bills that have skyrocketed as a result of usage from work-at-home initiatives to stop the spread of COVID-19, a health crisis that is also fattening profits at some of the country’s biggest mobile operators.

Canadians are opening cell phone bills that have skyrocketed as a result of usage from work-at-home initiatives to stop the spread of COVID-19, a health crisis that is also fattening profits at some of the country’s biggest mobile operators.

Rosette Okala of Pickering, a suburb of Toronto, was stunned to receive her Rogers Mobile bill this month for $540, up from the usual $160 she is used to paying.

“I almost dropped,” Okala told CBC News. She is a pharmaceutical employee whose job requires being online. Her 12-year-old son has been online more too, doing schoolwork.

The part of Pickering where Okala lives does not have wired internet service available, so she relies on internet service from her mobile provider, like hundreds of thousands of other Canadians do. Pickering is hardly a tiny town either. With a population of 92,000, the city is immediately east of Toronto in the Durham Region. Despite that, there are sections of the city still waiting to get wired internet service.

Using the internet in areas considered to be “rural Canada” by providers is not cheap. Rogers offers customers a $145/mo wireless internet plan that includes 100 GB of usage. Customers that exceed that do so at their peril, facing overlimit fees of $5/GB.

“This is just a slap in our face,” said Okala. “We [rural customers] pay huge bills just to be able to do something basic that most people take for granted.”

Okala hoped her employer would help cover her phone bill. Rogers has been reluctant to help, despite a showy ad campaign from the cable and wireless giant promising customers “we are in this together and are here to help.” When it comes to billing matters, talk is cheap and help is hard to find.

Pickering, Ont.

Okala said she spent hours on the phone with a Rogers representative trying to negotiate a lower bill. Rogers eventually offered a paltry $30 credit and a payment plan to pay off her balance. A second attempt resulted in an improved offer of $100 credit, an upgrade to a different service plan, and 50% off monthly service fees for 24 months. But Rogers still wanted to be paid at least $440, at least until the CBC pointed out it would share Okala’s story with the rest of Canada for free. Rogers suddenly offered to take another $230 off Okala’s March bill and give her the mobile hotspot hub she was leasing for free.

John Burbidge, a University of Waterloo economics professor in North Dumfries living in a town of 10,000 near Cambridge, Ont., got schooled in the mobile broadband business by Bell Mobility, which sent him a bill for $650, including nearly $400 in usage charges. Burbidge was confused by an email from Bell, Canada’s largest phone company, which claimed it was waiving overlimit usage fees for customers during the pandemic. He missed the fine print advising that fee waiver only applied to Bell’s DSL and fiber wired customers, not wireless data plans. Burbidge argued it was unfair to exempt some customers from usage fees, while continuing to charge them to others.

“If rural Canadians are expected to work and do school work from home, decent and reasonably priced access to the internet is a basic right. Bell should not be allowed to gouge rural customers,” Burbidge told Canada’s public broadcaster.

Bell told the CBC the company was offering customers an extra 10 GB on customer data allowances and a $10 credit off the cost of using a mobile hotspot connected to Bell’s mobile network. As a courtesy, Bell agreed to credit Burbidge’s account $350 for March and take 60% off overlimit fees in April, but he is on his own after that. Burbidge’s current plan charges $180 a month for up to 100 GB a month, with a $5/GB overlimit fee.

Bell told the CBC the company was offering customers an extra 10 GB on customer data allowances and a $10 credit off the cost of using a mobile hotspot connected to Bell’s mobile network. As a courtesy, Bell agreed to credit Burbidge’s account $350 for March and take 60% off overlimit fees in April, but he is on his own after that. Burbidge’s current plan charges $180 a month for up to 100 GB a month, with a $5/GB overlimit fee.

“It’s really sad to hear,” Laura Tribe, executive director of consumer group OpenMedia told the CBC. “Data caps are definitely unnecessary. We see them as a punitive mechanism to make sure that people suppress the amount of data that they use and overpay when they go over what they want.”

The Canadian Wireless Telecommunications Association (CWTA), an industry lobbying group representing the country’s wireless companies, claims data caps are necessary to prevent overwhelming Canada’s wireless networks, which could make calling 911 impossible. But voice calls can travel over different spectrum than data traffic, and no wireless company or the CWTA would admit if their networks were close to being overhwhelmed by traffic as a result of millions of Canadians working from home.

Tribe says the traffic spikes that have come from the coronavirus crisis prove her point. Even with data usage at all-time highs, no provider is claiming their network is close to capacity. That should call into question whether there is any need at all for mobile data caps.

“They’re a way to increase profits and suppress the usage of the networks,” said Tribe.

Rogers’ attitude towards loyal customers seems to be summed up by what people encounter when visiting some of their retail locations: a locked door.

Rogers’ attitude towards loyal customers seems to be summed up by what people encounter when visiting some of their retail locations: a locked door.

Subscribe

Subscribe (Reuters) – Altice USA Inc’s C$11.1 billion ($8.43 billion U.S.) revised offer to acquire Cogeco was rejected on Sunday by the Canadian cable company’s top investor, the Audet family.

(Reuters) – Altice USA Inc’s C$11.1 billion ($8.43 billion U.S.) revised offer to acquire Cogeco was rejected on Sunday by the Canadian cable company’s top investor, the Audet family.

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.” Canadians are opening cell phone bills that have skyrocketed as a result of usage from work-at-home initiatives to stop the spread of COVID-19, a health crisis that is also fattening profits at some of the country’s biggest mobile operators.

Canadians are opening cell phone bills that have skyrocketed as a result of usage from work-at-home initiatives to stop the spread of COVID-19, a health crisis that is also fattening profits at some of the country’s biggest mobile operators.

Bell told the CBC the company was offering customers an extra 10 GB on customer data allowances and a $10 credit off the cost of using a mobile hotspot connected to Bell’s mobile network. As a courtesy, Bell agreed to credit Burbidge’s account $350 for March and take 60% off overlimit fees in April, but he is on his own after that. Burbidge’s current plan charges $180 a month for up to 100 GB a month, with a $5/GB overlimit fee.

Bell told the CBC the company was offering customers an extra 10 GB on customer data allowances and a $10 credit off the cost of using a mobile hotspot connected to Bell’s mobile network. As a courtesy, Bell agreed to credit Burbidge’s account $350 for March and take 60% off overlimit fees in April, but he is on his own after that. Burbidge’s current plan charges $180 a month for up to 100 GB a month, with a $5/GB overlimit fee. Canadians, living under a regime of three national wireless carriers (Bell, Rogers, and Telus) pay some of the highest wireless prices in the world. A new plan announced today from Rogers Communications is unlikely to change that.

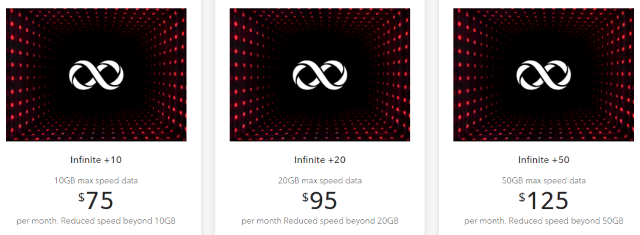

Canadians, living under a regime of three national wireless carriers (Bell, Rogers, and Telus) pay some of the highest wireless prices in the world. A new plan announced today from Rogers Communications is unlikely to change that.